Environmental Social Governance Supplement

Building the bank of the future

Contents Notes Page The term Barclays or Group refers to Barclays PLC together with its subsidiaries. The abbreviations ‘£m’ and ‘£bn’ represent millions and Con thousands of millions of Pounds Sterling respectively; the abbreviations The strategic context for our t e ‘$m’ and ‘$bn’ represent millions and thousands of millions of US Dollars xt and Appr respectively; and the abbreviations ‘€m’ and ‘€bn’ represent millions and citizenship performance 02 thousands of millions of Euros respectively. Relevant terms that are used in this document but are not defined under o applicable regulatory guidance or International Financial Reporting Shared Growth Ambition 04 ach Standards (IFRS) are explained in the results glossary that can be accessed at home.barclays/results. Non-IFRS performance measures Global Reporting Initiative G4 table 17 Barclays management believes that the non-IFRS performance measures included in this document provide valuable information to the readers of General Standard Disclosures 18 the financial statements as they enable the reader to identify a more consistent basis for comparing the business’ performance between Specific Standard Disclosures 30 financial periods, and provide more detail concerning the elements of Shar performance which the managers of these businesses are most directly able to influence or are relevant for an assessment of the Group. They also Assurance Statement 49 ed Gr reflect an important aspect of the way in which operating targets are o defined and performance is monitored by Barclays’ management. wth Ambition However, any non-IFRS performance measures in this document are not a substitute for IFRS measures and readers should consider the IFRS measures as well. Refer the Annual Report for further information, reconciliations and calculations of non-IFRS performance measures included throughout this document, and the most directly comparable IFRS measures. Forward-looking statements This document contains certain forward-looking statements within the meaning of Section 21E of the US Securities Exchange Act of 1934, as amended, and Section 27A of the US Securities Act of 1933, as amended, with respect to the Group. Barclays cautions readers that no Gener forward-looking statement is a guarantee of future performance and that actual results or other financial condition or performance measures could al S differ materially from those contained in the forward-looking statements. These forward-looking statements can be identified by the fact that they tandar do not relate only to historical or current facts. Forward-looking statements sometimes use words such as ‘may’, ‘will’, ‘seek’, ‘continue’, d Disclosur ‘aim’, ‘anticipate’, ‘target’, ‘projected’, ‘expect’, ‘estimate’, ‘intend’, ‘plan’, ‘goal’, ‘believe’, ‘achieve’ or other words of similar meaning. Examples of forward-looking statements include, among others, statements or guidance regarding the Group’s future financial position, income growth, es assets, impairment charges, provisions, notable items, business strategy, structural reform, capital, leverage and other regulatory ratios, payment of dividends (including dividend pay-out ratios and expected payment strategies), projected levels of growth in the banking and financial markets, projected costs or savings, original and revised commitments and targets in connection with the strategic cost programme and the Specific S Group Strategy Update, rundown of assets and businesses within Barclays Non-Core, sell down of the Group’s interest in Barclays Africa Group Limited, estimates of capital expenditures and plans and objectives for tandar future operations, projected employee numbers and other statements that are not historical fact. By their nature, forward-looking statements involve risk and uncertainty because they relate to future events and d Disclosur circumstances. These may be affected by changes in legislation, the development of standards and interpretations under International Financial Reporting Standards, evolving practices with regard to the interpretation and application of accounting and regulatory standards, the es outcome of current and future legal proceedings and regulatory investigations, future levels of conduct provisions, future levels of notable items, the policies and actions of governmental and regulatory authorities, geopolitical risks and the impact of competition. In addition, factors including (but not limited to) the following may have an effect: capital, KP leverage and other regulatory rules (including with regard to the future MG Assur structure of the Group) applicable to past, current and future periods; UK, US, Africa, Eurozone and global macroeconomic and business conditions; the effects of continued volatility in credit markets; market related risks such as changes in interest rates and foreign exchange rates; effects of ance S changes in valuation of credit market exposures; changes in valuation of issued securities; volatility in capital markets; changes in credit ratings of ta t any entities within the Group or any securities issued by such entities; the emen potential for one or more countries exiting the Eurozone; the implications of the results of the 23 June 2016 referendum in the United Kingdom and t the disruption that may result in the UK and globally from the withdrawal of the United Kingdom from the European Union; the implementation of the strategic cost programme; and the success of future acquisitions, Where can I find out more? disposals and other strategic transactions. A number of these influences and factors are beyond the Group’s control. As a result, the Group’s actual You can learn about Barclays’ future results, dividend payments, and capital and leverage ratios may strategy, our businesses and performance, differ materially from the plans, goals, expectations and guidance set forth in the Group’s forward-looking statements. Additional risks and factors approach to governance and risk online, which may impact the Group’s future financial condition and performance where latest and archived annual are identified in our filings with the SEC (including, without limitation, our and strategic reports are available annual report on form 20-F for the fiscal year ended 31 December 2016), which are available on the SEC’s website at www.sec.gov. Subject to our to view or download. obligations under the applicable laws and regulations of the United Kingdom and the United States in relation to disclosure and ongoing For further information and a fuller understanding of the results and the information, we undertake no obligation to update publicly or revise any forward looking statements, whether as a result of new information, state of affairs of the Group, please refer to the full 2016 Annual Report future events or otherwise. and Accounts at home.barclays/annualreport home.barclays/annualreport Barclays PLC Environmental Social Governance Supplement 2016 • 01

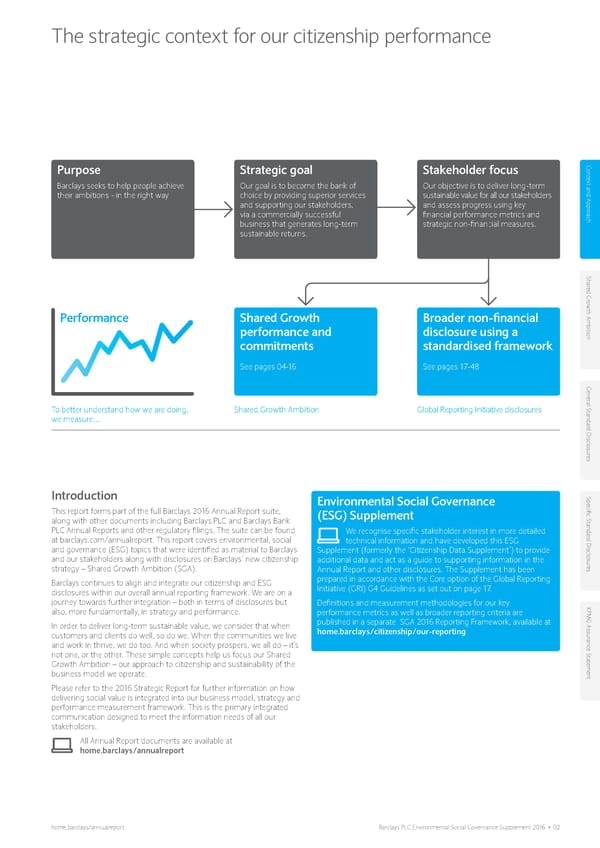

The strategic context for our citizenship performance Purpose Strategic goal Stakeholder focus Con t e Barclays seeks to help people achieve Our goal is to become the bank of Our objective is to deliver long-term xt and Appr their ambitions - in the right way choice by providing superior services sustainable value for all our stakeholders and supporting our stakeholders, and assess progress using key o via a commercially successful financial performance metrics and ach business that generates long-term strategic non-financial measures. sustainable returns. Shar ed Gr o Performance Shared Growth Broader non-financial wth Ambition performance and disclosure using a commitments standardised framework See pages 04-16 See pages 17-48 Gener al S To better understand how we are doing, Shared Growth Ambition Global Reporting Initiative disclosures tandar we measure… d Disclosur es Introduction Environmental Social Governance Specific S This report forms part of the full Barclays 2016 Annual Report suite, (ESG) Supplement along with other documents including Barclays PLC and Barclays Bank tandar PLC Annual Reports and other regulatory filings. The suite can be found We recognise specific stakeholder interest in more detailed at barclays.com/annualreport. This report covers environmental, social technical information and have developed this ESG d Disclosur and governance (ESG) topics that were identified as material to Barclays Supplement (formerly the ‘Citizenship Data Supplement’) to provide and our stakeholders along with disclosures on Barclays’ new citizenship additional data and act as a guide to supporting information in the strategy – Shared Growth Ambition (SGA). Annual Report and other disclosures. The Supplement has been es Barclays continues to align and integrate our citizenship and ESG prepared in accordance with the Core option of the Global Reporting disclosures within our overall annual reporting framework. We are on a Initiative (GRI) G4 Guidelines as set out on page 17. journey towards further integration – both in terms of disclosures but Definitions and measurement methodologies for our key KP also, more fundamentally, in strategy and performance. performance metrics as well as broader reporting criteria are MG Assur In order to deliver long-term sustainable value, we consider that when published in a separate SGA 2016 Reporting Framework, available at customers and clients do well, so do we. When the communities we live home.barclays/citizenship/our-reporting and work in thrive, we do too. And when society prospers, we all do – it’s ance S not one, or the other. These simple concepts help us focus our Shared ta t Growth Ambition – our approach to citizenship and sustainability of the emen business model we operate. t Please refer to the 2016 Strategic Report for further information on how delivering social value is integrated into our business model, strategy and performance measurement framework. This is the primary integrated communication designed to meet the information needs of all our stakeholders. All Annual Report documents are available at home.barclays/annualreport home.barclays/annualreport Barclays PLC Environmental Social Governance Supplement 2016 • 02

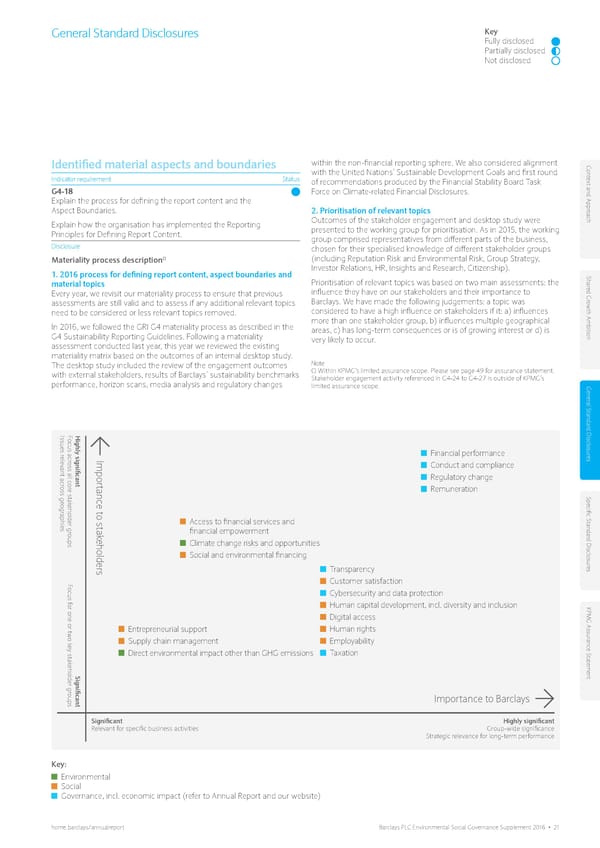

About this report Report navigation Con t e Focusing on specific topics that are important to our stakeholders and More information on all Environmental topics can be found primarily on xt and Appr strategically significant to our business performance allows us to pages 35-37, 41-43 and 46-47. address the right issues and provide disclosure on them. One of our More information on all Social topics can be found primarily within the major sustainability milestones in 2016 was the launch of the Shared o Growth Ambition, our new citizenship strategy. During its development GRI’s social indicator pages 38-48 and in the Annual Report. ach we engaged in extensive stakeholder consultation. The insights gained More information on all Governance topics can be found in the Annual from this exercise informed this year’s materiality assessment. Report, including the Corporate governance report, Risk review and on Every year we review our materiality matrix in order to align it with home.barclays/barclays-investor-relations. current trends and the changing context of the business, and reflect A range of case studies, research, policies and additional disclosures are feedback from ongoing stakeholder engagement. As a result of the 2016 available on home.barclays/citizenship. review, we made changes to the matrix and decreased the number of Shar topics from 23 to 18 primarily through grouping topics into broader ed Gr categories. o Please see pages 21-22 for a description of the materiality wth Ambition process. We have presented the results of the 2016 materiality process below and allocated each one of the material topics into an Environmental, Social or Governance category. Gener al S tandar d Disclosur Issues rFHighly significant ocus acr Financial performance es eleoss all cImportance t v an Conduct and compliance t acr Regulatory change oss geogror e stak Remuneration Specific S eholder gr aphies o stak Access to financial services and tandar oups eholders financial empowerment d Disclosur Climate change risks and opportunities Social and environmental financing Transparency es Customer satisfaction F ocus f Cybersecurity and data protection or one or tw Human capital development, incl. diversity and inclusion KP Digital access MG Assur Entrepreneurial support Human rights o k Supply chain management Employability ance S e y stak Direct environmental impact other than GHG emissions Taxation ta t eholder gr emen Significant t oups Importance to Barclays Significant Highly significant Relevant for specific business activities Group-wide significance Strategic relevance for long-term performance Key: Environmental Social Governance, incl. economic impact (refer to Annual Report and our website) home.barclays/annualreport Barclays PLC Environmental Social Governance Supplement 2016 • 03

