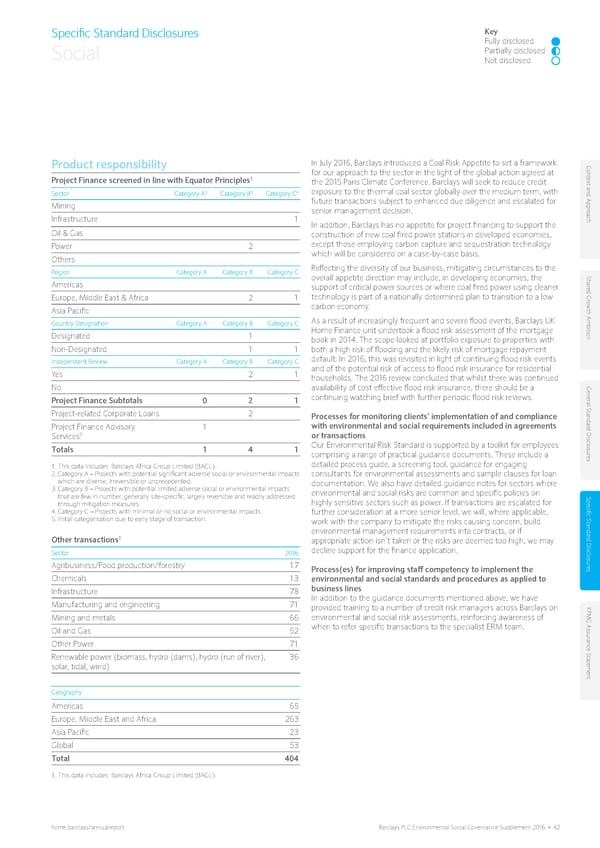

Specific Standard Disclosures Key Fully disclosed Social Partially disclosed Not disclosed Product responsibility In July 2016, Barclays introduced a Coal Risk Appetite to set a framework Con for our approach to the sector in the light of the global action agreed at t 1 e Project Finance screened in line with Equator Principles the 2015 Paris Climate Conference. Barclays will seek to reduce credit xt and Appr Sector Category A2 Category B3 Category C4 exposure to the thermal coal sector globally over the medium term, with Mining future transactions subject to enhanced due diligence and escalated for senior management decision. o Infrastructure 1 ach In addition, Barclays has no appetite for project financing to support the Oil & Gas construction of new coal fired power stations in developed economies, Power 2 except those employing carbon capture and sequestration technology Others which will be considered on a case-by-case basis. Region Category A Category B Category C Reflecting the diversity of our business, mitigating circumstances to the Americas overall appetite direction may include, in developing economies, the Shar support of critical power sources or where coal fired power using cleaner ed Gr Europe, Middle East & Africa 2 1 technology is part of a nationally determined plan to transition to a low o Asia Pacific carbon economy. wth Ambition Country Designation Category A Category B Category C As a result of increasingly frequent and severe flood events, Barclays UK Designated 1 Home Finance unit undertook a flood risk assessment of the mortgage book in 2014. The scope looked at portfolio exposure to properties with Non-Designated 1 1 both a high risk of flooding and the likely risk of mortgage repayment Independent Review Category A Category B Category C default. In 2016, this was revisited in light of continuing flood risk events Yes 2 1 and of the potential risk of access to flood risk insurance for residential households. The 2016 review concluded that whilst there was continued No availability of cost effective flood risk insurance, there should be a Gener continuing watching brief with further periodic flood risk reviews. Project Finance Subtotals 0 2 1 al S Project-related Corporate Loans 2 Processes for monitoring clients’ implementation of and compliance tandar Project Finance Advisory 1 with environmental and social requirements included in agreements d Disclosur 5 or transactions Services Totals 1 4 1 Our Environmental Risk Standard is supported by a toolkit for employees comprising a range of practical guidance documents. These include a es 1. This data includes Barclays Africa Group Limited (BAGL). detailed process guide, a screening tool, guidance for engaging 2. Category A – Projects with potential significant adverse social or environmental impacts consultants for environmental assessments and sample clauses for loan which are diverse, irreversible or unprecedented. documentation. We also have detailed guidance notes for sectors where 3. Category B – Projects with potential limited adverse social or environmental impacts environmental and social risks are common and specific policies on that are few in number, generally site-specific, largely reversible and readily addressed highly sensitive sectors such as power. If transactions are escalated for Specific S through mitigation measures. 4. Category C – Projects with minimal or no social or environmental impacts. further consideration at a more senior level, we will, where applicable, 5. Initial categorisation due to early stage of transaction. work with the company to mitigate the risks causing concern, build tandar environmental management requirements into contracts, or if 1 d Disclosur Other transactions appropriate action isn’t taken or the risks are deemed too high, we may Sector 2016 decline support for the finance application. Agribusiness/Food production/forestry 17 Process(es) for improving staff competency to implement the es Chemicals 13 environmental and social standards and procedures as applied to Infrastructure 78 business lines In addition to the guidance documents mentioned above, we have Manufacturing and engineering 71 provided training to a number of credit risk managers across Barclays on KP Mining and metals 66 environmental and social risk assessments, reinforcing awareness of MG Assur Oil and Gas 52 when to refer specific transactions to the specialist ERM team. Other Power 71 ance S Renewable power (biomass, hydro (dams), hydro (run of river), 36 ta t solar, tidal, wind) emen t Geography Americas 65 Europe, Middle East and Africa 263 Asia Pacific 23 Global 53 Total 404 1. This data includes Barclays Africa Group Limited (BAGL). home.barclays/annualreport Barclays PLC Environmental Social Governance Supplement 2016 • 42

Environmental Social Governance Supplement Page 45 Page 47

Environmental Social Governance Supplement Page 45 Page 47