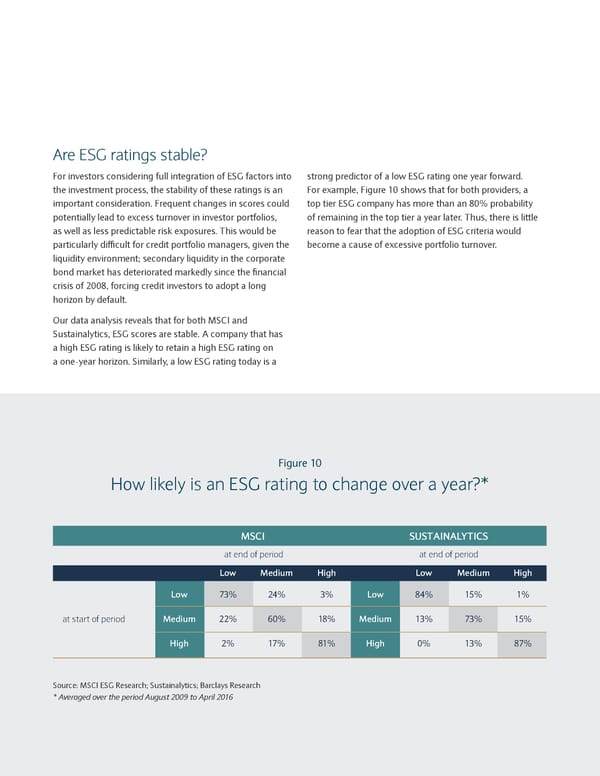

Are ESG ratings stable? For investors considering full integration of ESG factors into strong predictor of a low ESG rating one year forward. the investment process, the stability of these ratings is an For example, Figure 10 shows that for both providers, a important consideration. Frequent changes in scores could top tier ESG company has more than an 80% probability potentially lead to excess turnover in investor portfolios, of remaining in the top tier a year later. Thus, there is little as well as less predictable risk exposures. This would be reason to fear that the adoption of ESG criteria would particularly difficult for credit portfolio managers, given the become a cause of excessive portfolio turnover. liquidity environment; secondary liquidity in the corporate bond market has deteriorated markedly since the financial crisis of 2008, forcing credit investors to adopt a long horizon by default. Our data analysis reveals that for both MSCI and Sustainalytics, ESG scores are stable. A company that has a high ESG rating is likely to retain a high ESG rating on a one-year horizon. Similarly, a low ESG rating today is a Figure 10 How likely is an ESG rating to change over a year?* MSCI SUSTAINALYTICS at end of period at end of period Low Medium High Low Medium High Low 73% 24% 3% Low 84% 15% 1% at start of period Medium 22% 60% 18% Medium 13% 73% 15% High 2% 17% 81% High 0% 13% 87% Source: MSCI ESG Research; Sustainalytics; Barclays Research * Averaged over the period August 2009 to April 2016 26

Sustainable Investing and Bond Returns Page 28 Page 30

Sustainable Investing and Bond Returns Page 28 Page 30