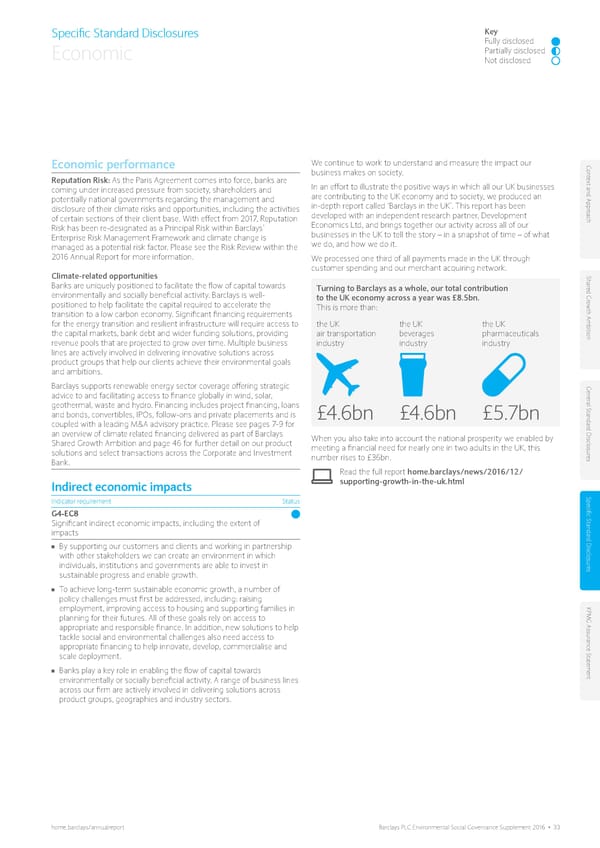

Specific Standard Disclosures Key Fully disclosed Economic Partially disclosed Not disclosed Economic performance We continue to work to understand and measure the impact our Con business makes on society. t e Reputation Risk: As the Paris Agreement comes into force, banks are In an effort to illustrate the positive ways in which all our UK businesses xt and Appr coming under increased pressure from society, shareholders and are contributing to the UK economy and to society, we produced an potentially national governments regarding the management and in-depth report called ‘Barclays in the UK’. This report has been disclosure of their climate risks and opportunities, including the activities o of certain sections of their client base. With effect from 2017, Reputation developed with an independent research partner, Development ach Risk has been re-designated as a Principal Risk within Barclays’ Economics Ltd, and brings together our activity across all of our Enterprise Risk Management Framework and climate change is businesses in the UK to tell the story – in a snapshot of time – of what managed as a potential risk factor. Please see the Risk Review within the we do, and how we do it. 2016 Annual Report for more information. We processed one third of all payments made in the UK through customer spending and our merchant acquiring network. Climate-related opportunities Shar Banks are uniquely positioned to facilitate the flow of capital towards Turning to Barclays as a whole, our total contribution ed Gr environmentally and socially beneficial activity. Barclays is well- to the UK economy across a year was £8.5bn. o positioned to help facilitate the capital required to accelerate the This is more than: wth Ambition transition to a low carbon economy. Significant financing requirements for the energy transition and resilient infrastructure will require access to the UK the UK the UK the capital markets, bank debt and wider funding solutions, providing air transportation beverages pharmaceuticals revenue pools that are projected to grow over time. Multiple business industry industry industry lines are actively involved in delivering innovative solutions across product groups that help our clients achieve their environmental goals and ambitions. Barclays supports renewable energy sector coverage offering strategic Gener advice to and facilitating access to finance globally in wind, solar, geothermal, waste and hydro. Financing includes project financing, loans al S and bonds, convertibles, IPOs, follow-ons and private placements and is £4.6bn £4.6bn £5.7bn tandar coupled with a leading M&A advisory practice. Please see pages 7-9 for an overview of climate related financing delivered as part of Barclays d Disclosur Shared Growth Ambition and page 46 for further detail on our product When you also take into account the national prosperity we enabled by solutions and select transactions across the Corporate and Investment meeting a financial need for nearly one in two adults in the UK, this Bank. number rises to £36bn. es Read the full report home.barclays/news/2016/12/ Indirect economic impacts supporting-growth-in-the-uk.html Indicator requirement Status Specific S G4-EC8 Significant indirect economic impacts, including the extent of tandar impacts d Disclosur ■■ By supporting our customers and clients and working in partnership with other stakeholders we can create an environment in which individuals, institutions and governments are able to invest in es sustainable progress and enable growth. ■■ To achieve long-term sustainable economic growth, a number of policy challenges must first be addressed, including: raising employment, improving access to housing and supporting families in KP planning for their futures. All of these goals rely on access to MG Assur appropriate and responsible finance. In addition, new solutions to help tackle social and environmental challenges also need access to ance S appropriate financing to help innovate, develop, commercialise and scale deployment. ta t emen ■■ Banks play a key role in enabling the flow of capital towards environmentally or socially beneficial activity. A range of business lines t across our firm are actively involved in delivering solutions across product groups, geographies and industry sectors. home.barclays/annualreport Barclays PLC Environmental Social Governance Supplement 2016 • 33

Environmental Social Governance Supplement Page 36 Page 38

Environmental Social Governance Supplement Page 36 Page 38