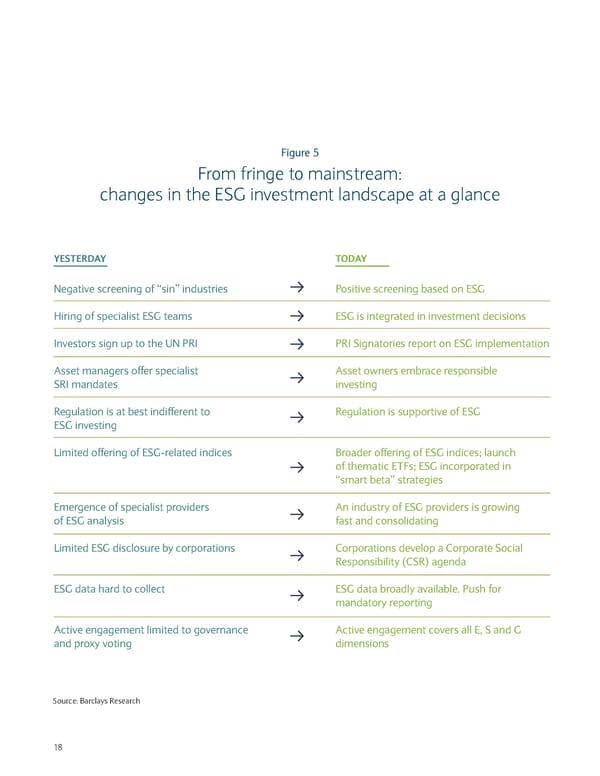

Figure 5 From fringe to mainstream: changes in the ESG investment landscape at a glance YESTERDAY TODAY Negative screening of “sin” industries Positive screening based on ESG Hiring of specialist ESG teams ESG is integrated in investment decisions Investors sign up to the UN PRI PRI Signatories report on ESG implementation Asset managers offer specialist Asset owners embrace responsible SRI mandates investing Regulation is at best indifferent to Regulation is supportive of ESG ESG investing Limited offering of ESG-related indices Broader offering of ESG indices; launch of thematic ETFs; ESG incorporated in “smart beta” strategies Emergence of specialist providers An industry of ESG providers is growing of ESG analysis fast and consolidating Limited ESG disclosure by corporations Corporations develop a Corporate Social Responsibility (CSR) agenda ESG data hard to collect ESG data broadly available. Push for mandatory reporting Active engagement limited to governance Active engagement covers all E, S and G and proxy voting dimensions Source: Barclays Research 18

Sustainable Investing and Bond Returns Page 19 Page 21

Sustainable Investing and Bond Returns Page 19 Page 21