Shared Growth Ambition Con t e xt and Appr o ach Shar ed Gr o wth Ambition Gener al S tandar d Disclosur es Specific S tandar d Disclosur es KP MG Assur ance S ta t Growing Underground emen Growing Underground (GU) was part of the first cohort of the UK t Unreasonable Impact programme. It utilises the latest LED lighting and hydroponic growing systems to sustainably grow fresh herbs and salads year-round. Supplying local food services, retail, and farmers’ markets, GU reduces the need to import crops and minimises wasted energy from long-distance food transport. For more details about Unreasonable Impact, refer to page 14. home.barclays/annualreport Barclays PLC Environmental Social Governance Supplement 2016 • 04

Introduction and strategic context Con t e xt and Appr o ach Shar ed Gr o wth Ambition The Board Reputation Committee is I went into this industry as a young man out of 2016 was an important milestone in the responsible for overseeing our citizenship college because I was fascinated by the evolution of Barclays’ Citizenship journey, with agenda. This includes active engagement in profession of finance: how banks and bankers the launch of our Shared Growth Ambition developing and approving our strategy, can help people, businesses and countries which defines our objectives for the years regularly reviewing our performance against succeed. It mattered to me when I started my ahead. the objectives we have set, and signing off our career and it matters even more today. annual disclosure. In one way or another, finance when delivered Each and every person at Barclays has a role to Gener play in realising our ambition, and we are I am very proud of the work that Barclays does with transparency and integrity makes a working together with our network of clients, al S to improve the economic and social prospects fundamental difference to everyone’s lives. The partners and other stakeholders to collectively tandar of people in the communities we serve. This profession of finance is absolutely integral to achieve the commitments we have made. By report is an important reflection on that work. the successful running and growth of healthy continually focusing our efforts on the d Disclosur It is also a valuable tool which will help us economies, and in giving everyone access to a opportunities that align most closely with our continue to shape and improve our strategy more prosperous future. This is the core focus core strengths as a bank, we will be able to es over the coming years. of our Shared Growth Ambition. have the greatest and most sustainable Citizenship is an integral part of the ethos of I’m immensely proud of the work that is impact. this company, and the Board will continue to reflected in this report. The progress we have Citizenship matters to the future success of our work hard to ensure that we are focused on made in the first year of our Shared Growth business. But it’s not good enough to think, Specific S driving sustainable economic development and Ambition is a significant step towards building wish and hope. We have set out an ambitious social prosperity in the long term. a better Barclays and I’m looking forward to plan, and aspire to act with both integrity and seeing what more we can achieve in the years persistence to deliver against it. tandar to come. Strong progress has been made in 2016 across d Disclosur our businesses and geographical markets. We’re incredibly proud of the growing suite of Sir Gerry Grimstone innovative products, services and partnerships es Deputy Chairman, that Barclays has developed to deliver both Senior Independent Director, societal and commercial value in tandem. Chairman of the Board Reputation Committee We hope you will enjoy reading about our progress to date and our ambition for the KP coming years. MG Assur James E. Staley ance S Group Chief Executive ta t emen Diane Eshleman t Global Head of Citizenship and Reputation home.barclays/annualreport Barclays PLC Environmental Social Governance Supplement 2016 • 05

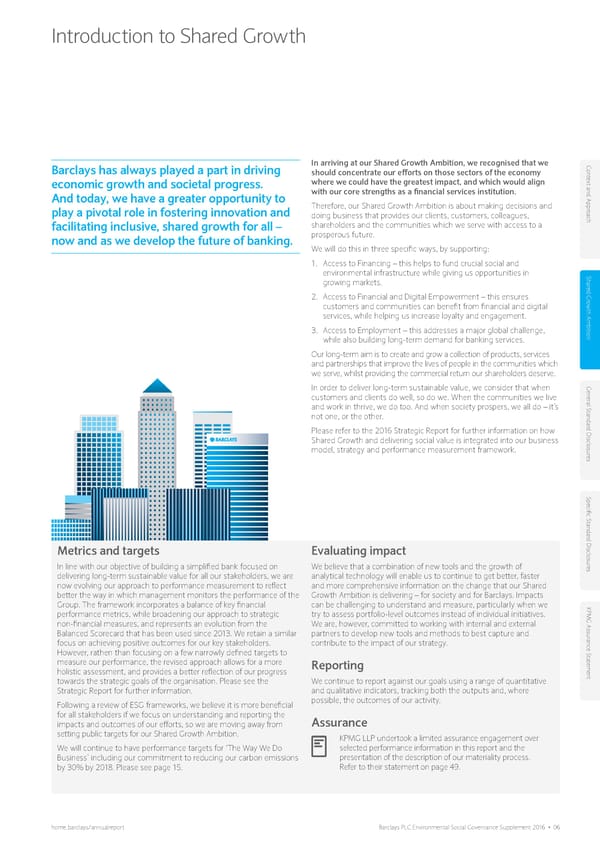

Introduction to Shared Growth Barclays has always played a part in driving In arriving at our Shared Growth Ambition, we recognised that we Con should concentrate our efforts on those sectors of the economy t e economic growth and societal progress. where we could have the greatest impact, and which would align xt and Appr And today, we have a greater opportunity to with our core strengths as a financial services institution. Therefore, our Shared Growth Ambition is about making decisions and o play a pivotal role in fostering innovation and doing business that provides our clients, customers, colleagues, ach facilitating inclusive, shared growth for all – shareholders and the communities which we serve with access to a now and as we develop the future of banking. prosperous future. We will do this in three specific ways, by supporting: 1. A ccess to Financing – this helps to fund crucial social and environmental infrastructure while giving us opportunities in Shar growing markets. 2. A ccess to Financial and Digital Empowerment – this ensures ed Gr o customers and communities can benefit from financial and digital wth Ambition services, while helping us increase loyalty and engagement. 3. A ccess to Employment – this addresses a major global challenge, while also building long-term demand for banking services. Our long-term aim is to create and grow a collection of products, services and partnerships that improve the lives of people in the communities which we serve, whilst providing the commercial return our shareholders deserve. In order to deliver long-term sustainable value, we consider that when Gener customers and clients do well, so do we. When the communities we live and work in thrive, we do too. And when society prospers, we all do – it’s al S not one, or the other. tandar Please refer to the 2016 Strategic Report for further information on how d Disclosur Shared Growth and delivering social value is integrated into our business model, strategy and performance measurement framework. es Specific S tandar Metrics and targets Evaluating impact d Disclosur In line with our objective of building a simplified bank focused on We believe that a combination of new tools and the growth of es delivering long-term sustainable value for all our stakeholders, we are analytical technology will enable us to continue to get better, faster now evolving our approach to performance measurement to reflect and more comprehensive information on the change that our Shared better the way in which management monitors the performance of the Growth Ambition is delivering – for society and for Barclays. Impacts Group. The framework incorporates a balance of key financial can be challenging to understand and measure, particularly when we KP performance metrics, while broadening our approach to strategic try to assess portfolio-level outcomes instead of individual initiatives. MG Assur non-financial measures, and represents an evolution from the We are, however, committed to working with internal and external Balanced Scorecard that has been used since 2013. We retain a similar partners to develop new tools and methods to best capture and focus on achieving positive outcomes for our key stakeholders. contribute to the impact of our strategy. ance S However, rathen than focusing on a few narrowly defined targets to ta t measure our performance, the revised approach allows for a more Reporting emen holistic assessment, and provides a better reflection of our progress towards the strategic goals of the organisation. Please see the We continue to report against our goals using a range of quantitative t Strategic Report for further information. and qualitative indicators, tracking both the outputs and, where Following a review of ESG frameworks, we believe it is more beneficial possible, the outcomes of our activity. for all stakeholders if we focus on understanding and reporting the Assurance impacts and outcomes of our efforts, so we are moving away from setting public targets for our Shared Growth Ambition. KPMG LLP undertook a limited assurance engagement over We will continue to have performance targets for ‘The Way We Do selected performance information in this report and the Business’ including our commitment to reducing our carbon emissions presentation of the description of our materiality process. by 30% by 2018. Please see page 15. Refer to their statement on page 49. home.barclays/annualreport Barclays PLC Environmental Social Governance Supplement 2016 • 06

