Press Coverage

The Smart Contract Templates application developed by Barclays has starred in the first ever public demonstration of the R3 Corda "fabric" for shared banking ledgers, which took place before an audience of over 800 people at The O2 in London.

The event was the public demo day of the Barclays Accelerator, powered by Techstars, where 11 teams presented, including 10 startups and a Barclays internal team. The team behind the prototype smart contracts application was the internal one headed up by Dr Lee Braine from Barclays Investment Bank's CTO Office.

Braine said: "The technology we have used for our demonstration is the R3 consortium's prototype platform called Corda. What you will now see is the first public demonstration of an application using the underlying Corda platform. This is history in the making."

He explained the banking industry is facing an extremely complex challenge: each bank maintains its own ledger systems, which means there is huge duplication of effort and cost. He elaborated that blockchains, shared ledgers and smart contracts are trying to solve that challenge - but said a missing piece in the puzzle would be filled by standardised yet customisable templates for running automated financial contracts.

"They provide an elegant way to connect the text within legal agreements to the corresponding business logic. I emphasise to you that legal documentation processes can be lengthy, cumbersome and manual. Smart Contract Templates could simplify all of that and, because they are templates designed for reuse, they could drive the industry's adoption of standards that are legally enforceable.

"This has huge potential to enable banks to mutualise costs across the industry by using common components - the potential for a paradigm shift in a field where there are billions of pages of legal agreements."

Ushered in by Daft Punk's "Harder, Better, Faster, Stronger" to signify lean processes and optimisation, Braine began his demo: a prototype of an investment banking application showing the lifecycle of an interest rate swap. The first screen he called the template editor. "You can imagine these templates being maintained by a standards body. Unlike the paper versions, these templates are smart," he said. Some legal text was highlighted in a master agreement and converted into a parameter; then the mouse hovered over some other lines of text to reveal the corresponding computer code.

Braine then used the template to edit an actual agreement: on the left were a series of fields, with an outstanding field in red; on the right, the corresponding legal agreement. Next, he entered a trade for an interest rate swap.

The appropriate governing legal documentation was automatically retrieved and attached to the trade, which was then submitted - and finally affirmed by the counterparty.

The smart contract was then run on a distributed ledger using the R3 Corda technology. Displaying the trade running on the Corda platform, Braine said: "You can see the confirmation on the left, and the legal documents on the right. It's important to note that both parties see the same set of documents. On the schedule tab, our prototype illustrates three months passing, and shows the schedule being updated as the smart contract runs on the distributed ledger.

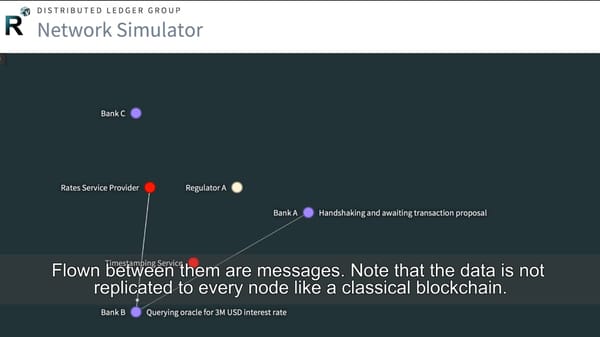

Braine then replayed the smart contract in action, so to speak, via a visualisation using R3's network monitor. The screen displayed banks as purple nodes, a regulator in white, and service providers in red. The screen showed messages flowing between these nodes.

As per the recently-released specifications of Corda by R3 CTO Richard Brown, the data was not being replicated to every node. Braine added: "Unlike a classic blockchain, the data is going only to those entitled to see it. The business logic here is controlled by the parameters from the smart contract templates."

In closing, Braine said Barclays is at the forefront of this field and that the bank was proud to publicly demonstrate its prototype. He said: "We achieved collaboration that far exceeded our expectations: with R3 on their distributed ledger platform; with University College London's Centre for Blockchain Technologies on a new programming language created by team member Dr Chris Clack who named his language CLACK; with the key standards organisation ISDA for permission to reproduce their legal agreements; with Société Générale for their valuable review feedback; and with Techstars during the last three intense months.

"This type of solution will take time to build. But it has the potential to transform legal documentation and enable legally-enforceable smart contacts. Now that Barclays has planted the seed of Smart Contract Templates, further collaboration is required to grow this idea.

