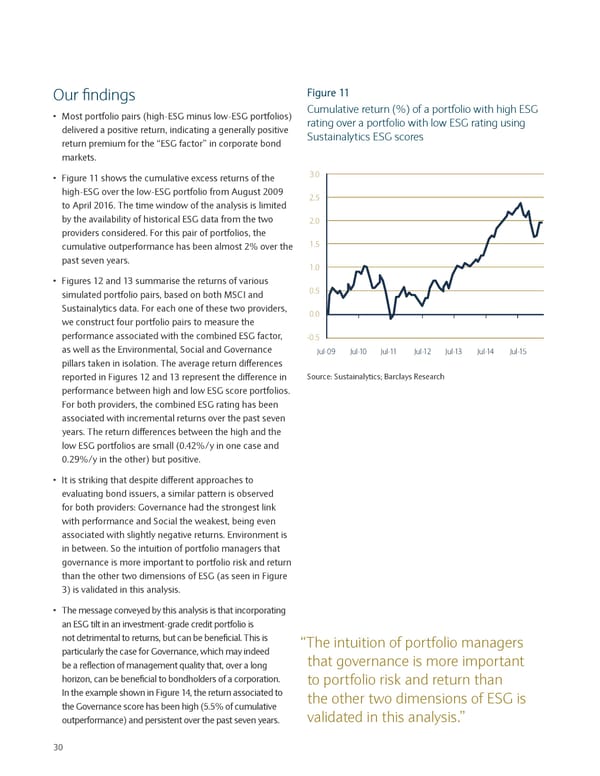

Our findings Figure 11 • Most portfolio pairs (high-ESG minus low-ESG portfolios) Cumulative return (%) of a portfolio with high ESG delivered a positive return, indicating a generally positive rating over a portfolio with low ESG rating using return premium for the “ESG factor” in corporate bond Sustainalytics ESG scores markets. • Figure 11 shows the cumulative excess returns of the 3.0 high-ESG over the low-ESG portfolio from August 2009 2.5 to April 2016. The time window of the analysis is limited by the availability of historical ESG data from the two 2.0 providers considered. For this pair of portfolios, the cumulative outperformance has been almost 2% over the 1.5 past seven years. 1.0 • Figures 12 and 13 summarise the returns of various simulated portfolio pairs, based on both MSCI and 0.5 Sustainalytics data. For each one of these two providers, 0.0 we construct four portfolio pairs to measure the performance associated with the combined ESG factor, -0.5 as well as the Environmental, Social and Governance Jul-09 Jul-10 Jul-11 Jul-12 Jul-13 Jul-14 Jul-15 pillars taken in isolation. The average return differences reported in Figures 12 and 13 represent the difference in Source: Sustainalytics; Barclays Research performance between high and low ESG score portfolios. For both providers, the combined ESG rating has been associated with incremental returns over the past seven years. The return differences between the high and the low ESG portfolios are small (0.42%/y in one case and 0.29%/y in the other) but positive. • It is striking that despite different approaches to evaluating bond issuers, a similar pattern is observed for both providers: Governance had the strongest link with performance and Social the weakest, being even associated with slightly negative returns. Environment is in between. So the intuition of portfolio managers that governance is more important to portfolio risk and return than the other two dimensions of ESG (as seen in Figure 3) is validated in this analysis. • The message conveyed by this analysis is that incorporating an ESG tilt in an investment-grade credit portfolio is not detrimental to returns, but can be beneficial. This is “The intuition of portfolio managers particularly the case for Governance, which may indeed that governance is more important be a reflection of management quality that, over a long horizon, can be beneficial to bondholders of a corporation. to portfolio risk and return than In the example shown in Figure 14, the return associated to the other two dimensions of ESG is the Governance score has been high (5.5% of cumulative validated in this analysis.” outperformance) and persistent over the past seven years. 30

Sustainable Investing and Bond Returns Page 33 Page 35

Sustainable Investing and Bond Returns Page 33 Page 35