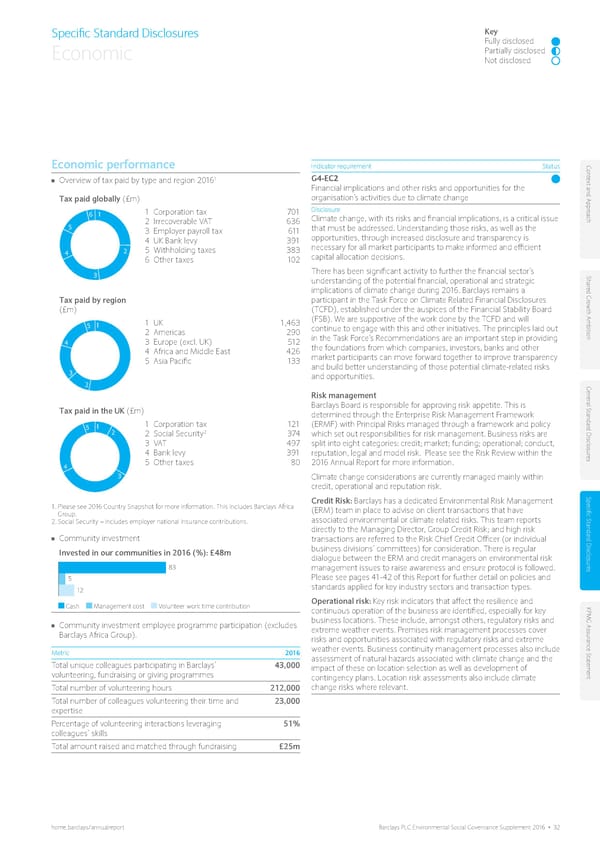

Specific Standard Disclosures Key Fully disclosed Economic Partially disclosed Not disclosed Economic performance Indicator requirement Status Con t 1 e ■■ Overview of tax paid by type and region 2016 G4-EC2 xt and Appr Financial implications and other risks and opportunities for the Tax paid globally (£m) organisation’s activities due to climate change Disclosure o 6 1 1 Corporation tax 701 Climate change, with its risks and financial implications, is a critical issue ach 5 2 Irrecoverable VAT 636 that must be addressed. Understanding those risks, as well as the 3 Employer payroll tax 611 opportunities, through increased disclosure and transparency is 4 UK Bank levy 391 necessary for all market participants to make informed and efficient 4 2 5 Withholding taxes 383 capital allocation decisions. 6 Other taxes 102 There has been significant activity to further the financial sector’s 3 understanding of the potential financial, operational and strategic Shar implications of climate change during 2016. Barclays remains a ed Gr Tax paid by region participant in the Task Force on Climate Related Financial Disclosures o (£m) (TCFD), established under the auspices of the Financial Stability Board wth Ambition 1 1 UK 1,463 (FSB). We are supportive of the work done by the TCFD and will 5 2 Americas 290 continue to engage with this and other initiatives. The principles laid out 4 3 Europe (excl. UK) 512 in the Task Force’s Recommendations are an important step in providing 4 Africa and Middle East 426 the foundations from which companies, investors, banks and other 5 Asia Pacific 133 market participants can move forward together to improve transparency 3 and build better understanding of those potential climate-related risks and opportunities. 2 Risk management Gener Barclays Board is responsible for approving risk appetite. This is al S Tax paid in the UK (£m) determined through the Enterprise Risk Management Framework tandar 1 Corporation tax 121 (ERMF) with Principal Risks managed through a framework and policy 5 1 2 2 d Disclosur 2 Social Security 374 which set out responsibilities for risk management. Business risks are 3 VAT 497 split into eight categories: credit; market; funding; operational; conduct, 4 Bank levy 391 reputation, legal and model risk. Please see the Risk Review within the es 4 5 Other taxes 80 2016 Annual Report for more information. 3 Climate change considerations are currently managed mainly within credit, operational and reputation risk. Credit Risk: Barclays has a dedicated Environmental Risk Management Specific S 1. Please see 2016 Country Snapshot for more information. This includes Barclays Africa (ERM) team in place to advise on client transactions that have Group. 2. Social Security – includes employer national insurance contributions. associated environmental or climate related risks. This team reports tandar directly to the Managing Director, Group Credit Risk; and high risk ■■ Community investment transactions are referred to the Risk Chief Credit Officer (or individual d Disclosur Invested in our communities in 2016 (%): £48m business divisions’ committees) for consideration. There is regular dialogue between the ERM and credit managers on environmental risk 83 management issues to raise awareness and ensure protocol is followed. es 5 Please see pages 41-42 of this Report for further detail on policies and 12 standards applied for key industry sectors and transaction types. Operational risk: Key risk indicators that affect the resilience and Cash Management cost Volunteer work time contribution continuous operation of the business are identified, especially for key KP business locations. These include, amongst others, regulatory risks and MG Assur ■■ Community investment employee programme participation (excludes extreme weather events. Premises risk management processes cover Barclays Africa Group). risks and opportunities associated with regulatory risks and extreme ance S Metric 2016 weather events. Business continuity management processes also include ta assessment of natural hazards associated with climate change and the t Total unique colleagues participating in Barclays’ 43,000 impact of these on location selection as well as development of emen volunteering, fundraising or giving programmes contingency plans. Location risk assessments also include climate t Total number of volunteering hours 212,000 change risks where relevant. Total number of colleagues volunteering their time and 23,000 expertise Percentage of volunteering interactions leveraging 51% colleagues’ skills Total amount raised and matched through fundraising £25m home.barclays/annualreport Barclays PLC Environmental Social Governance Supplement 2016 • 32

Environmental Social Governance Supplement Page 35 Page 37

Environmental Social Governance Supplement Page 35 Page 37