"It will only really work if the industry is behind it. So if you are part of the industry, and you are excited by the prototype, I encourage you to participate in a Smart Contract Templates summit this June that will be organised by R3."

Following the demo, Braine told IBTimes UK: "The typical startup joins an accelerator intent on advancing the pace of their team, their networking and future prospects. Many join with a product and it may even be fully fledged with paying customers.

"However, Barclays Investment Bank's internal team joined the accelerator with just an idea back in January. In the space of these three months, we built a prototype application and also collaborated extensively so that Smart Contract Templates could be showcased within the lifecycle of a standardised financial product.

"Being part of an accelerator culminating in a public demo day undoubtedly inspired our team - and we have been overwhelmed by the positive response."

July 13, 2016 (New York/San Francisco/London) - Financial innovation company R3 is spearheading efforts to understand and address the challenges of developing master templates for smart contracts, the self-executing contractual agreements used to trade, record and manage assets on distributed and shared ledger platforms, and how they could be implemented within existing legal and regulatory frameworks.

Following the R3 Smart Contract Templates Summit in London and New York in late June, R3 has agreed to collaborate with a diverse working group of its consortium members, standards bodies, law firms, academic institutions, exchanges and market infrastructure providers, including Barclays, the International Swaps and Derivatives Association (ISDA), Norton Rose Fulbright and University College London (UCL).

The group will begin exploring the development of repositories of smart contract templates for banks to download and use on blockchain-inspired platforms, such as R3's Corda.

At the summit the group discussed potential roadmaps for development, with a short-term focus on understanding the challenges of connecting existing real-world legal contracts, for products such as interest rate swaps, to smart contracts - enabling the simplification of legal documentation and mutualisation of costs for banks.

The R3 Smart Contract Templates Summit's presentations are now publicly available online: http://r3cev.com/s/R3-Smart-Contract-Templates-Summit-_FINAL.pdf

Currently each bank stores its own instance of contracts, which can introduce inconsistencies and reconciliation challenges. Smart contracts operating on distributed and shared ledgers enable each of the parties to see the same agreed set of legal documents.

The group's longer term goals include working with the legal community and academics to investigate how to take smart contracts to a point where they can be admissible in court and used for entry into dispute resolution. An update will be given at the second R3 Smart Contract Templates Summit later this year.

Richard Brown, Chief Technology Officer at R3, commented: "The promise of distributed ledger technology is that we can move to a world where sophisticated financial agreements between firms can be recorded and managed consistently and accurately without duplication, error or unnecessary cost. However, for this vision to be realized, more than just innovative technology is required: this technology must be embedded in a broader legal context and be sympathetic to the reality of business. Earlier this year, we collaborated with Barclays to demonstrate how Smart Contract Templates and R3's Corda platform could work together to provide a workable and understandable bridge between the worlds of law and technology - and were delighted by the interest this created in the broader community and the interest in our Smart Contract Templates summit. The quality of the presentations and debate at the Smart Contract Templates summit exceeded our best expectations and we are looking forward to collaborating on the further development of this innovative approach."

Dr. Lee Braine, Investment Bank CTO Office at Barclays, commented: "Barclays has been actively engaging in the blockchain field for two years, including experimenting with vendor products, supporting innovative startups via the Barclays Accelerator, and participating in industry consortia such as the R3 consortium and the Post-Trade Distributed Ledger Group. This year, Barclays Investment Bank has explored smart contracts in greater depth by leveraging its technology, legal and front-office teams - and collaborating with industry and academia through open innovation. In April, we demonstrated a Smart Contract Templates prototype creating an ISDA agreement and an interest rate swap trade that then executed as a smart contract on R3's prototype Corda platform. We were delighted to participate in the recent R3 Smart Contract Templates Summit and it was inspiring to hear the views from industry, standards bodies, law firms and academia on how these emerging technologies could progress. We look forward to ongoing collaboration and the second summit in the autumn."

Clive Ansell, Head of Market Infrastructure and Technology at ISDA, commented: "Technology is becoming ever more important in derivatives markets, as participants look for ways to enhance the efficiency of their operations. ISDA is committed to supporting innovations in technology, and smart contracts represent one area where considerable opportunity exists. ISDA's existing suite of derivatives documentation, developed over many years, provides a basis to explore this further. The R3 Smart Contract Templates Summit provided a great opportunity for market participants to collaboratively work to drive technology opportunities like this forward, and ISDA is committed to working with all market participants to ensure markets continue to function safely and efficiently."

