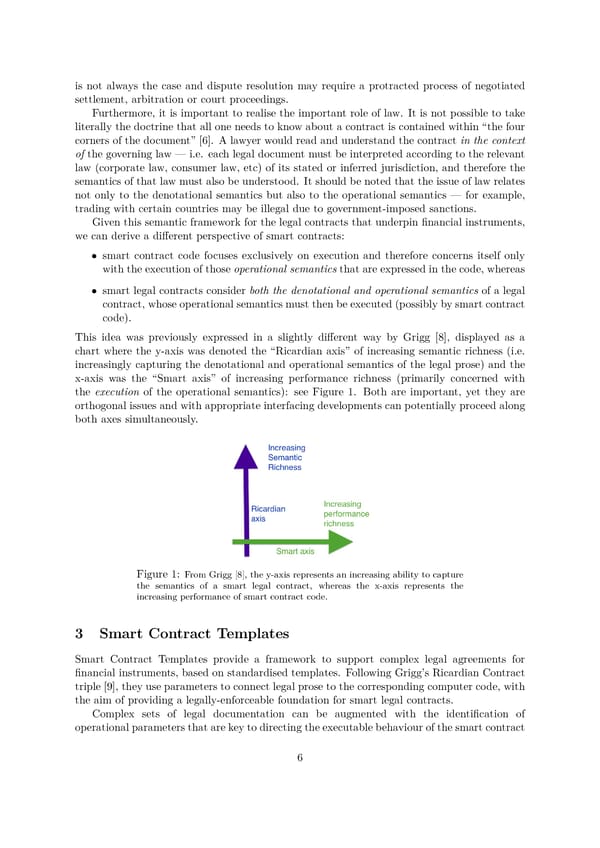

is not always the case and dispute resolution may require a protracted process of negotiated settlement, arbitration or court proceedings. Furthermore, it is important to realise the important role of law. It is not possible to take literally the doctrine that all one needs to know about a contract is contained within “the four corners of the document” [6]. A lawyer would read and understand the contract in the context of the governing law — i.e. each legal document must be interpreted according to the relevant law (corporate law, consumer law, etc) of its stated or inferred jurisdiction, and therefore the semantics of that law must also be understood. It should be noted that the issue of law relates not only to the denotational semantics but also to the operational semantics — for example, trading with certain countries may be illegal due to government-imposed sanctions. Given this semantic framework for the legal contracts that underpin financial instruments, we can derive a different perspective of smart contracts: • smart contract code focuses exclusively on execution and therefore concerns itself only with the execution of those operational semantics that are expressed in the code, whereas • smart legal contracts consider both the denotational and operational semantics of a legal contract, whose operational semantics must then be executed (possibly by smart contract code). This idea was previously expressed in a slightly different way by Grigg [8], displayed as a chart where the y-axis was denoted the “Ricardian axis” of increasing semantic richness (i.e. increasingly capturing the denotational and operational semantics of the legal prose) and the x-axis was the “Smart axis” of increasing performance richness (primarily concerned with the execution of the operational semantics): see Figure 1. Both are important, yet they are orthogonal issues and with appropriate interfacing developments can potentially proceed along both axes simultaneously. Figure 1: From Grigg [8], the y-axis represents an increasing ability to capture the semantics of a smart legal contract, whereas the x-axis represents the increasing performance of smart contract code. 3 Smart Contract Templates Smart Contract Templates provide a framework to support complex legal agreements for financial instruments, based on standardised templates. Following Grigg’s Ricardian Contract triple [9], they use parameters to connect legal prose to the corresponding computer code, with the aim of providing a legally-enforceable foundation for smart legal contracts. Complex sets of legal documentation can be augmented with the identification of operational parameters that are key to directing the executable behaviour of the smart contract 6

Position Paper | Smart Contract Templates Page 7 Page 9

Position Paper | Smart Contract Templates Page 7 Page 9