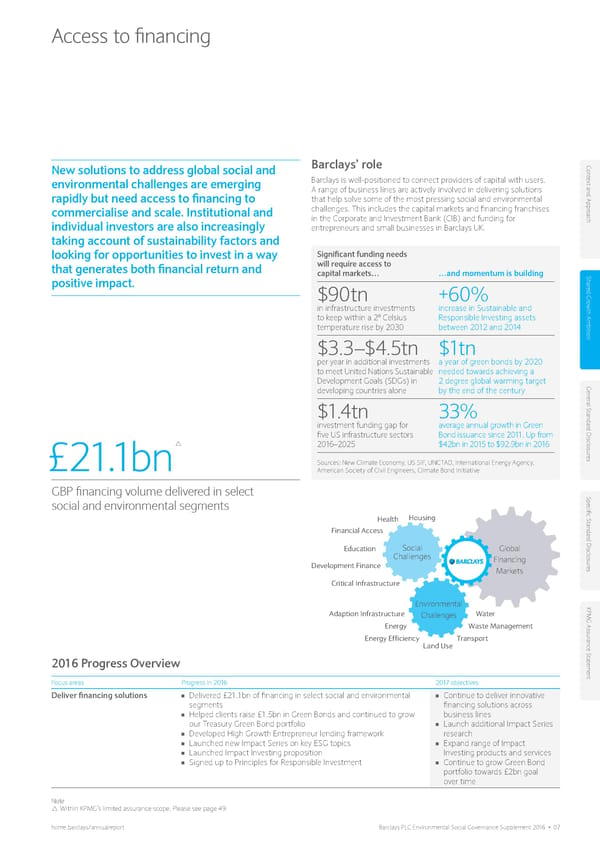

Access to financing New solutions to address global social and Barclays’ role Con t e environmental challenges are emerging Barclays is well-positioned to connect providers of capital with users. xt and Appr A range of business lines are actively involved in delivering solutions rapidly but need access to financing to that help solve some of the most pressing social and environmental challenges. This includes the capital markets and financing franchises o commercialise and scale. Institutional and in the Corporate and Investment Bank (CIB) and funding for ach individual investors are also increasingly entrepreneurs and small businesses in Barclays UK. taking account of sustainability factors and looking for opportunities to invest in a way Significant funding needs that generates both financial return and will require access to positive impact. capital markets… …and momentum is building Shar $90tn +60% ed Gr o in infrastructure investments increase in Sustainable and wth Ambition to keep within a 2º Celsius Responsible Investing assets temperature rise by 2030 between 2012 and 2014 $3.3–$4.5tn $1tn per year in additional investments a year of green bonds by 2020 to meet United Nations Sustainable needed towards achieving a Development Goals (SDGs) in 2 degree global warming target developing countries alone by the end of the century Gener al S $1.4tn 33% tandar investment funding gap for average annual growth in Green d Disclosur five US infrastructure sectors Bond issuance since 2011. Up from 2016–2025 $42bn in 2015 to $92.9bn in 2016 £ 21.1bn Sources: New Climate Economy, US SIF, UNCTAD, International Energy Agency, es American Society of Civil Engineers, Climate Bond Initiative GBP financing volume delivered in select social and environmental segments Specific S Housing Health tandar Financial Access Education Social Global d Disclosur Challenges Financing Development Finance Markets es Critical Infrastructure Environmental KP Adaption Infrastructure Challenges Water MG Assur Energy Waste Management Energy Efficiency Land Use Transport ance S ta t 2016 Progress Overview emen Focus areas Progress in 2016 2017 objectives t Deliver financing solutions ■■ Delivered £21.1bn of financing in select social and environmental ■■ Continue to deliver innovative segments financing solutions across ■■ Helped clients raise £1.5bn in Green Bonds and continued to grow business lines our Treasury Green Bond portfolio ■■ Launch additional Impact Series ■■ Developed High Growth Entrepreneur lending framework research ■■ Launched new Impact Series on key ESG topics ■■ Expand range of Impact ■■ Launched Impact Investing proposition Investing products and services ■■ Signed up to Principles for Responsible Investment ■■ Continue to grow Green Bond portfolio towards £2bn goal over time Note Within KPMG’s limited assurance scope. Please see page 49. home.barclays/annualreport Barclays PLC Environmental Social Governance Supplement 2016 • 07

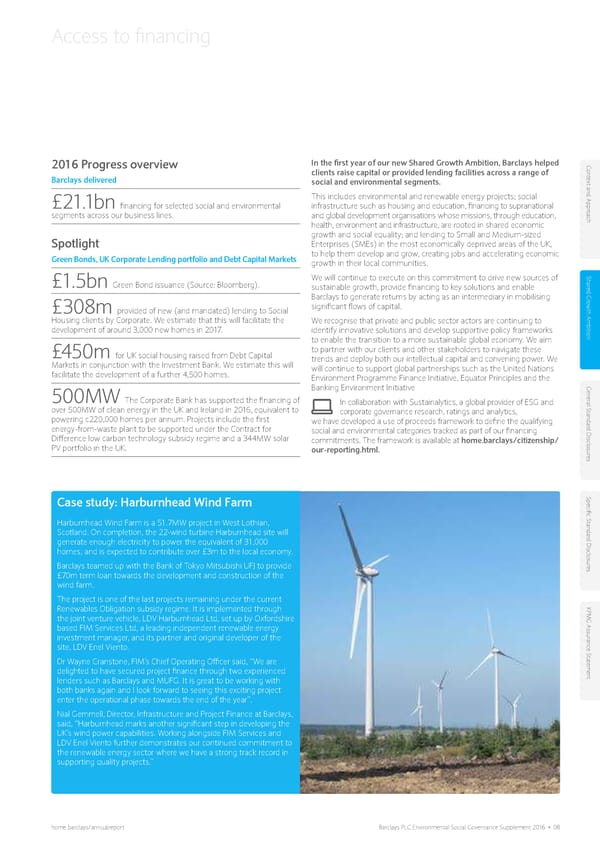

Access to financing 2016 Progress overview In the first year of our new Shared Growth Ambition, Barclays helped Con clients raise capital or provided lending facilities across a range of t e Barclays delivered social and environmental segments. xt and Appr £21.1bn financing for selected social and environmental This includes environmental and renewable energy projects; social infrastructure such as housing and education, financing to supranational o segments across our business lines. and global development organisations whose missions, through education, ach health, environment and infrastructure, are rooted in shared economic growth and social equality; and lending to Small and Medium-sized Spotlight Enterprises (SMEs) in the most economically deprived areas of the UK, Green Bonds, UK Corporate Lending portfolio and Debt Capital Markets to help them develop and grow, creating jobs and accelerating economic growth in their local communities. We will continue to execute on this commitment to drive new sources of Shar £1.5bn Green Bond issuance (Source: Bloomberg). sustainable growth, provide financing to key solutions and enable ed Gr Barclays to generate returns by acting as an intermediary in mobilising o £308m provided of new (and mandated) lending to Social significant flows of capital. wth Ambition Housing clients by Corporate. We estimate that this will facilitate the We recognise that private and public sector actors are continuing to development of around 3,000 new homes in 2017. identify innovative solutions and develop supportive policy frameworks to enable the transition to a more sustainable global economy. We aim £450m for UK social housing raised from Debt Capital to partner with our clients and other stakeholders to navigate these Markets in conjunction with the Investment Bank. We estimate this will trends and deploy both our intellectual capital and convening power. We facilitate the development of a further 4,500 homes. will continue to support global partnerships such as the United Nations Environment Programme Finance Initiative, Equator Principles and the Banking Environment Initiative Gener 500MW The Corporate Bank has supported the financing of In collaboration with Sustainalytics, a global provider of ESG and al S over 500MW of clean energy in the UK and Ireland in 2016, equivalent to corporate governance research, ratings and analytics, tandar powering c220,000 homes per annum. Projects include the first we have developed a use of proceeds framework to define the qualifying energy-from-waste plant to be supported under the Contract for social and environmental categories tracked as part of our financing d Disclosur Difference low carbon technology subsidy regime and a 344MW solar commitments. The framework is available at home.barclays/citizenship/ PV portfolio in the UK. our-reporting.html. es Case study: Harburnhead Wind Farm Specific S Harburnhead Wind Farm is a 51.7MW project in West Lothian, tandar Scotland. On completion, the 22-wind turbine Harburnhead site will generate enough electricity to power the equivalent of 31,000 d Disclosur homes, and is expected to contribute over £3m to the local economy. Barclays teamed up with the Bank of Tokyo Mitsubishi UFJ to provide es £70m term loan towards the development and construction of the wind farm. The project is one of the last projects remaining under the current Renewables Obligation subsidy regime. It is implemented through KP the joint venture vehicle, LDV Harburnhead Ltd, set up by Oxfordshire MG Assur based FIM Services Ltd, a leading independent renewable energy investment manager, and its partner and original developer of the ance S site, LDV Enel Viento. ta t Dr Wayne Cranstone, FIM’s Chief Operating Officer said, “We are emen delighted to have secured project finance through two experienced lenders such as Barclays and MUFG. It is great to be working with t both banks again and I look forward to seeing this exciting project enter the operational phase towards the end of the year”. Nial Gemmell, Director, Infrastructure and Project Finance at Barclays, said, “Harburnhead marks another significant step in developing the UK’s wind power capabilities. Working alongside FIM Services and LDV Enel Viento further demonstrates our continued commitment to the renewable energy sector where we have a strong track record in supporting quality projects.” home.barclays/annualreport Barclays PLC Environmental Social Governance Supplement 2016 • 08

Access to financing Barclays has client relationships across a range of industry sectors and Case study: ESG research impact series Con we have processes in place to manage environmental and social t e considerations. We do not exclude entire sectors; to do so would be Barclays’ Research department launched the first report in its Impact xt and Appr impractical given that many of our larger corporate clients are Series focusing on the effect of Environmental, Social and multifaceted and can have dynamic portfolios of businesses which may Governance (ESG) investing on bond portfolio performance. Jeff Meli, change according to shifts in markets or business model. We prefer to o assess relationships or transactions on a case by case basis, identifying Co-head of Research and Lev Dynkin and Albert Desclee from the ach relevant merits and taking into account material social and environmental Quantitative Portfolio Strategy Team answer some questions about risks and issues. Please see page 46 for further information. the launch of the Impact Series and its first report. Q: How did this initiative start? Financing social infrastructure In October 2016, Barclays’ Social Innovation Facility (SIF) funded the Barclays offers financing solutions for a number of businesses and launch of an Impact Series through the Investment Bank’s Research governments that generate positive social outcomes, including department. This series is designed to explore the impact of Shar supranational agencies, municipalities, health care systems, universities, economic, demographic, and disruptive changes on markets, sectors, ed Gr social housing authorities, and other not-for-profit organisations, among and society at large. o others. In 2016, Barclays acted as bookrunner on over €21.2bn of Q: How is Barclays research approaching ESG themes: wth Ambition financings in 19 separate transactions for the European Investment what are your areas of focus? Bank, EIB. As the European Union bank, the EIB provides long-term Barclays’ Quantitative Portfolio Strategy (QPS) team is part of finance for sound, sustainable investment projects in support of EU Barclays’ Research department and focuses on the quantitative policy goals in Europe and beyond. aspects of portfolio management. As clients’ interest in ESG investing Green Bonds and environmental financing continues to grow, there is a need to better understand the effect of Green Bonds are fixed income securities designed to raise capital to ESG factors on the investment process. Although significant research finance environmental projects. The CIB has been active in issuing green has already been published on the performance implications of an bonds for a variety of clients including municipalities, corporations and ESG tilt in equity portfolios, much less has been published on this Gener topic in credit markets. The QPS research report addresses this void. supranational organisations. In 2016 we underwrote £1.5bn of green It has been released externally as the first publication in the Impact al S bonds (Source: Bloomberg). In addition to corporate issuance including Series, bringing its findings to an audience that is broader than tandar US and European utilities, Barclays also led Green Bond transactions for banks including a US$500m 3-year Green Covered Bond offering for Bank traditional institutional investor clients. d Disclosur of China London Branch. This transaction marks the first green notes Q: What are the key research themes and findings? issued by a Chinese entity that is secured by on-shore qualifying By constructing a US investment grade credit portfolio with a positive climate-aligned bonds that are traded on the China interbank bond ESG tilt designed to replicate the corresponding index, we found that es market. Use of proceeds will fund eligible green projects in renewable this portfolio modestly outperformed a corresponding portfolio with energy, pollution prevention and control, clean transportation, and a negative ESG tilt, as well as the index, over the period of the study. sustainable water management. We also managed a €500m 7-year There was no evidence to suggest that this outperformance resulted Sustainable Covered Bond transaction for Caja Rural de Navarra, a Spanish bank. This was Barclays’ first Sustainable/ESG Covered Bond transaction. in high ESG bonds becoming expensive compared to their peers. Specific S The proceeds will be allocated to existing or new loans financing projects Therefore – no reason to expect that it would be followed by underperformance. focused on creating a social impact in local communities and tandar environmental sustainability. In the United States, Barclays acted as a lead Of the three components of ESG scores, the G – governance score – bookrunner in a US$1.3bn offering, including 3- and 5-year Green Bonds is the main contributor to performance (followed by E and by S) and d Disclosur for Southern Power Company, a wholly-owned subsidiary of The Southern can often be taken as an indicator of management quality. Company which manages long-term contracted generation assets including renewable energy projects. The proceeds will be allocated to Our research finds that strong governance attributes are related to a es solar and wind power generation facilities. Also in 2016, Barclays executed lower frequency of credit downgrades. ESG scores are shown to have a €1.1bn Green Bond offering for Southern Power Company – the first contained information independent of credit ratings over the period Euro Green Bond issued by a US-based corporate. of the study. Please see pages 44-48 for further information on our social and Q: How have investors responded? KP environmental financing product portfolio. The QPS team fielded many questions on the ESG report from MG Assur investors around the globe, as well as through one-on-one discussions with client teams. Interest in this research remains strong with a ance S growing number of investors looking to align their portfolios with their values. In turn, this is forcing portfolio managers to implement ESG ta t factors in their credit portfolio management framework. emen We believe ESG investing is a long-term trend, not only because t investors want to align their investments with their values, but also because the ESG tilt may have positive risk and performance implications on a credit portfolio. At Barclays, we have seen an increase in the number of our asset manager clients starting to offer ESG funds. More broadly ESG attributes are increasingly being considered alongside other financial metrics to form investment decisions. Read the full study and see the infographic at investmentbank.barclays.com/our-insights/esg- sustainable-investing-and-bond-returns. html?icid=ESG_20217_Annualreport home.barclays/annualreport Barclays PLC Environmental Social Governance Supplement 2016 • 09

