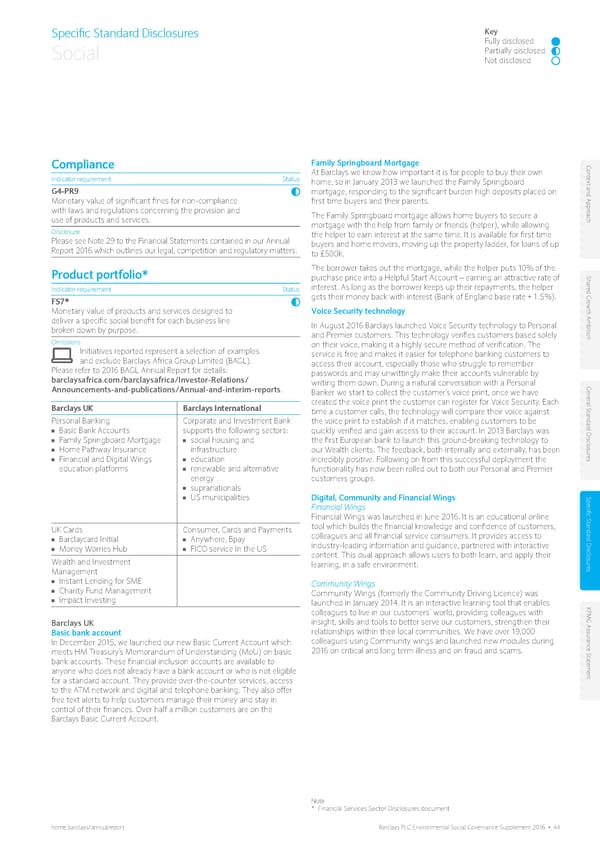

Specific Standard Disclosures Key Fully disclosed Social Partially disclosed Not disclosed Compliance Family Springboard Mortgage Con At Barclays we know how important it is for people to buy their own t e Indicator requirement Status home, so in January 2013 we launched the Family Springboard xt and Appr G4-PR9 mortgage, responding to the significant burden high deposits placed on Monetary value of significant fines for non-compliance first time buyers and their parents. with laws and regulations concerning the provision and o use of products and services. The Family Springboard mortgage allows home buyers to secure a ach mortgage with the help from family or friends (helper), while allowing Disclosure the helper to earn interest at the same time. It is available for first time Please see Note 29 to the Financial Statements contained in our Annual buyers and home movers, moving up the property ladder, for loans of up Report 2016 which outlines our legal, competition and regulatory matters. to £500k. The borrower takes out the mortgage, while the helper puts 10% of the Product portfolio* purchase price into a Helpful Start Account – earning an attractive rate of Shar Indicator requirement Status interest. As long as the borrower keeps up their repayments, the helper ed Gr gets their money back with interest (Bank of England base rate + 1.5%). FS7* o Monetary value of products and services designed to Voice Security technology wth Ambition deliver a specific social benefit for each business line In August 2016 Barclays launched Voice Security technology to Personal broken down by purpose. and Premier customers. This technology verifies customers based solely Omissions on their voice, making it a highly secure method of verification. The Initiatives reported represent a selection of examples service is free and makes it easier for telephone banking customers to and exclude Barclays Africa Group Limited (BAGL). access their account, especially those who struggle to remember Please refer to 2016 BAGL Annual Report for details: passwords and may unwittingly make their accounts vulnerable by barclaysafrica.com/barclaysafrica/Investor-Relations/ writing them down. During a natural conversation with a Personal Announcements-and-publications/Annual-and-interim-reports. Banker we start to collect the customer’s voice print, once we have Gener Barclays UK Barclays International created the voice print the customer can register for Voice Security. Each al S Personal Banking Corporate and Investment Bank time a customer calls, the technology will compare their voice against tandar the voice print to establish if it matches, enabling customers to be ■■ Basic Bank Accounts supports the following sectors: quickly verified and gain access to their account. In 2013 Barclays was d Disclosur ■■ Family Springboard Mortgage ■■ social housing and the first European bank to launch this ground-breaking technology to ■■ Home Pathway Insurance infrastructure our Wealth clients. The feedback, both internally and externally, has been ■■ Financial and Digital Wings ■■ education incredibly positive. Following on from this successful deployment the es education platforms ■■ renewable and alternative functionality has now been rolled out to both our Personal and Premier energy customers groups. ■■ supranationals ■■ US municipalities Digital, Community and Financial Wings Specific S Financial Wings Financial Wings was launched in June 2016. It is an educational online UK Cards Consumer, Cards and Payments tool which builds the financial knowledge and confidence of customers, tandar ■■ Barclaycard Initial ■■ Anywhere, Bpay colleagues and all financial service consumers. It provides access to d Disclosur ■■ Money Worries Hub ■■ FICO service In the US industry-leading information and guidance, partnered with interactive Wealth and Investment content. This dual approach allows users to both learn, and apply their Management learning, in a safe environment. es ■■ Instant Lending for SME Community Wings ■■ Charity Fund Management Community Wings (formerly the Community Driving Licence) was ■■ Impact Investing launched in January 2014. It is an interactive learning tool that enables KP colleagues to live in our customers’ world, providing colleagues with MG Assur Barclays UK insight, skills and tools to better serve our customers, strengthen their Basic bank account relationships within their local communities. We have over 19,000 In December 2015, we launched our new Basic Current Account which colleagues using Community wings and launched new modules during ance S meets HM Treasury’s Memorandum of Understanding (MoU) on basic 2016 on critical and long term illness and on fraud and scams. ta t bank accounts. These financial inclusion accounts are available to emen anyone who does not already have a bank account or who is not eligible for a standard account. They provide over-the-counter services, access t to the ATM network and digital and telephone banking. They also offer free text alerts to help customers manage their money and stay in control of their finances. Over half a million customers are on the Barclays Basic Current Account. Note * Financial Services Sector Disclosures document home.barclays/annualreport Barclays PLC Environmental Social Governance Supplement 2016 • 44

Environmental Social Governance Supplement Page 47 Page 49

Environmental Social Governance Supplement Page 47 Page 49