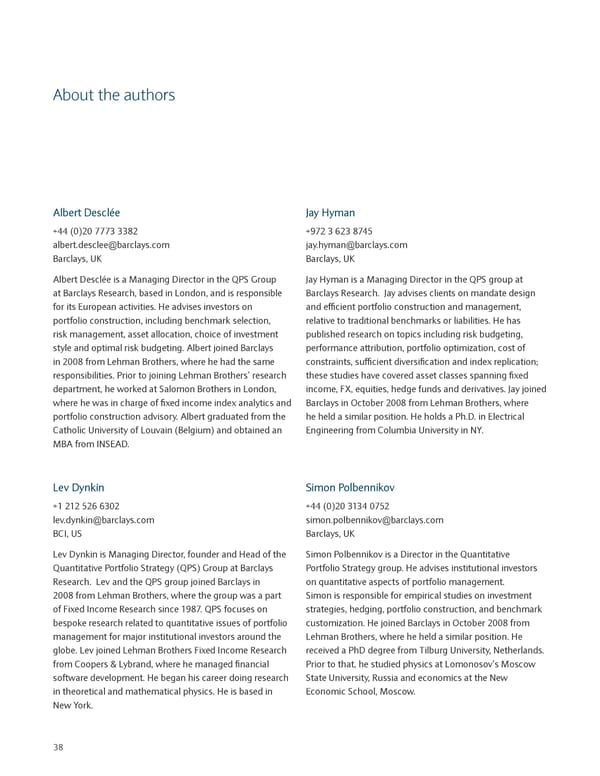

About the authors Albert Desclée Jay Hyman +44 (0)20 7773 3382 +972 3 623 8745 albert.desclee@barclays.com jay.hyman@barclays.com Barclays, UK Barclays, UK Albert Desclée is a Managing Director in the QPS Group Jay Hyman is a Managing Director in the QPS group at at Barclays Research, based in London, and is responsible Barclays Research. Jay advises clients on mandate design for its European activities. He advises investors on and efficient portfolio construction and management, portfolio construction, including benchmark selection, relative to traditional benchmarks or liabilities. He has risk management, asset allocation, choice of investment published research on topics including risk budgeting, style and optimal risk budgeting. Albert joined Barclays performance attribution, portfolio optimization, cost of in 2008 from Lehman Brothers, where he had the same constraints, sufficient diversification and index replication; responsibilities. Prior to joining Lehman Brothers’ research these studies have covered asset classes spanning fixed department, he worked at Salomon Brothers in London, income, FX, equities, hedge funds and derivatives. Jay joined where he was in charge of fixed income index analytics and Barclays in October 2008 from Lehman Brothers, where portfolio construction advisory. Albert graduated from the he held a similar position. He holds a Ph.D. in Electrical Catholic University of Louvain (Belgium) and obtained an Engineering from Columbia University in NY. MBA from INSEAD. Lev Dynkin Simon Polbennikov +1 212 526 6302 +44 (0)20 3134 0752 lev.dynkin@barclays.com simon.polbennikov@barclays.com BCI, US Barclays, UK Lev Dynkin is Managing Director, founder and Head of the Simon Polbennikov is a Director in the Quantitative Quantitative Portfolio Strategy (QPS) Group at Barclays Portfolio Strategy group. He advises institutional investors Research. Lev and the QPS group joined Barclays in on quantitative aspects of portfolio management. 2008 from Lehman Brothers, where the group was a part Simon is responsible for empirical studies on investment of Fixed Income Research since 1987. QPS focuses on strategies, hedging, portfolio construction, and benchmark bespoke research related to quantitative issues of portfolio customization. He joined Barclays in October 2008 from management for major institutional investors around the Lehman Brothers, where he held a similar position. He globe. Lev joined Lehman Brothers Fixed Income Research received a PhD degree from Tilburg University, Netherlands. from Coopers & Lybrand, where he managed financial Prior to that, he studied physics at Lomonosov’s Moscow software development. He began his career doing research State University, Russia and economics at the New in theoretical and mathematical physics. He is based in Economic School, Moscow. New York. 38

Sustainable Investing and Bond Returns Page 42 Page 44

Sustainable Investing and Bond Returns Page 42 Page 44