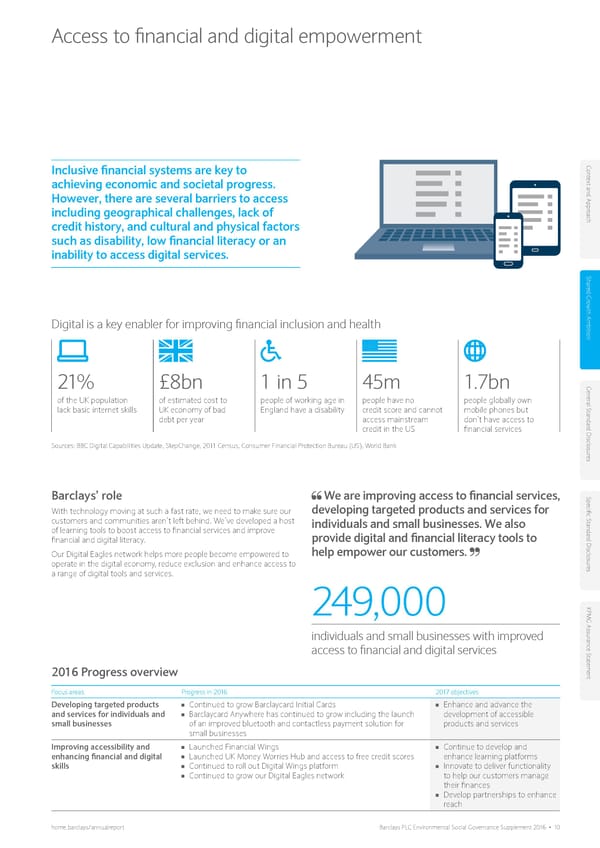

Access to financial and digital empowerment Inclusive financial systems are key to Con t e achieving economic and societal progress. xt and Appr However, there are several barriers to access o including geographical challenges, lack of ach credit history, and cultural and physical factors such as disability, low financial literacy or an inability to access digital services. Shar ed Gr o wth Ambition Digital is a key enabler for improving financial inclusion and health 21% £8bn 1 in 5 45m 1.7bn Gener of the UK population of estimated cost to people of working age in people have no people globally own al S lack basic internet skills UK economy of bad England have a disability credit score and cannot mobile phones but tandar debt per year access mainstream don’t have access to credit in the US financial services d Disclosur Sources: BBC Digital Capabilities Update, StepChange, 2011 Census, Consumer Financial Protection Bureau (US), World Bank es Barclays’ role We are improving access to financial services, Specific S With technology moving at such a fast rate, we need to make sure our developing targeted products and services for customers and communities aren’t left behind. We’ve developed a host individuals and small businesses. We also tandar of learning tools to boost access to financial services and improve financial and digital literacy. provide digital and financial literacy tools to d Disclosur Our Digital Eagles network helps more people become empowered to help empower our customers. operate in the digital economy, reduce exclusion and enhance access to es a range of digital tools and services. KP 249,000 MG Assur individuals and small businesses with improved ance S access to financial and digital services ta t 2016 Progress overview emen t Focus areas Progress in 2016 2017 objectives Developing targeted products ■■ Continued to grow Barclaycard Initial Cards ■■ Enhance and advance the and services for individuals and ■■ Barclaycard Anywhere has continued to grow including the launch development of accessible small businesses of an improved bluetooth and contactless payment solution for products and services small businesses Improving accessibility and ■■ Launched Financial Wings ■■ Continue to develop and enhancing financial and digital ■■ Launched UK Money Worries Hub and access to free credit scores enhance learning platforms skills ■■ Continued to roll out Digital Wings platform ■■ Innovate to deliver functionality ■■ Continued to grow our Digital Eagles network to help our customers manage their finances ■■ Develop partnerships to enhance reach home.barclays/annualreport Barclays PLC Environmental Social Governance Supplement 2016 • 10

Access to financial and digital empowerment We are innovating to reach under-banked and underserved Case study: Empowering customers Con individuals and small business customers with financial services by: t e Developing accessibility solutions for customers and SMEs. We build in Barclaycard in the UK and the US xt and Appr on accessible services such as Sign Video and high-visibility cards for customers with disabilities, and share advice and provide learning to help Credit Score and the Money Worries Hub are two initiatives o other businesses become more accessible. We also provide targeted developed to support and empower UK customers by giving them ach products, such as the Barclaycard Initial Card, to help enhance access to knowledge and resources to take control of their financial health. credit for those with limited credit histories and provide a way to build They show how Barclaycard colleagues use their internal knowledge, their credit health over time. skills and resources to provide holistic support for customers. Hosted Enhancing digital skills. In 2016, we used our Digital Eagles network to on the Barclaycard website, the hub is the first of its kind for a UK help people become empowered to operate in the digital economy, reduce card provider, leveraging real-life, financially challenging events to exclusion and enhance access to a range of digital tools and services. In provide tangible and relevant stories to help them understand how Shar addition, we have also provided digital skills training through our Digital Barclaycard can support them when they need it most. Within the ed Gr Wings online learning platform. online account management Credit Score provides customers with a o Improving access to financial literacy and financial health. We use detailed, free credit score helping to promote responsible credit wth Ambition improvements in technology and analytics to develop a range of tools to behaviour and educate customers about the importance of provide better and quicker information and money management maintaining their credit health. capabilities. We provide proactive and reactive support to customers in The free credit score service has been used by more than 650,000 financial difficulty, and develop new financial education resources with a customers and more than 100,000 have visited the stories and range of experts including apps and gamified learning platforms, such as information on the Money Worries Hub. Financial Wings, our online financial skills learning platform. Garry Hepherd, Relationship Manager at StepChange Debt Charity See pages 44-48 for further detail on our product portfolio and supports the work that Barclaycard is doing: “The Money Worries accessibility initiatives. Hub has been a great addition in helping people with debt worries. Gener We know that people can often have sleepless nights and if they can al S Further information on our programmes is available access help and advice online 24/7, confidentially and anonymously tandar at a time that suits them, it really helps them to face up to that debt at home.barclays/citizenship. problem and seek help as early as possible. d Disclosur In Barclaycard US, Jennifer Hitchens recently embarked on a mission to provide Barclaycard Ring card members with a clearer path to es credit health. Jennifer partnered with the credit experts at advanced analytics Case study: Financial Wings company FICO, the company behind the FICO® Score, the standard In April 2016, Barclays launched Financial Wings, our free online money measure of consumer credit risk in the United States. Working with Specific S Senior Scores Consultant, Roy Pfeifer, Jennifer co-ordinated a 12-day management tool. With content written in collaboration with experts ‘Ask FICO’ online event which connected members of the Barclaycard from the Money Advice Service, StepChange Debt Charity and National Ring Community directly with the credit experts at FICO. The event tandar Debtline, Financial Wings looks to give colleagues and customers the opened up long-term benefits for card members and consumers, knowledge, skills and confidence to plan financial goals and deal with while improving existing products and services. d Disclosur the financial impact of life’s ups and downs. The website employs FICO’s Roy Pfeifer, describes his initial reaction to Jennifer’s idea: gamification to help users engage with the information and users can test their knowledge and earn points in a series of games. “When Barclays approached us about doing the ‘Ask FICO’ es programme, we were really excited about the opportunity to help On launching Financial Wings, Clare Francis, Savings and Investing directly answer questions that Barclays customers are asking about Expert at Barclays said: “Every day we hear from customers who FICO scores. Like Barclays, we are trying to get credit education out want to understand how to make the most of their money but find into the marketplace and to help people better understand credit KP managing their finances a complex and daunting task. We are scoring and how credit scoring affects their lives.” MG Assur committed to supporting their achievement of financial fitness and believe that Financial Wings will help many to achieve this.” Talking about her experience of using Financial Wings, Rachael Murphy, ance S ta Community Banker said: “I made time last week to complete my t #financialwings and it has been really helpful to see some of the emen problems our customers might be facing from their point of view. Some t great tips for customers and staff on budgeting and where to go for help!” Talking about Financial Wings, Raymond Petit, Managing Director of Community Banking said: “Financial Wings was created to empower people and give them the confidence to make better financial decisions. With Financial Wings we want to remove any fear or confusion by providing essential information in manageable chunks.” home.barclays/annualreport Barclays PLC Environmental Social Governance Supplement 2016 • 11

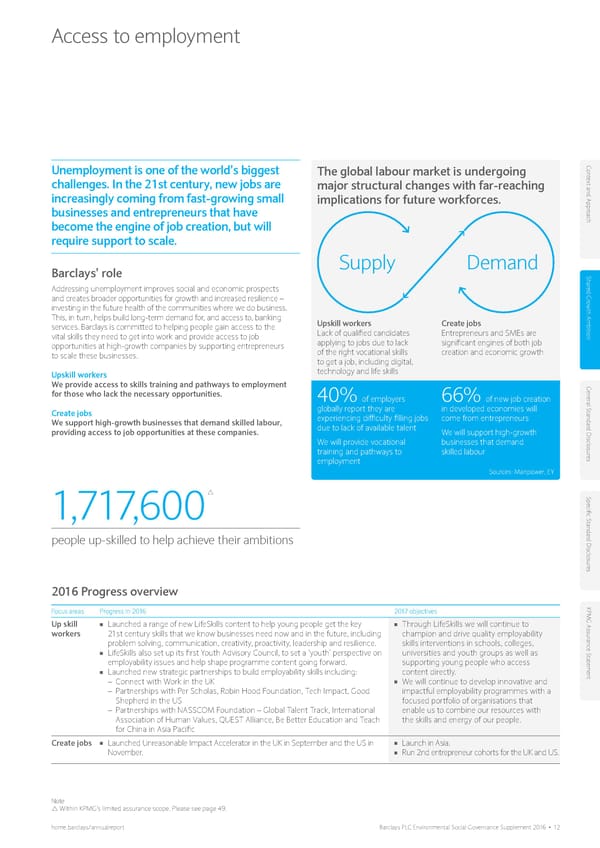

Access to employment Unemployment is one of the world’s biggest The global labour market is undergoing Con t e challenges. In the 21st century, new jobs are major structural changes with far-reaching xt and Appr increasingly coming from fast-growing small implications for future workforces. o businesses and entrepreneurs that have ach become the engine of job creation, but will require support to scale. Supply Demand Barclays’ role Shar Addressing unemployment improves social and economic prospects ed Gr and creates broader opportunities for growth and increased resilience – o investing in the future health of the communities where we do business. wth Ambition This, in turn, helps build long-term demand for, and access to, banking Upskill workers Create jobs services. Barclays is committed to helping people gain access to the Lack of qualified candidates Entrepreneurs and SMEs are vital skills they need to get into work and provide access to job applying to jobs due to lack significant engines of both job opportunities at high-growth companies by supporting entrepreneurs of the right vocational skills creation and economic growth to scale these businesses. to get a job, including digital, Upskill workers technology and life skills We provide access to skills training and pathways to employment Gener for those who lack the necessary opportunities. 40% of employers 66% of new job creation al S Create jobs globally report they are in developed economies will tandar We support high-growth businesses that demand skilled labour, experiencing difficulty filling jobs come from entrepreneurs providing access to job opportunities at these companies. due to lack of available talent We will support high-growth d Disclosur We will provide vocational businesses that demand training and pathways to skilled labour employment es Sources: Manpower, EY 1,717,600 Specific S tandar people up-skilled to help achieve their ambitions d Disclosur es 2016 Progress overview Focus areas Progress in 2016 2017 objectives KP MG Assur Up skill ■■ Launched a range of new LifeSkills content to help young people get the key ■■ Through LifeSkills we will continue to workers 21st century skills that we know businesses need now and in the future, including champion and drive quality employability problem solving, communication, creativity, proactivity, leadership and resilience. skills interventions in schools, colleges, ance S ■■ LifeSkills also set up its first Youth Advisory Council, to set a ‘youth’ perspective on universities and youth groups as well as ta t employability issues and help shape programme content going forward. supporting young people who access emen ■■ Launched new strategic partnerships to build employability skills including: content directly. – Connect with Work in the UK ■■ We will continue to develop innovative and t – Partnerships with Per Scholas, Robin Hood Foundation, Tech Impact, Good impactful employability programmes with a Shepherd in the US focused portfolio of organisations that – Partnerships with NASSCOM Foundation – Global Talent Track, International enable us to combine our resources with Association of Human Values, QUEST Alliance, Be Better Education and Teach the skills and energy of our people. for China in Asia Pacific Create jobs ■■ Launched Unreasonable Impact Accelerator in the UK in September and the US in ■■ Launch in Asia. November. ■■ Run 2nd entrepreneur cohorts for the UK and US. Note Within KPMG’s limited assurance scope. Please see page 49. home.barclays/annualreport Barclays PLC Environmental Social Governance Supplement 2016 • 12

