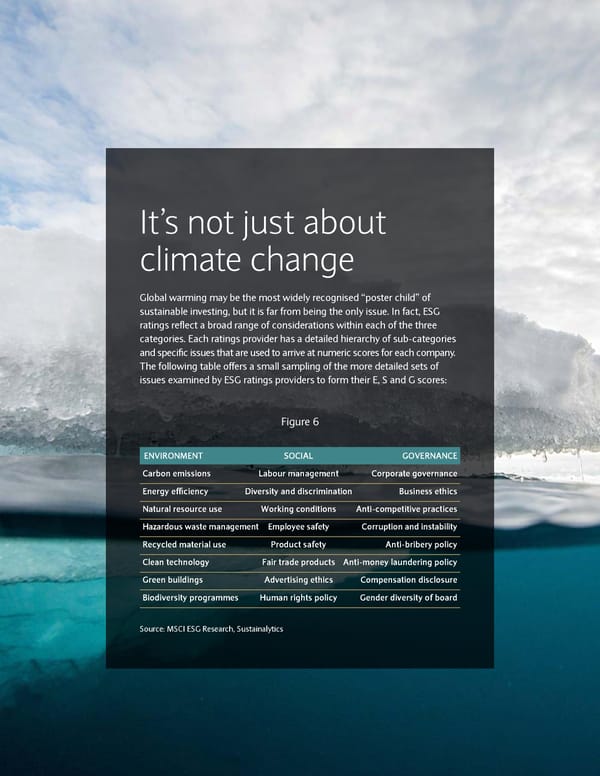

It’s not just about climate change Global warming may be the most widely recognised “poster child” of sustainable investing, but it is far from being the only issue. In fact, ESG ratings reflect a broad range of considerations within each of the three categories. Each ratings provider has a detailed hierarchy of sub-categories and specific issues that are used to arrive at numeric scores for each company. The following table offers a small sampling of the more detailed sets of issues examined by ESG ratings providers to form their E, S and G scores: Figure 6 ENVIRONMENT SOCIAL GOVERNANCE Carbon emissions Labour management Corporate governance Energy efficiency Diversity and discrimination Business ethics Natural resource use Working conditions Anti-competitive practices Hazardous waste management Employee safety Corruption and instability Recycled material use Product safety Anti-bribery policy Clean technology Fair trade products Anti-money laundering policy Green buildings Advertising ethics Compensation disclosure Biodiversity programmes Human rights policy Gender diversity of board Source: MSCI ESG Research, Sustainalytics

Sustainable Investing and Bond Returns Page 24 Page 26

Sustainable Investing and Bond Returns Page 24 Page 26