Dr. Chris Clack, Senior Lecturer at University College London, commented: "The R3 Smart Contract Templates Summit provided an excellent opportunity to connect academia with lawyers and technologists in financial services. This included discussing different ways of modelling smart legal agreements and considering a potential roadmap of increasing sophistication. UCL's Centre for Blockchain Technologies is exploring the academic foundations behind such ideas and looks forward to further participation at similar events."

Sean Murphy, Head of Global Distributed Ledger and Blockchain Practice at Norton Rose Fulbright LLP, commented: "Smart contracts are receiving significant commercial attention, and for good reason. As highlighted in the R3 Smart Contract Templates Summit, smart contracts have the potential to transform businesses and deliver significant cost savings by automating and streamlining contracting processes. However, careful legal and regulatory analysis will be required as part of the risk assessment involved in using this technology. Our dedicated Fintech practice is helping our clients to identify, manage and mitigate legal and regulatory risks associated with the use of smart contracts."

About R3R3 is leading a consortium with over 50 of the world's largest financial institutions to develop ground- breaking commercial applications for the financial services industry that leverage the appropriate elements of distributed and shared ledger technology.

Operating in New York, London and San Francisco, the R3 team is made up of financial industry veterans, technologists, and new tech entrepreneurs, bringing together expertise from electronic financial markets, cryptography and digital currencies.

The R3 Lab and Research Centre has quickly become a centre of gravity for collaborative research and testing of distributed and shared-ledger inspired technologies, and is where R3 works with its partners to define, design and deliver the next generation of financial infrastructure.

Press contactEllie McFatridge, Chatsworth Communications

+44 (0)207 440 9780 ellie@chatsworthcommunications.com

Charley Cooper, R3

+1 917 855 8529 charley@r3cev.com

This press release is for information purposes only and are not intended to constitute, and should not be construed as, an offer to sell or a solicitation of any offer to buy any securities of R3CEV LLC (the "Company") in the United States or in any other jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration, exemption from registration or qualification under the securities laws of such jurisdiction. The statements contained herein may include statements of future expectations and other forward-looking statements that are based on management's current views and assumptions and involve known and unknown risks and uncertainties that could cause actual results, performance or events to differ materially from those expressed or implied in such statements. In addition to statements which are forward-looking by reason of context, the words "may", "will", "should", "expects", "plans", "intends", "anticipates", "believes", "estimates", "predicts", "potential", or "continue" and similar expressions identify forward-looking statements. Past performance does not guarantee future results in any respects.

Actual results, performance or events may differ materially from those in such statements due to, without limitation, (i) general economic conditions, including in particular economic conditions in the company's core business and core markets, (ii) performance of financial markets, including emerging markets, and including market volatility, liquidity and credit events, (iii) the frequency and severity of insured loss events, including from natural catastrophes and including the development of loss expenses, (iv) the extent of credit defaults, (v) interest rate levels, (vi) currency exchange rates including the Euro/U.S. Dollar exchange rate, (vii) changing levels of competition, (viii) changes in laws and regulations, (ix) changes in the policies of central banks and/or foreign governments, (x) the impact of acquisitions and commercial arrangements, including related integration issues, (xi) reorganization measures and (xii) general competitive factors, in each case on a local, regional, national and/or global basis. Many of these factors may be more likely to occur, or more pronounced, as a result of terrorist activities and their consequences.

The Company assumes no obligation to update any forward-looking statement or update any information contained in the press release.

Hosted by Barclays and blockchain technology company R3CEV LLC, which leads a consortium of more than 40 global financial services companies, the event, held simultaneously in London and New York, was attended by 35 experienced attendees including, investment banks, ISDA, FIA, UCL's computer science unit, amongst others.

Smart contracts, which were defined at the summit as being agreements whose execution is automatable and enforceable, present great opportunities for increased efficiency and security in legal and financial transactions. With these opportunities, comes an array of challenges, which were discussed by the roundtable participants. Below, we summarise the key themes arising from the summit.

Interoperability - standardisation of language, templates and underlying technology

There was a strong emphasis on the importance of interoperability between smart contracts and their supporting technologies. A key challenge that was recognised was the development of a 'domain-specific' language, which would be both capable of legal expression whilst also carrying code to be electronically executable. The challenge here is to address the multiple separate ledgers and systems being developed by the different financial institutions, which will breed inefficiency through duplication and incompatibility. To address this challenge, there was general agreement that increased communication and cooperation through shared ledgers would be required. The general benefits identified were reductions in cost and risk, as well as an improvement in efficiency.