Access to employment Con t e xt and Appr o ach US UK Asia Pacific Shar In the US our programme is concentrated on In the UK our focus has been to address Across Asia Pacific, our Access to ed Gr vocational skills training in targeted sectors unemployment, improving individuals’ social Employment programme touches the lives o that exhibit high employer-demand, such as and economic prospects and creating broader of young people in multiple ways. wth Ambition coding, web development and cyber-security. opportunities for growth and increased resilience. Our focus is to partner with organisations ■■ In Hong Kong, our programme with who demonstrate innovation and impact, ■■ LifeSkills is Barclays flagship employability Changing Young Lives provides young working together to positively impact programme that brings together educators, people with the right skills to help them underserved communities. businesses, young people and parents to find employment. support young people in developing core ■■ Through our partnership with Japan ■■ Our new Per Scholas Technology Training employability skills. Since its launch in 2013 Association of Refugees, Syrian refugees Centre in Brooklyn and co-designed more than 3.6 million young people have cybersecurity curriculum has so far helped will be provided language training and the Gener participated in LifeSkills (1.6 million in 2016). skills to help them find jobs and 449 New Yorkers to receive free technology 2016 was marked by the launch of some new mainstream them into Japanese society. al S training. We also work with The Robin innovative resources – Virtual Work Experience, tandar Hood foundation, so far helping over 1,700 Virtual Interview Practice. ■■ In India, our partnership with NASSCOM low-income New Yorkers either access the ■■ Connect with Work is a newly launched Foundation – GTT and International d Disclosur digital economy or receive web innovative employability programme, aimed Association of Human Values provides development training. at individuals with the aptitude and attitude young engineers and graduates with LifeSkills, helping them to find jobs in es ■■ Our recently launched Tech Impact to enter the workplace, but who face barriers leading organisations including Amazon, Opportunity Centre in Nevada has helped such as a lack of qualifications, experience or Infosys, HDFC Bank. Over 120,000 young over 56 students receive IT and customer confidence. The programme connects people were upskilled and approximately service training. individuals aged 16 or over with businesses that are recruiting but struggling to find 30,000 placed in 2016. Specific S ■■ As a Cornerstone partner of Acumen America we support their Workforce skilled and motivated individuals. Together ■■ In Singapore, our partnership with YMCA Development Portfolio, providing patient with a selection of charity partners, including will provide the right skills for ‘at risk’ tandar capital to early-stage companies that are the Prince’s Trust and Catch 22, we train young people to enable them find skilled delivering social impact through their people in the job-specific skills that employment while mainstreaming them d Disclosur business model. businesses are looking for and support them into society. into jobs or apprenticeships. es KP Case study: Focusing on the impact of LifeSkills MG Assur In 2016, The Work Foundation carried out the third independent evaluation of the LifeSkills programme and its impact on participants. ance S The research shows that of those young people surveyed who had ta t participated in LifeSkills, 53% said the programme had helped them to emen get a job, 83% feel more confident to succeed at work, 68% said they make more informed decisions about their future and 91% got better at t managing their finances. The report highlighted that LifeSkills is raising young people’s aspirations and helping them to feel more confident about their future. Academic reports highlight the fact that there are strong links between young people’s aspirations and future educational attainment and subsequent labour market success. The report was launched in November 2016 at a reception in Parliament hosted by Barclays CEO, Jes Staley, that brought together 38 MPs, Ministers, Peers and advisers; LifeSkills schools from right across the UK; with charity To find out more, please visit partners, Ambassadors and the LifeSkills Advisory and Youth Advisory barclayslifeskills.com Councils to showcase the scale and impact the programme has in the UK. Note Within KPMG’s limited assurance scope. Please see page 49. home.barclays/annualreport Barclays PLC Environmental Social Governance Supplement 2016 • 13

Access to employment Con t e xt and Appr o ach Shar ed Gr o wth Ambition Case study: Unreasonable Impact Gener al S We joined forces with Unreasonable Group, a leading platform for Destination New York tandar entrepreneurs solving global challenges with scalable models, to launch a The global programme moved to New York in November and the US new partnership called Unreasonable Impact. This is a multi-year, participants were a diverse mix, from Thread, a textile company that d Disclosur international network of Accelerators focused on scaling up entrepreneurial transforms trash into thread, to Accio Energy, a venture employing a solutions that will in turn help employ thousands worldwide. wind system that generates high-voltage energy without turbines. Each company participating in the Accelerators must be focused on The US programme saw the entrepreneurs receive mentorship and es solving a pressing societal and/or environmental challenge and have a advice from business experts and serial entrepreneurs, such as Hunter solution that can scale. The programme selects ventures that each Lovins, president of Natural Capital Solutions and Time Magazine Hero demonstrate potential to create at least 500 new jobs over the next of the planet for 2009, Tom Chi, co-founder of Google Glass and five years. Google’s self-driving car, and Steven Berkenfeld, Managing Director at Specific S Barclays, among others. A successful launch “Scale ups are fundamental in driving economic growth,” explained Joe tandar In October, we launched UK Accelerator with 10 businesses participating, each focused on finding solutions to a diverse range of global McGrath, CEO of Barclays Americas and Global Head of Capital Markets. d Disclosur challenges, including food production, remote healthcare support, “It’s an honour to partner with Unreasonable to create an accelerator deforestation and water scarcity. The selected entrepreneurs attended a program in the US to help alleviate unemployment and grow the green two week programme in Gloucestershire where they received focused economy. By supporting ventures that have scalable solutions to some es and bespoke support, and guidance from business experts, serial of the world’s greatest challenges with our resources and mentorship, entrepreneurs, key funders as well as experts from across Barclays. we will not only help to address significant societal and environmental issues, but we will also be creating the jobs of tomorrow.” A profound experience KP 26 Barclays specialists provided discussion on topics ranging from 2017 and beyond MG Assur Public Relations management, marketing advice through to looking Following New York, the programme will head to Singapore in 2017 after Intellectual Property rights. with companies selected to participate from across Asia Pacific. Successive programmes will then run in the UK, US and Asia over the ance S The Barclays specialists soaked in the energy and enthusiasm of the next three years, creating a global network centred around scaling ta entrepreneurs and were inspired by their innovation and desire to t address such impactful issues. Feedback received from the specialists impact entrepreneurs as job creators. emen was unanimously positive, with some citing they had a special and You can read more about the programme and entrepreneurs t profound experience. taking part by visiting unreasonableimpact.com. Nichola Sharpe, Director External Communications, Barclays UK attended as a specialist and said “It was great to see Barclays supporting such a worthwhile accelerator initiative and I was thankful for having the opportunity to lend my communications expertise to such an inspiring group of entrepreneurs and to meet wonderful individuals from the Unreasonable Group, a diverse range of inspiring mentors, plus a great collection of Barclays colleagues. I came away with positivity, confidence, inspiration and a great network of fascinating individuals and entrepreneurs I will definitely stay connected with.” home.barclays/annualreport Barclays PLC Environmental Social Governance Supplement 2016 • 14

