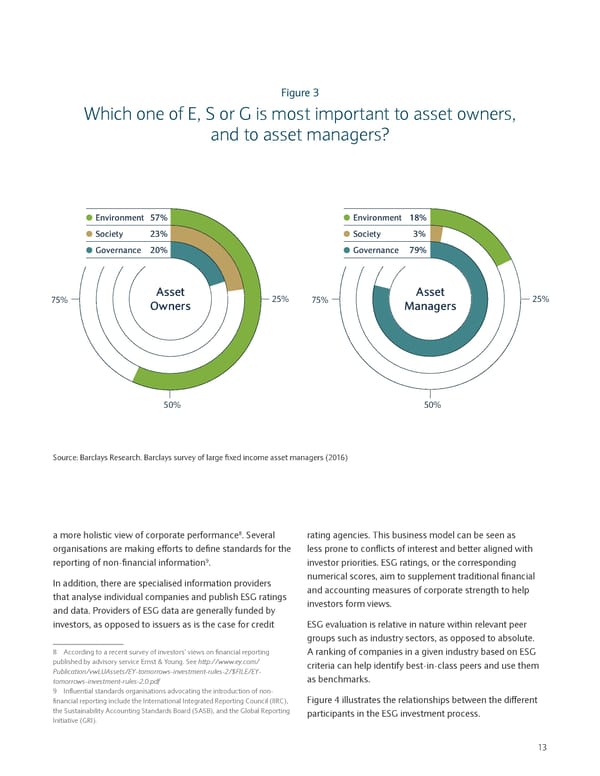

Figure 3 Which one of E, S or G is most important to asset owners, and to asset managers? Environment 57% Environment 18% Society 23% Society 3% Governance 20% Governance 79% 75% Asset 25% 75% Asset 25% Owners Managers 50% 50% Source: Barclays Research. Barclays survey of large fixed income asset managers (2016) 8 a more holistic view of corporate performance . Several rating agencies. This business model can be seen as organisations are making efforts to define standards for the less prone to conflicts of interest and better aligned with reporting of non-financial information9. investor priorities. ESG ratings, or the corresponding In addition, there are specialised information providers numerical scores, aim to supplement traditional financial that analyse individual companies and publish ESG ratings and accounting measures of corporate strength to help and data. Providers of ESG data are generally funded by investors form views. investors, as opposed to issuers as is the case for credit ESG evaluation is relative in nature within relevant peer groups such as industry sectors, as opposed to absolute. 8 According to a recent survey of investors’ views on financial reporting A ranking of companies in a given industry based on ESG published by advisory service Ernst & Young. See http://www.ey.com/ criteria can help identify best-in-class peers and use them Publication/vwLUAssets/EY-tomorrows-investment-rules-2/$FILE/EY- as benchmarks. tomorrows-investment-rules-2.0.pdf 9 Influential standards organisations advocating the introduction of non- financial reporting include the International Integrated Reporting Council (IIRC), Figure 4 illustrates the relationships between the different the Sustainability Accounting Standards Board (SASB), and the Global Reporting participants in the ESG investment process. Initiative (GRI). 13

Sustainable Investing and Bond Returns Page 13 Page 15

Sustainable Investing and Bond Returns Page 13 Page 15