A proposal to remedy this problem was through a uniform approach, which could be achieved through common terminology and standardised template documentation. This could, for example, be started by leveraging the ISDA library which could provide a suite of templates, designed in FpML (Financial products Markup Language), increasing efficiency and promoting consistency.

This could potentially tie in with the idea of setting parameters within coded smart-contracts; values which are negotiated before being populated into the contracts 'terms', and a hypothetic future where prose and code can 'bind' together, and coexist (something that is already being progressed through the Common Language for Augmented Contract Knowledge). All in the context of Ricardian Contracts, which seek to bridge this gap between the prose and code - through these was general acknowledgment around the difficulties faced in attempting to simplify legal prose to be reduced to bytes that can be used electronically, especially under existing legal principles across introductions.

Legal interpretation, formalities and practicalities

There was some discussion of the spectrum of a smart contract's definition, from a 'code is contract' model that fully encodes contractual agreements, to the automation of the performance of aspects of traditional contracts, and challenges were identified with each of these.

- Interpretation of terms - In addition to the construct of the language used in smart contracts, and the transposition between legal prose and its electronic code (as discussed above), the language of a contract, in terms of its meaning and interpretation, also poses a challenge to smart contracts. A key issue which challenges the 'code is contract' model, is that the nuances of a contract's obligations cannot currently be contained entirely by code; the contract is ultimately what the law says it is, and there will invariably be terms implied into the agreement, not by code, but by legal statute, or through the conduct of the parties. Even in less comprehensive agreements, where certain elements are automated, there is the issue of ambiguity around the triggers and conditions of performance of contractual obligations. Phrases such as 'best endeavours' or 'as soon as practicable' were highlighted as key pitfalls in this respect. A key risk that was noted was that of unintended consequences - this is more prevalent in a code is contract model where full automation (without a kill switch operated, for example, by private parties and/or a regulator or government could have significant financial stability implications.

- Formalities - A further challenge in the adoption of a contract, set out entirely in code, might arise from the formalities of a jurisdiction's contract law - for example, the principle of offer and acceptance, consideration and certainty of terms, which determine the existence of a legal contract in the first instance under English law, might be less easily satisfied. Another problem may lie in the signing of certain documents, for example the electronic equivalent of executing documents by way of a deed.

- Practicalities - Automatically processed contractual provisions are not only reliant on predetermined values of set parameters, but also on reference points provided by external data sources. Such information might be determinative of a clause in a contract being triggered, for example a stock reaching a certain price, or the passing of a certain date. In this instance, smart contracts become less smart as times passes. Long-term or irrevocable smart contracts would be susceptible to issues due to a determinative data source (e.g. a pricing index) ceasing to exist. Alternatively, laws or sanctions critical to the contract's provisions, or affecting its performance, might change. These exemplify clauses of contracts which would demand greater agility in the technology that underpins them.

Accordingly, it was agreed that at present we are at the smart processing end of the spectrum, where parts of a contract or process could be automated. Such a "split contract" model, would allow identifiers within a natural language contract to be coded with smart-contract parameters to permit a certain degree of automation. This would be supported by wrappers within automated contracts as fall-backs in the case of the primary code construct failing.

Enforceability and regulation

Matters of enforceability extend beyond the construct of smart contracts satisfying the formalities of a jurisdiction's contract law principles. Automation and encoding of contractual terms will not make them immune to litigation or scrutiny by the courts; this poses jurisdictional challenges, requiring agreement over the relevant governing law and the courts responsible for settling disputes arising out of the smart contract. This could be particularly difficult where the contract is silent on such issues, and this could present particular difficulty to existing agreements which become "on-boarded" to smart-contract templates in the future.

A further concern is that of the regulators' approval. Though the UK's Financial Conduct Authority has been proactive in its engagement and encouragement of innovation in the financial services sector, (see our articles on the Regulatory Sandbox, RegTech Roundtables and RegTech: FCA Call for Input Findings) the implementation of smart contract technology is still very much in its infancy, as is the acceptance of an accredited standard of technological solution. Aside from financial regulation, a meaningful adoption of smart contracts by the legal industry may be reliant on similar engagement, or at least acceptance, by each jurisdiction' regulator's (for example, the UK's Solicitors Regulation Authoirty), who have to date remained silent on the issue.