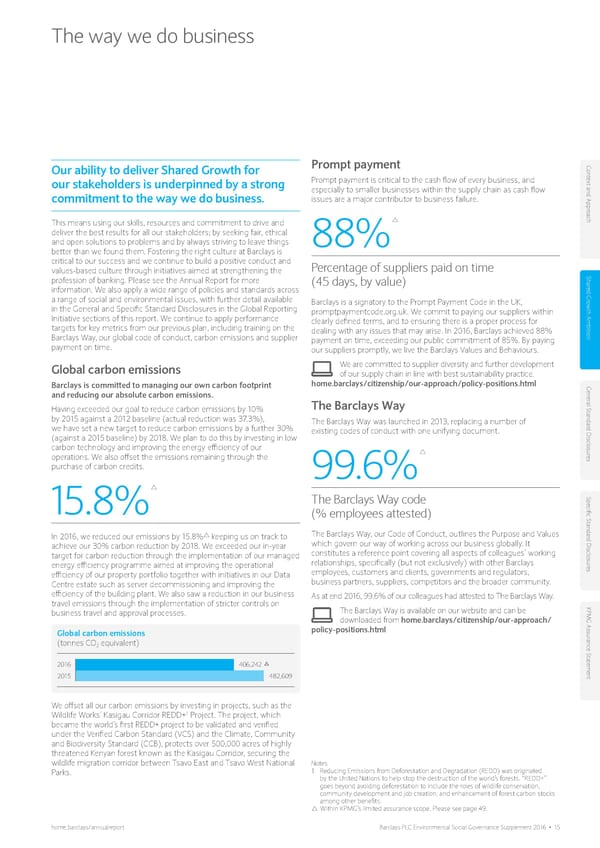

The way we do business Our ability to deliver Shared Growth for Prompt payment Con t e our stakeholders is underpinned by a strong Prompt payment is critical to the cash flow of every business, and xt and Appr especially to smaller businesses within the supply chain as cash flow commitment to the way we do business. issues are a major contributor to business failure. o This means using our skills, resources and commitment to drive and ach deliver the best results for all our stakeholders; by seeking fair, ethical and open solutions to problems and by always striving to leave things 88% better than we found them. Fostering the right culture at Barclays is critical to our success and we continue to build a positive conduct and Percentage of suppliers paid on time values-based culture through initiatives aimed at strengthening the profession of banking. Please see the Annual Report for more (45 days, by value) Shar information. We also apply a wide range of policies and standards across ed Gr a range of social and environmental issues, with further detail available o in the General and Specific Standard Disclosures in the Global Reporting Barclays is a signatory to the Prompt Payment Code in the UK, wth Ambition Initiative sections of this report. We continue to apply performance promptpaymentcode.org.uk. We commit to paying our suppliers within targets for key metrics from our previous plan, including training on the clearly defined terms, and to ensuring there is a proper process for Barclays Way, our global code of conduct, carbon emissions and supplier dealing with any issues that may arise. In 2016, Barclays achieved 88% payment on time. payment on time, exceeding our public commitment of 85%. By paying our suppliers promptly, we live the Barclays Values and Behaviours. Global carbon emissions We are committed to supplier diversity and further development of our supply chain in line with best sustainability practice. Barclays is committed to managing our own carbon footprint home.barclays/citizenship/our-approach/policy-positions.html Gener and reducing our absolute carbon emissions. The Barclays Way al S Having exceeded our goal to reduce carbon emissions by 10% tandar by 2015 against a 2012 baseline (actual reduction was 37.3%), The Barclays Way was launched in 2013, replacing a number of we have set a new target to reduce carbon emissions by a further 30% existing codes of conduct with one unifying document. d Disclosur (against a 2015 baseline) by 2018. We plan to do this by investing in low carbon technology and improving the energy efficiency of our operations. We also offset the emissions remaining through the es purchase of carbon credits. 99.6% 15 . 8 % The Barclays Way code Specific S (% employees attested) tandar The Barclays Way, our Code of Conduct, outlines the Purpose and Values In 2016, we reduced our emissions by 15.8% keeping us on track to which govern our way of working across our business globally. It d Disclosur achieve our 30% carbon reduction by 2018. We exceeded our in-year constitutes a reference point covering all aspects of colleagues’ working target for carbon reduction through the implementation of our managed relationships, specifically (but not exclusively) with other Barclays energy efficiency programme aimed at improving the operational employees, customers and clients, governments and regulators, es efficiency of our property portfolio together with initiatives in our Data business partners, suppliers, competitors and the broader community. Centre estate such as server decommissioning and improving the efficiency of the building plant. We also saw a reduction in our business As at end 2016, 99.6% of our colleagues had attested to The Barclays Way. travel emissions through the implementation of stricter controls on The Barclays Way is available on our website and can be KP business travel and approval processes. downloaded from home.barclays/citizenship/our-approach/ MG Assur Global carbon emissions policy-positions.html (tonnes CO2 equivalent) ance S ta t 2016 406,242 emen 2015 482,609 t We offset all our carbon emissions by investing in projects, such as the 1 Wildlife Works’ Kasigau Corridor REDD+ Project. The project, which became the world’s first REDD+ project to be validated and verified under the Verified Carbon Standard (VCS) and the Climate, Community and Biodiversity Standard (CCB), protects over 500,000 acres of highly threatened Kenyan forest known as the Kasigau Corridor, securing the wildlife migration corridor between Tsavo East and Tsavo West National Notes Parks. 1 Reducing Emissions from Deforestation and Degradation (REDD) was originated by the United Nations to help stop the destruction of the world’s forests. “REDD+” goes beyond avoiding deforestation to include the roles of wildlife conservation, community development and job creation, and enhancement of forest carbon stocks among other benefits. Within KPMG’s limited assurance scope. Please see page 49. home.barclays/annualreport Barclays PLC Environmental Social Governance Supplement 2016 • 15

Colleague engagement and external recognition Colleague engagement ESG ratings and benchmarks Con t e Our people are Barclays’ greatest ambassadors, Our performance is benchmarked by a xt and Appr contributing time, skills and expertise to create range of ESG analysts and rating agencies o a positive and sustainable societal impact. on an annual basis. A summary of 2016 ach performance is available below. In 2016 more than 43,000 colleagues participated in a range of causes, contributing over 212,000 hours, donating a total of almost £25m, including Barclays matched funding. Colleagues also have the opportunity to share their ideas for innovative Shar products or services that can deliver commercial returns for Barclays while addressing a social cause. Each year Barclays Social Innovation Facility ed Gr o (SIF) engages intrapreneurs across our business globally (see case study). Dow Jones Sustainability Index The Dow Jones Sustainability Index wth Ambition (DJSI) tracks the financial performance of the leading sustainability- driven companies worldwide. In 2016, we maintained our membership of both the DJSI World and DJSI Europe Indices. Our score increased to Social Innovation Facility 84% overall (industry average 61%), making this the highest score since Barclays’ inclusion in the Index. Barclays Social Innovation Facility (SIF) is committed to developing FTSE4Good The FTSE4Good Index Series is designed to objectively commercial solutions that directly address societal challenges. measure the performance of companies that meet globally recognised The SIF is a resource available to employees across Barclays business corporate responsibility standards. We have been a member of the Gener divisions and geographies, providing support, networks and funding FTSE4Good index since its inception in 2001. In 2016, our absolute score for products that benefit society. Purpose driven colleagues from the was 3.9/5 (up from 3.6 in 2015). al S UK, US and Asia are engaged through Hackathons, and Innovation MSCI ESG Ratings MSCI is a leading investor-focused ESG ratings tandar Labs. To date, the SIF has incubated more than 40 products within research provider. Barclays maintained a ‘BBB’ rating in 2016. d Disclosur Barclays core business which is driving an ongoing social impact. Sustainalytics ESG Ratings Sustainalytics is a leading provider of ESG “Fostering social innovation in the way we think, work and operate is a priority for Barclays. Through the Social Innovation Facility, B research and analysis, serving investors and financial institutions around es arclays is cultivating an intrapreneurial mind-set where colleagues the world. Barclays ESG score improved to 62 points in 2016, up from are encouraged to think and develop independent ideas in order 61 points in 2015. to bring new perspectives to our businesses and clients.” Barbara Byrne, Awards and recognition Specific S Vice Chair of Barclays Investment Bank ■■ Tower Hamlets Education Business Partnership 2016 ‘Partnership of Product innovations supported by Barclays Social Innovation Facility the Year' Award. tandar are created, and lead by intrapreneurs – our innovative purpose-driven ■■ Lender of the Year at the 2016 Education Investor Awards. Barclays d Disclosur colleagues. Barclays top performing talent are given the opportunity has won this in each of the seven years that the awards have run. to spend time at Rise (thinkrise.com) in India, the UK, and the US, ■■ Bank or Lender of the Year at the 2016 HealthInvestor Awards. innovating product solutions to the vast challenges outlined in the UN’s Barclays has won for the sixth time in eight years. es Sustainable Development Goals. Selected proposals are then incubated and launched within Barclays, providing meaningful leadership ■■ The Asset Triple A Regional Awards. ‘Best Corporate Green Bond’ - opportunities for the intrapreneurs who created them. Zhejiang Geely Holding Group Company US$400 million green bond. ■■ ‘Vulnerable Customer Support Initiative - Creator’ at the Collections KP and Customer Service Awards. MG Assur ■■ The Prince’s Trust Corporate Employee Award in the category ‘Services to Young People’. ance S ■■ Business Disability Forum’s annual Disability Smart Award for Products and Services - business to business category. ta t ■■ Voted 2nd runner up for the 'Best Integrated Report' in the 2016 emen Corporate Register Reporting Awards. t ■■ LifeSkills and Early Careers Team reaccredited with the ‘Inspiring Young Talent’ Award at the BiTC Responsible Business Awards. Recognition ■■ Barclays Social Innovation and Intrapreneur programmes were featured in the Harvard Business Review. ■■ The ‘Barclays Lens’ decision making tool featured within new Transparency International research on Incentivising Ethics – Managing incentives to encourage good and deter bad behaviour. home.barclays/annualreport Barclays PLC Environmental Social Governance Supplement 2016 • 16

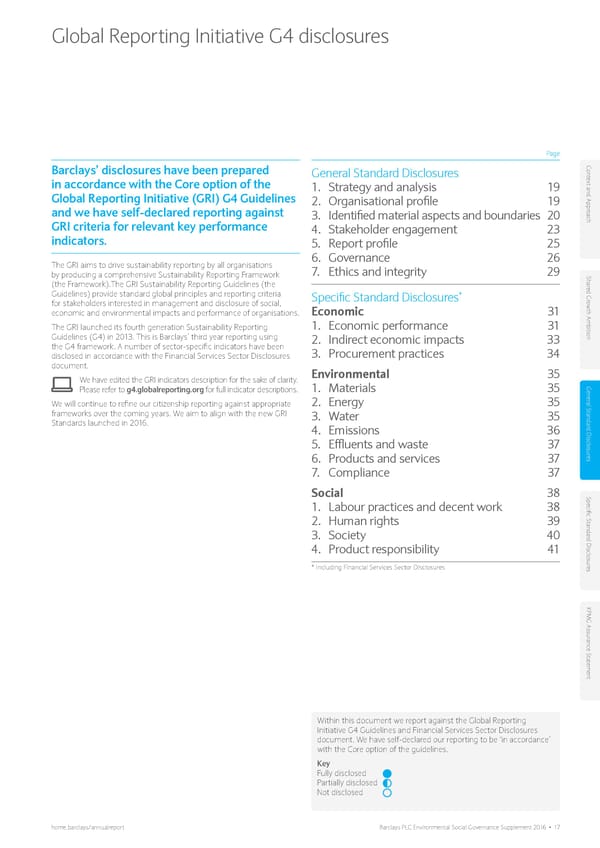

Global Reporting Initiative G4 disclosures Page Barclays’ disclosures have been prepared Con General Standard Disclosures t e in accordance with the Core option of the 1. Strategy and analysis 19 xt and Appr Global Reporting Initiative (GRI) G4 Guidelines 2. Organisational profile 19 o and we have self-declared reporting against 3. Identified material aspects and boundaries 20 ach GRI criteria for relevant key performance 4. Stakeholder engagement 23 indicators. 5. Report profile 25 The GRI aims to drive sustainability reporting by all organisations 6. Governance 26 by producing a comprehensive Sustainability Reporting Framework 7. Ethics and integrity 29 Shar (the Framework).The GRI Sustainability Reporting Guidelines (the Guidelines) provide standard global principles and reporting criteria Specific Standard Disclosures* ed Gr o for stakeholders interested in management and disclosure of social, Economic 31 wth Ambition economic and environmental impacts and performance of organisations. The GRI launched its fourth generation Sustainability Reporting 1. Economic performance 31 Guidelines (G4) in 2013. This is Barclays’ third year reporting using 2. Indirect economic impacts 33 the G4 framework. A number of sector-specific indicators have been 3. Procurement practices 34 disclosed in accordance with the Financial Services Sector Disclosures document. Environmental 35 We have edited the GRI indicators description for the sake of clarity. Please refer to g4.globalreporting.org for full indicator descriptions. 1. Materials 35 Gener We will continue to refine our citizenship reporting against appropriate 2. Energy 35 al S frameworks over the coming years. We aim to align with the new GRI 3. Water 35 tandar Standards launched in 2016. 4. Emissions 36 d Disclosur 5. Effluents and waste 37 6. Products and services 37 es 7. Compliance 37 Social 38 Specific 1. Labour practices and decent work 38 S 2. Human rights 39 tandar 3. Society 40 d 4. Product responsibility 41 Disclosur * Including Financial Services Sector Disclosures es KP MG Assur ance S ta t emen t Within this document we report against the Global Reporting Initiative G4 Guidelines and Financial Services Sector Disclosures document. We have self-declared our reporting to be ‘in accordance’ with the Core option of the guidelines. Key Fully disclosed Partially disclosed Not disclosed home.barclays/annualreport Barclays PLC Environmental Social Governance Supplement 2016 • 17

