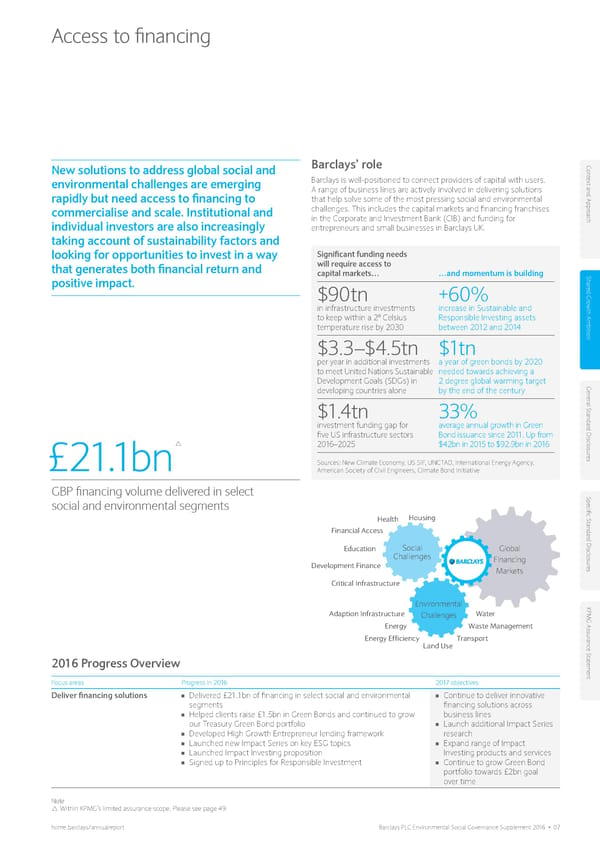

Access to financing New solutions to address global social and Barclays’ role Con t e environmental challenges are emerging Barclays is well-positioned to connect providers of capital with users. xt and Appr A range of business lines are actively involved in delivering solutions rapidly but need access to financing to that help solve some of the most pressing social and environmental challenges. This includes the capital markets and financing franchises o commercialise and scale. Institutional and in the Corporate and Investment Bank (CIB) and funding for ach individual investors are also increasingly entrepreneurs and small businesses in Barclays UK. taking account of sustainability factors and looking for opportunities to invest in a way Significant funding needs that generates both financial return and will require access to positive impact. capital markets… …and momentum is building Shar $90tn +60% ed Gr o in infrastructure investments increase in Sustainable and wth Ambition to keep within a 2º Celsius Responsible Investing assets temperature rise by 2030 between 2012 and 2014 $3.3–$4.5tn $1tn per year in additional investments a year of green bonds by 2020 to meet United Nations Sustainable needed towards achieving a Development Goals (SDGs) in 2 degree global warming target developing countries alone by the end of the century Gener al S $1.4tn 33% tandar investment funding gap for average annual growth in Green d Disclosur five US infrastructure sectors Bond issuance since 2011. Up from 2016–2025 $42bn in 2015 to $92.9bn in 2016 £ 21.1bn Sources: New Climate Economy, US SIF, UNCTAD, International Energy Agency, es American Society of Civil Engineers, Climate Bond Initiative GBP financing volume delivered in select social and environmental segments Specific S Housing Health tandar Financial Access Education Social Global d Disclosur Challenges Financing Development Finance Markets es Critical Infrastructure Environmental KP Adaption Infrastructure Challenges Water MG Assur Energy Waste Management Energy Efficiency Land Use Transport ance S ta t 2016 Progress Overview emen Focus areas Progress in 2016 2017 objectives t Deliver financing solutions ■■ Delivered £21.1bn of financing in select social and environmental ■■ Continue to deliver innovative segments financing solutions across ■■ Helped clients raise £1.5bn in Green Bonds and continued to grow business lines our Treasury Green Bond portfolio ■■ Launch additional Impact Series ■■ Developed High Growth Entrepreneur lending framework research ■■ Launched new Impact Series on key ESG topics ■■ Expand range of Impact ■■ Launched Impact Investing proposition Investing products and services ■■ Signed up to Principles for Responsible Investment ■■ Continue to grow Green Bond portfolio towards £2bn goal over time Note Within KPMG’s limited assurance scope. Please see page 49. home.barclays/annualreport Barclays PLC Environmental Social Governance Supplement 2016 • 07

Environmental Social Governance Supplement Page 9 Page 11

Environmental Social Governance Supplement Page 9 Page 11