Financial innovation firm R3 has released details of a recent Smart Contract Templates Summit, expanding the breadth and depth of work done with Barclays in this area earlier this year.

The summit in London and New York in late June explored developing master templates for smart contracts, the self-executing contractual agreements used to trade, record and manage assets on distributed and shared ledger platforms, and how they could be implemented within existing legal and regulatory frameworks.

As well as R3's consortium members, the summit was attended by standards bodies, law firms, academic institutions, exchanges and market infrastructure providers.

There were 60 representatives from 20 institutions - and presentations from Barclays, the International Swaps and Derivatives Association (ISDA), Norton Rose Fulbright, University College London (UCL) and R3.

Earlier this year, R3 collaborated with Barclays to demonstrate how Smart Contract Templates and R3's Corda platform could work together to provide a workable and understandable bridge between the worlds of law and technology.

Richard Brown, chief technology officer at R3, told IBTimes UK: "Coming out of the work we did jointly with the Barclays Accelerator and the other institutions at that time, we were really keen to arrange this summit and make sure it had a broad coverage.

"And not just from us as a technology firm and the banks, but also from the other parties who have an interest in the pieces of the jigsaw that need to be put together so smart contracts can be deployed and integrated with the legal realm."

A key question is which representation of the contract is authoritative: the legal prose (natural language) or the automation of it (the code).

Dr Lee Braine, Investment Bank CTO Office at Barclays told IBTimes UK: "It's useful to think of a smart contract as an agreement whose execution is both automatable and enforceable. Automatable via execution on a computer, although some parts may require human input and control. And enforceable via either the legal enforcement of rights and obligations or through tamper-proof execution on a permissionless blockchain.

"Our preference is for legal enforceability, so we look to leverage and build upon existing structures in place for legal agreements. For certain financial products, these may range from high-level master agreements with schedules and annexes, right the way through to confirmations."

Clive Ansell, head of market infrastructure and technology at ISDA, said: "ISDA is committed to supporting innovations in technology, and smart contracts represent one area where considerable opportunity exists. ISDA's existing suite of derivatives documentation, developed over many years, provides a basis to explore this further."

Braine said that one of the motivations for creating smart contracts, together with shared ledgers underneath them, is the opportunity to reduce the number and duration of disputes. Some of the potential improvements could result from simply making the relevant information, such as agreements governing specific trades, more easily accessible.

Brown agreed, adding: "If you look at the experience with The DAO recently, one of the key takeaways from that incident was that, in a system that perhaps had an express design goal of having the code be dominant, there is a need to have a broader contract that explains what happens in the event that things do go wrong."

The presentation slides from the summit show how smart contract thinking around legal prose and code has progressed to date and may evolve in future. Ian Grigg, consultant architect at R3, provided a retrospective on his invention of the Ricardian Contract triple of legal prose, parameters and computer code.

Dr Chris Clack of University College London described research which in the long term may result in new languages that could be automatically transformed into both legal prose and executable code - or even new executable languages that are admissible in court.

Brown said: "It's also a business question, and one of the things I took from Dr Clack's talk was that he was careful to lay out which concepts were potentially feasible for deployment in the short to medium term, and which ones were aspirations for the longer term.

"We have to make sure that what we propose to be deployed is deliverable within the existing context, given that early deployments will be small scale and they will be for narrow use cases. Therefore, allowing these to be fitted into the existing legal regimes with minimal changes, rather than requiring a wholesale change to everything, is clearly desirable."

Sean Murphy, partner at Norton Rose Fulbright, said: "Smart contracts have the potential to transform business and delivery significant cost savings by automating and streamlining contract processes. However, careful legal and regulatory analysis will be required as part of the work assessment involved in using this technology."

Another interesting point raised at the summit came from Darren Jones, head of investment banking legal automation at Barclays, whose presentation touched on the future of legal services including the potential for "AI lawyers" in litigation prediction and intelligent search for e-discovery and due diligence.

Braine said Smart Contract Templates could also potentially benefit from the application of machine intelligence. "You can imagine some processes that currently require human judgement being supported by automation. For example, a service based on historical case analysis suggesting to lawyers the most suitable agreement templates for particular scenarios based on criteria such as credit rating etc."

Brown added: "Maybe there is a standards point to be made here as well, which is a recurring theme in technology more generally. When common standards arise from protocols, data formats, code, etc, they can facilitate innovation higher up the stack. A standardised stable infrastructure can be leveraged by other parties as a base to deploy innovative solutions."