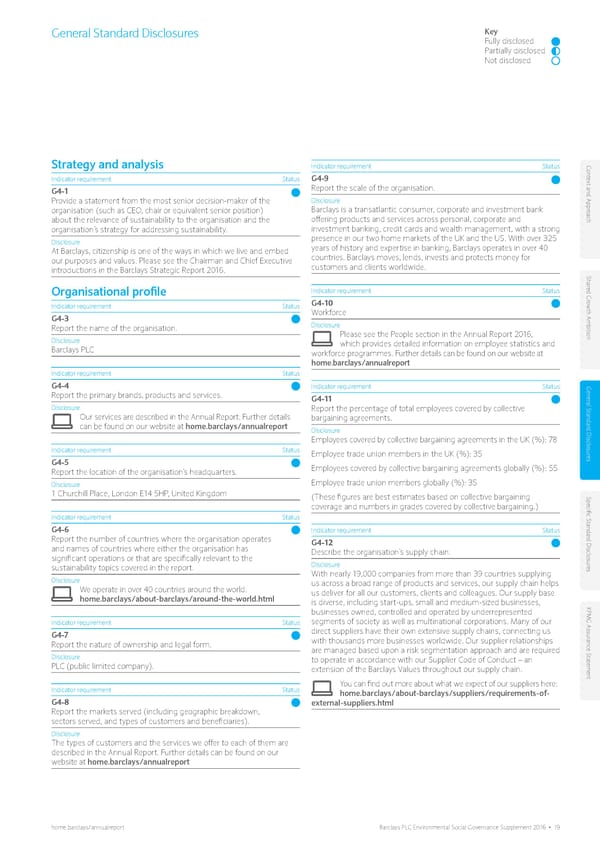

General standard disclosures Con t e xt and Appr o ach Shar ed Gr o wth Ambition Gener al S tandar d Disclosur es Specific S tandar d Disclosur es KP MG Assur ance S ta t Bitty Foods emen Bitty Foods was part of the first cohort of the US Unreasonable t Impact programme. Bitty Foods is a San Francisco-based company that makes delicious, healthy snacks with cricket flour. The name might be Bitty, but their mission is huge – to help alleviate stress on the global food system by popularising edible insects as a sustainable protein source that conserves natural resources and can feed billions of people. Bitty’s mission and products have received accolades in publications including the New York Times, Fast Company and Vogue, and Bitty was named one of Entrepreneur magazine’s 100 Brilliant Companies. For more details about Unreasonable Impact, refer to page 14. home.barclays/annualreport Barclays PLC Environmental Social Governance Supplement 2016 • 18

General Standard Disclosures Key Fully disclosed Partially disclosed Not disclosed Strategy and analysis Indicator requirement Status Con t e Indicator requirement Status G4-9 xt and Appr G4-1 Report the scale of the organisation. Provide a statement from the most senior decision-maker of the Disclosure organisation (such as CEO, chair or equivalent senior position) Barclays is a transatlantic consumer, corporate and investment bank o about the relevance of sustainability to the organisation and the offering products and services across personal, corporate and ach organisation’s strategy for addressing sustainability. investment banking, credit cards and wealth management, with a strong Disclosure presence in our two home markets of the UK and the US. With over 325 At Barclays, citizenship is one of the ways in which we live and embed years of history and expertise in banking, Barclays operates in over 40 our purposes and values. Please see the Chairman and Chief Executive countries. Barclays moves, lends, invests and protects money for introductions in the Barclays Strategic Report 2016. customers and clients worldwide. Shar Organisational profile Indicator requirement Status ed Gr o Indicator requirement Status G4-10 wth Ambition G4-3 Workforce Report the name of the organisation. Disclosure Please see the People section in the Annual Report 2016, Disclosure which provides detailed information on employee statistics and Barclays PLC workforce programmes. Further details can be found on our website at home.barclays/annualreport Indicator requirement Status G4-4 Indicator requirement Status Gener Report the primary brands, products and services. G4-11 Disclosure al S Our services are described in the Annual Report. Further details Report the percentage of total employees covered by collective tandar bargaining agreements. can be found on our website at home.barclays/annualreport Disclosure d Disclosur Employees covered by collective bargaining agreements in the UK (%): 78 Indicator requirement Status G4-5 Employee trade union members in the UK (%): 35 es Report the location of the organisation’s headquarters. Employees covered by collective bargaining agreements globally (%): 55 Disclosure Employee trade union members globally (%): 35 1 Churchill Place, London E14 5HP, United Kingdom (These figures are best estimates based on collective bargaining Specific coverage and numbers in grades covered by collective bargaining.) Indicator requirement Status S G4-6 Indicator requirement Status tandar d Report the number of countries where the organisation operates and names of countries where either the organisation has G4-12 Disclosur significant operations or that are specifically relevant to the Describe the organisation’s supply chain. sustainability topics covered in the report. Disclosure es With nearly 19,000 companies from more than 39 countries supplying Disclosure us across a broad range of products and services, our supply chain helps We operate in over 40 countries around the world. us deliver for all our customers, clients and colleagues. Our supply base home.barclays/about-barclays/around-the-world.html is diverse, including start-ups, small and medium-sized businesses, KP businesses owned, controlled and operated by underrepresented MG Assur Indicator requirement Status segments of society as well as multinational corporations. Many of our G4-7 direct suppliers have their own extensive supply chains, connecting us Report the nature of ownership and legal form. with thousands more businesses worldwide. Our supplier relationships ance S are managed based upon a risk segmentation approach and are required Disclosure ta to operate in accordance with our Supplier Code of Conduct – an t PLC (public limited company). extension of the Barclays Values throughout our supply chain. emen You can find out more about what we expect of our suppliers here: t Indicator requirement Status home.barclays/about-barclays/suppliers/requirements-of- G4-8 external-suppliers.html Report the markets served (including geographic breakdown, sectors served, and types of customers and beneficiaries). Disclosure The types of customers and the services we offer to each of them are described in the Annual Report. Further details can be found on our website at home.barclays/annualreport home.barclays/annualreport Barclays PLC Environmental Social Governance Supplement 2016 • 19