Turning to the Corda design itself, and with regard to privacy, Brown said: "We very much believe in the philosophy of defence in depth when it comes to anything to do with security, or associated non-functional requirements.

"There is no silver bullet and there is no one solution. I think it's uncontroversial to say that the best way to avoid data reaching people who shouldn't have it is by not giving it to them - and one could argue not giving it to them even in encrypted form, because one can always worry about whether the encryption may be subsequently compromised."

The R3 Smart Contract Templates Summit's presentations are publicly available online.

Questions around how smart contracts will be deployed and when we can see them operate in the real world were discussed by experts in this buzzing area of future finance.

A London Fintech Week 2016 panel session had gathered together Dr Lee Braine of the CTO Office of Barclays Investment Bank; Ajit Tripathi, director, Fintech & Digital at PwC; Sean Murphy, partner at Norton Rose Fulbright; and Preston Byrne, COO, Eris Industries.

Lee Braine has been leading an initiative to bring standardisation to this area with Smart Contract Templates, an idea which Barclays demonstrated earlier this year and the R3 consortium hosted a summit on last month.

To get things started, he offered a concise definition of a smart contract. He said: "A smart contract is an agreement that is both automatable and enforceable; automatable on a computer, perhaps requiring some human input and control, and enforceable by either traditional legal means, such as dispute resolution in the courts, or via a permissionless distributed blockchain."

Murphy agreed with this definition, and added some thought's from a lawyer's perspective. "What I see in the blockchain ecosystem is a spectrum of definitions of what smart contracts are and people have different understandings of what they are.

"What Lee has described is towards one end of the spectrum of what people think smart contracts are. There is another end of the spectrum, which I call the purist 'code is contract' school of thought; where people think about attempting to entirely codify complex contracts and for those complex contracts to be fully self-contained and self-enforcing and self-performing in all aspects.

"I think there is a question mark about the code is contract form of smart contracts; whether all of them are in fact legally-enforceable contracts. It's quite an interesting area of law."

Regarding the possibility of error or bugs in computer code causing problems in the automation of such contracts, Murphy pointed out that contracts, in the traditional sense, also suffer various imperfections. "As a lawyer, I can tell you that contracts are very seldom perfect. There can be simple typos in the contract. Or if it's a long term contract, it's just impossible to anticipate what might happen in the future. The contract might become illegal because of a change of law in the future, which would be an extreme example.

"In reality what happens, particularly with complex long term contracts in the conventional world, is that they are often amended because the parties recognise that something is wrong in that contract and needs to be changed," said Murphy.

Byrne, a securities lawyer in his past professional life, began by saying the phrase "smart contract" is a term of art, but essentially it means a piece of code on a blockchain that's running in two places at once, automating an existing legal relationship.

Byrne mentioned a meet-up he attended recently in Brooklyn called "Legal Hackers" which had attracted a bunch of young lawyers who could also write machine code (a useful skill-set if smart contracts become ubiquitous governance instruments).

"They were sick of doing the same thing over and over again manually," said Byrne. "So they are using software to improve how they do it.

"Law is one of those funny disciplines; if you are managing the life cycle of a deal, you are emailing and faxing. But there is no reason, if you are calling an event default, you shouldn't just push a button and then have the payment system on the other side update to reflect this.

"Instead what you are doing is sending an email to a trustee, the trustee is going and talking to their lawyers; there's back and forth and then you have to determine where the new event is occurring. Then, only after a very long back and forth of $100K of legal fees, do you manually change your bank system to reflect the new circumstances."

Byrne said there is a whole generation of young lawyers who are learning to code and basically to make things more efficient because there is a better way to do all this.

Ajit Tripathi said one of the things PwC does is performance assurance, because regardless of technological advancements there will always be ambiguity and interests that differ between counterparties.

"There are financial contracts that are fairly standardised and there is very little ambiguity, but even though there is very little ambiguity there are nonetheless disputes around collateral and the performance of the contracts, where the counterparties wish to dispute whether the other party performed on the contract or not."

Tripathi said there is a role for regulators and for independent verifiers to essentially come and step in and use the verfiability that blockchain technology provides. This feature of blockchains reduces ambiguity and to some extent a lot of back office can be taken out from the performance.