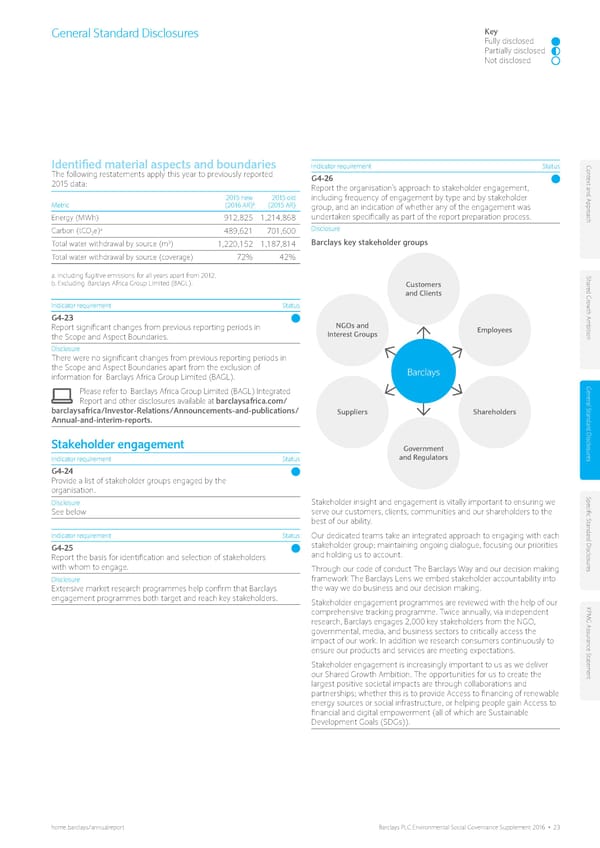

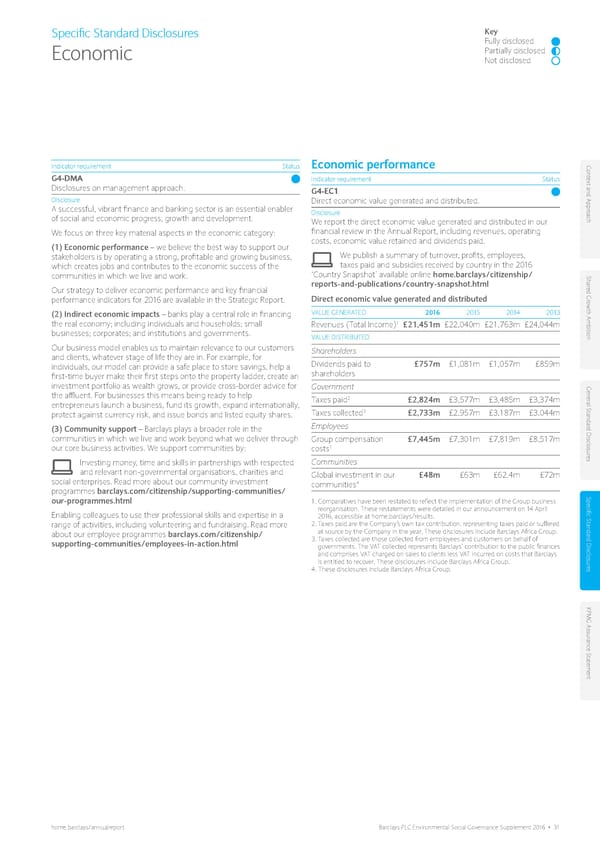

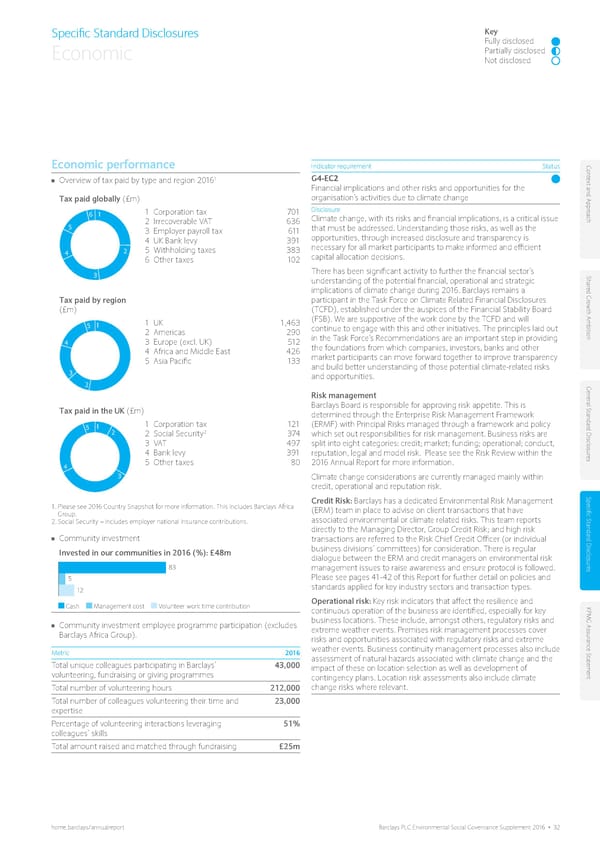

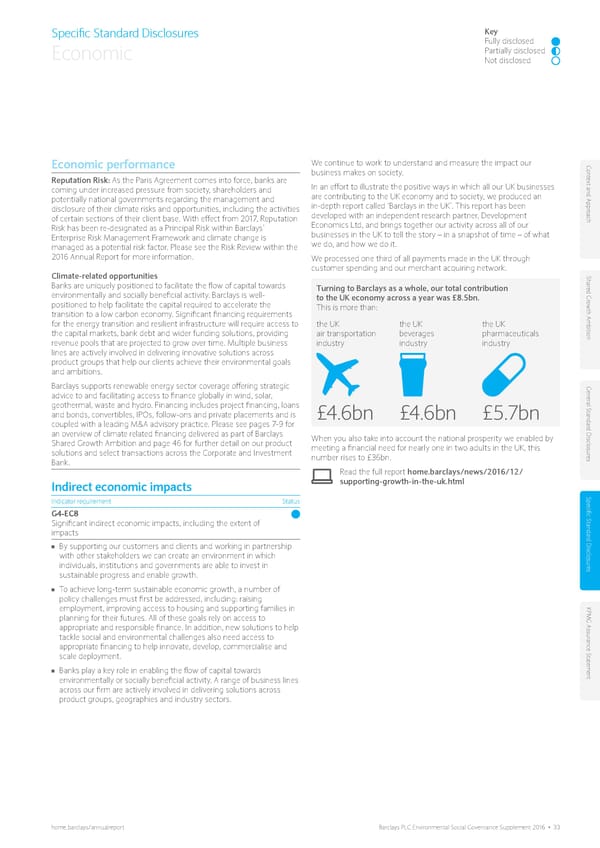

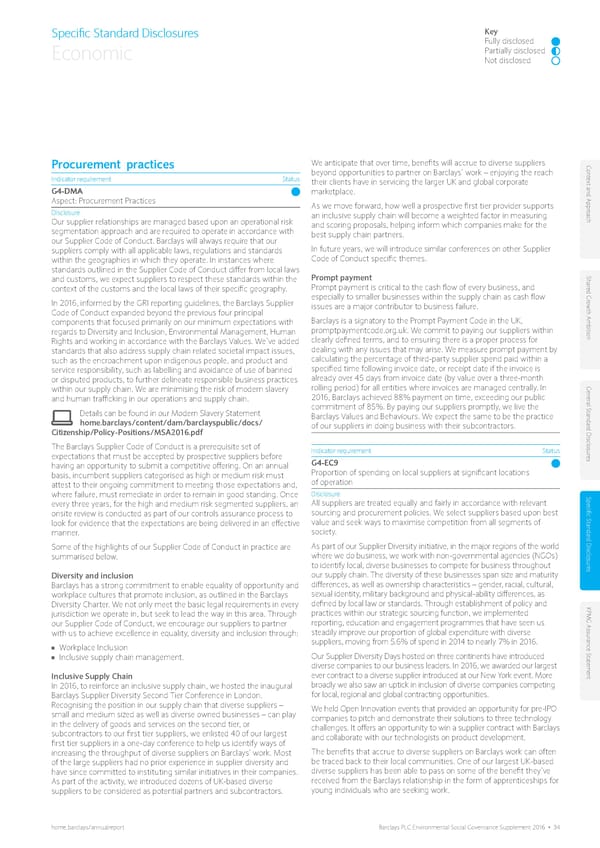

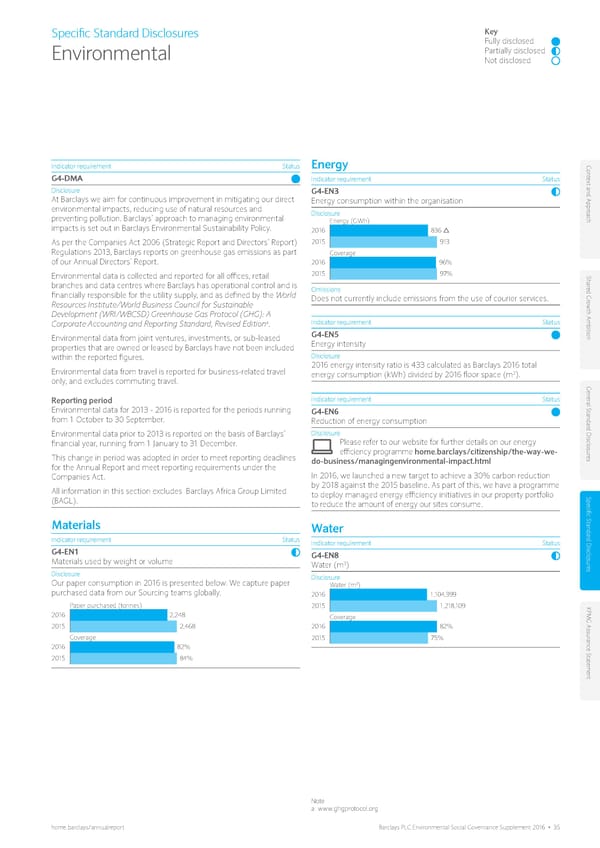

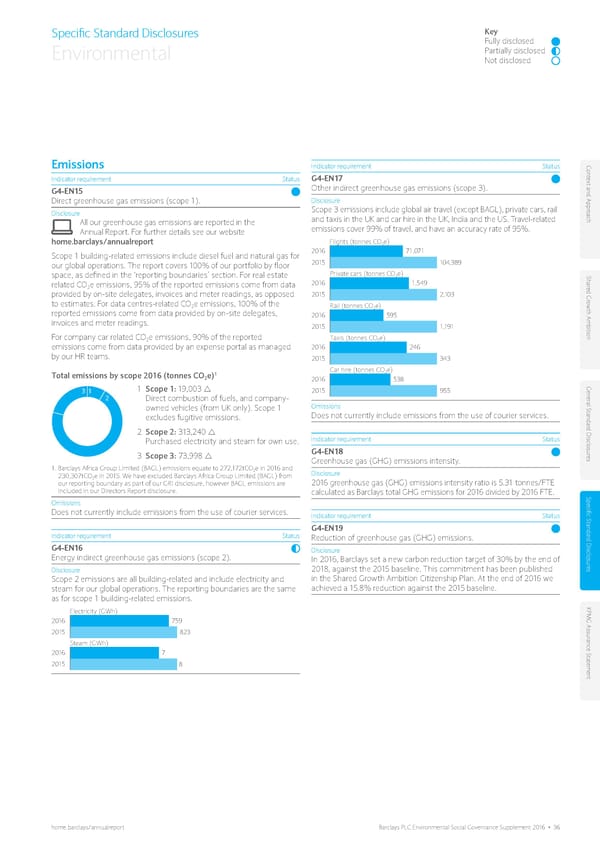

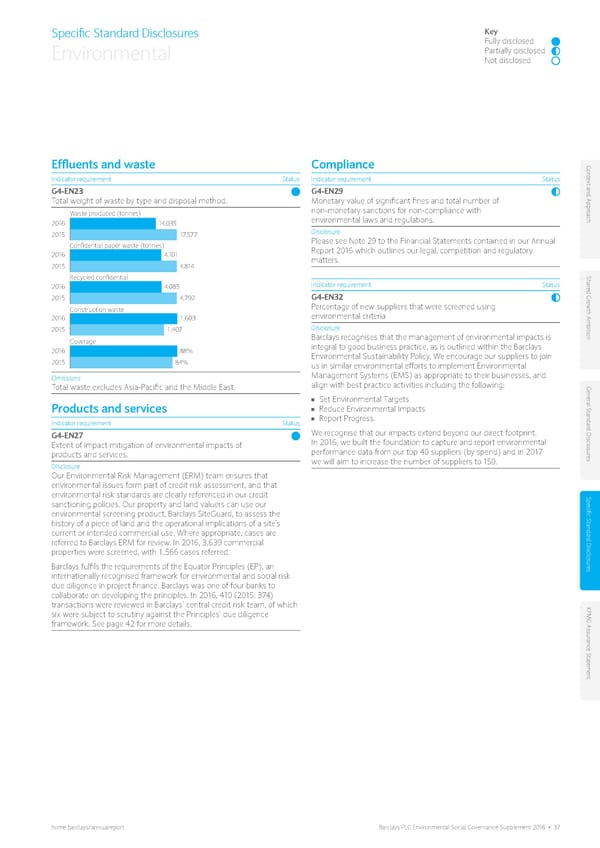

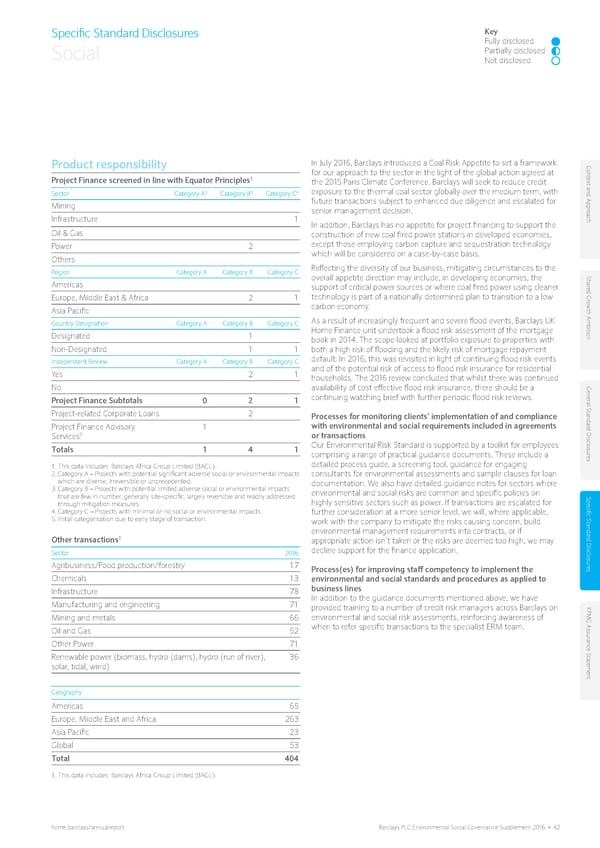

General Standard Disclosures Key Fully disclosed Partially disclosed Not disclosed Organisational profile Indicator requirement Status Con t e Indicator requirement Status G4-16 xt and Appr G4-13 List memberships of associations (such as industry Report any significant changes during the reporting period associations) and national or international advocacy organisations in which the organisation: regarding the organisation’s size, structure, ownership or its o supply chain, including: ach ■■ Holds a position on the governance body ■■ Changes in the location of, or changes in, operations, ■■ Participates in projects or committees including facility openings, closings and expansions ■■ Provides substantive funding beyond routine membership dues ■■ Changes in the share capital structure and other capital formation, maintenance and alteration operations (for private ■■ Views membership as strategic sector organisations) Disclosure Shar ■■ Changes in the location of suppliers, the structure of the ■■ Banking Environment Initiative ed Gr supply chain, or in relationships with suppliers, including ■■ Equator Principles o selection and termination wth Ambition ■■ Business in the Community Disclosure In March 2016, we announced the following actions to materially ■■ United Nations Environment Programme Finance Initiative (UNEP FI) progress our restructuring and lay the foundations for a period of ■■ Thun Group increased stability and improved performance. ■■ Business for Social Responsibility (BSR) ■■ The creation of two clearly defined divisions, Barclays UK and Barclays International, consistent with the regulatory requirement of Trade associations ringfencing in the UK. Barclays is a member of several trade associations globally. These Gener ■■ associations work to represent their members and shape Sell-down of our 62.3% stake in Barclays Africa Group Limited (BAGL) industry’s collective response to public policy issues. A summary of the key al S to a non-controlling, non-consolidated, position. associations in which we participate is also available on our website – tandar ■■ A one-time increase to Barclays Non-Core, whilst retaining our plan to barclays.com/citizenship/reports-and-publications/public-policy.html accelerate the run down our Non-Core business and close it by the d Disclosur end of 2017. Identified material aspects and boundaries Details of the Strategic Review and Group structure can be found in Indicator requirement Status es the Annual Report. Further details can be found on our website at G4-17 home.barclays/annualreport List all entities included in the organisation’s consolidated financial statements or equivalent documents. Indicator requirement Status Report whether any entity included in the organisation’s Specific G4-14 consolidated financial statements or equivalent documents is S Report whether and how the precautionary approach or not covered by the report. tandar principle is addressed by the organisation. Disclosure d Disclosure This Report covers Barclays operations globally except for Barclays Africa Disclosur In 2016, we reviewed 410 transactions for environmental or social Group Limited (BAGL). impacts. Refer to page 41 of this document for details. Please refer to Barclays Africa Group Limited (BAGL) Integrated es Indicator requirement Status Report and other disclosures available at barclaysafrica.com/ barclaysafrica/Investor-Relations/Announcements-and-publications/ G4-15 Annual-and-interim-reports List externally developed economic, environmental and social KP charters, principles, or other initiatives to which the organisation As part of our CRD IV Country by Country Reporting requirements, we MG Assur subscribes or which it endorses. also publish a list of the main entities that Barclays operates around the world and which together contribute over 90% of the Group’s turnover. Disclosure This document is available at the following link home.barclays/ ance S ■■ Equator Principles citizenship/reports-and-publications/country-snapshot.html ta t ■■ Green Bond Principles emen ■■ United Nations Environment Programme Finance Initiative (UNEP FI) t ■■ Wolfsburg Principles ■■ Soft Commodities Compact (Banking Environment Initiative and Consumer Goods Forum) ■■ Living Wage (UK) ■■ New York Declaration on Forests (2014) ■■ The Paris Pledge for Action (2015) ■■ UN Principles for Responsible Investment (The Barclays UK Retirement fund and Barclays Asset Management Ltd are signatories) home.barclays/annualreport Barclays PLC Environmental Social Governance Supplement 2016 • 20