Braine concluded by emphasising there could be valid reasons to change the code in a smart contract other than fixing bugs, such as to reflect updates in regulation, for instance. "In these cases, a suitable governance model would be needed to allow network participants to use a controlled way of deploying updates to the smart contract code that is running - for defects, changes in regulation, and potentially also a kill switch if it's necessary to stop it."

UK banking giant Barclays and University College London have set forth their initial vision for smart contracts in a new position paper.

Released this week, the 15-page research effort explores the definitions of key terms surrounding the emerging blockchain application and its terminology, aiming to cut through the layers of hype that have arguably lead to irrational market expectations for the technology today.

Report author Lee Braine, of the investment Bank CTO Office at Barclays, said the aim was to search for "narrower definitions" of commonly used terms such as "automation" and "enforceability" as a means of moving forward with its work on smart contract templates for use by institutions.

In this light, the position paper can be viewed as a necessary step back, one that finds the bank and its partner university examining how smart contracts will be used, and how they can be best architected to meet those anticipated needs going forward.

Braine told CoinDesk:

"We were looking to consider the terminology, the wording of smart contract. We asked, 'What were some of the key features?', and we give definitions."

Braine said that this exercise proved useful in exposing some of the problematic thinking that has developed around the nascent concept. While he didn't name The DAO specifically, Braine hinted that the public blockchain space offered examples of challenges inherent in the deployment of smart contracts today.

For example, Braine cited the idea that smart contracts should be "tamper-proof", arguing that while contracts that are resistant to change may be preferred in some instances, in others it could prove problematic.

"How would you stop such a smart contract from executing if it was necessary? How would you change its behavior to reflect a defect that had been fixed, and you then need to deploy a corrected version?" Braine asked.

Braine noted that this is relevant to Barclays and its work developing smart contract templates, as these scenarios are likely to occur frequently for regulated entities.

For the bank, the paper marks a continuation of an investigative process it began at the end of last year with the intent to create a smart contracts proof-of-concept.

That project, which leveraged then-new technology from banking consortium R3CEV, was eventually demoed in April during a exhibition at its accelerator in London.

Language-level innovation

Ultimately, the paper puts forth the idea that Barclays believes it will need to encourage innovation in smart contracting languages in order to best develop the tech it believes could be leveraged in global finance.

He noted that while there are existing languages (Java) and new languages ( ethereum's Solidity) that have been created or that can be used for this purpose, the market will perhaps best benefit from a healthy competition between alternatives.

"One of the things we were aiming to do was to remain agnostic of the target platform. This means remaining agnostic of the target language of the detailed business logic," Braine said, adding:

"We should assume there will be more progress and more variety and what we need to do is construct interoperability."

Braine suggested that Barclays foresees a world where a diversity of smart contract languages could be used to create implementations on platforms as diverse as R3's distributed ledger, Corda, public blockchains like ethereum and consortium efforts like Hyperledger.

"As long as they conform to the smart contract, the prose could delegate to the implementation," he continued.

Legal considerations

On the business side, the paper also aims to ensure that the technology is being developed in a way that is "faithful" to existing processes for legal documentation.

As such, it states that it believes the term "smart contracts" should encompass two definitions - executing both obligations, possibly within a shared ledger framework, as well as informing operational aspects such as how legal contracts are written and their prose interpreted.

The paper's definition of smart contracts reads:

"A smart contract is an agreement whose execution is both automatable and enforceable. Automatable by computer, although some parts may require human input and control. Enforceable by either legal enforcement of rights and obligations or tamper-proof execution."

Elsewhere, the paper makes a distinction between "smart legal contracts" and "smart contract code" in statements that arguably move away from the idea popular in the open-source community that code can serve as law.

In this way, it is seeking to encourage a definition of smart contracts in which traditional means of enforcement, such as a court of law, are considered.

Work ahead

Going forward, Braine said Barclays and its partners intend to pursue a strategy that encourages open innovation, and he cited this new paper as evidence it is seeking to give back to those working to move forward smart contracts in other ways.

For example, Braine said that Barclays intends to put out another paper this year that will expand on the CLACK language being developed by report co-author Christopher Clack of University College London.

Barclays, he said, also intends to leverage its network to capture more mindshare for smart contracts development. To date, this has included working with the R3 consortium, which it joined in September of last year, and presenting its work to consortia such as the Post-Trade Distributed Ledger Group.

He concluded:

Legal tech image via Shutterstock"We're looking at the foundations and the structure and we'll be sharing more research as it becomes available."