Sustainable Investing and Bond Returns

Research study into the impact of ESG on credit portfolio performance

01 Impact Series Sustainable investing and bond returns Research study into the impact of ESG on credit portfolio performance 1

Environmental Social Governance 2

Foreword Welcome to the first report in our Impact Series, showcasing groundbreaking research into the effect of environmental, social and governance investing on bond portfolio performance. Across the world, individual and institutional investors If ESG attributes are aligned with bond returns as our seek attractive financial returns while helping to achieve study suggests, we can expect the move to sustainable a positive impact on the communities around them. With investing to endure. As our analysts remind us in this growing concerns over climate change and global warming, report: “As ESG considerations play out over a long horizon, geopolitical instability and uncertainty in financial markets, and as they increasingly become a priority for company this has become even more pressing. managers, they may help alleviate the pressure for short- The growing awareness of and support for responsible termism and encourage a focus on long-term value investing has led to it becoming inherent to the investment creation – to the mutual benefit of the firm, its investors processes of many institutional investors. These responsible and the world at large.” investors often hope to improve sustainability by engaging with corporate managers, allocating capital to more virtuous companies and lobbying for broader reporting standards and changes in regulations. Much research has been done on the relationship between environmental, social and corporate governance (ESG) Jes Staley, Chief Executive Officer of Barclays investing and performance in equity markets, but far less on its effect on the credit markets. This study by the Barclays Research team into the behaviour of corporate bond portfolios makes a significant contribution to the available body of evidence on sustainable investing. The research shows that applying ESG factors resulted in a small but steady performance benefit and the team could find no evidence of a negative effect. 3

Key findings of this report: In investigating the link between ESG and corporate bond performance, Barclays Research constructed broadly diversified portfolios tracking the Bloomberg Barclays US Investment-Grade Corporate Bond Index. They matched the index’s key characteristics (sector, quality, duration) but imposed either a positive or negative tilt to different ESG factors. • Barclays research shows that ESG need not be an “equity-only” phenomenon and can be applied to credit markets without being detrimental to bondholders’ returns. • The findings show that a positive ESG tilt resulted in a small but steady performance advantage. • No evidence of a negative performance impact was found. • ESG attributes did not significantly affect the price of corporate bonds. No evidence was found that the performance advantage was due to a change in relative valuation over the study period. • When applying separate tilts to E, S and G scores, the positive effect was strongest for a positive tilt towards the Governance factor, and weakest for Social scores. • Issuers with high Governance scores experienced lower incidence of downgrades by credit rating agencies. • Broadly similar results were observed using ratings from the two ESG providers considered in this report despite the significant differences between their methodologies.

The road to sustainable returns Sustainable investing, in which Environmental, Social, managers in evaluating the potential performance effect and Governance (ESG) issues are incorporated into the of integrating ESG data into their portfolio construction, investment process, is increasingly gaining a foothold in we knew it was important to construct a study that mainstream financial markets. carefully avoids any systematic risk exposures. For some of the most committed investors, the knowledge that their funds are being invested to support their values What this report covers is so important that they would accept a lower return on We begin with a short overview of what drives ESG their investments. A much larger group would be happy investing and the rapid rise in its popularity over the last to support these values, but only once they are convinced decade. Next, we offer a glossary of terms to help address that there is limited negative return impact. Finally, if the proliferation of buzzwords and acronyms that have consideration of ESG principles can actually help to been used in this field. We then investigate the impact that improve portfolio performance – as many adherents claim increasing ESG awareness has had on different groups of – then it would be hard to justify any resistance to their financial market participants, including asset owners, asset adoption. The relationship between ESG characteristics and managers, corporate managers and regulators. Finally, performance is therefore of primary importance. we present a list of ten areas in which the industry has undergone significant changes in recent years, and discuss Focus on credit market the implications of these trends for the future. In the absence of much research into the impact of ESG on The second section addresses ESG ratings. Many market the credit markets, Barclays Research has conducted a new participants rely on independent providers of ESG scores study to determine the nature of the relationship between and ratings in their investment decisions. In fact, we rely on bond performance and ESG. We focused on the credit them ourselves when we seek to quantify the performance markets for several reasons. impact of ESG-motivated investment decisions. We therefore try to understand them better: what exactly First, an increasingly large number of bond investors is do the scores measure and how are they constructed? interested in ESG investing. We describe the approaches followed by two major ESG Second, the relationship between sustainability and providers – MSCI and Sustainalytics – and investigate the portfolio performance has been extensively researched in relationships between different metrics. How do these the equity market and much less so in credit. scores relate to more traditional credit ratings, or to corporate bond spreads? How stable are the scores over Third, credit investing is dominated by institutional time? We investigate these questions in the context of the investors, including pension funds, which are leading the US investment-grade credit market. trend for sustainable returns; bonds represent a substantial Finally, we perform a detailed analysis of the relationship percentage of their assets. between ESG scores and corporate bond performance. We Finally, corporate bonds are complex: they combine construct high-ESG and low-ESG bond portfolios carefully exposure to interest rates and credit spread, so allocations designed to track the index by controlling for the non-ESG along both dimensions influence risk and performance. factors known to affect bond returns. We find that the high- Unintended biases can therefore easily appear when ESG portfolios have tended to outperform historically, and overweighting one bond relative to another. To aid bond we try to understand why. 5

ESG is becoming mainstream Responsible investing goes by many different names and ensure that corporate behaviour is always desirable from a definitions, but can broadly be described as expanding the broad societal perspective. In this context, ESG can be seen objectives of an investment process beyond pure financial as an alternative to more regulation. considerations to reflect investors’ values and beliefs that We are at a turning point where ESG investing is maturing their holdings affect the community and broader eco-system. and being formalised through ESG integration into In order to measure the sustainability of investments, decision-making processes, standardisation of ESG a widely accepted set of metrics has evolved, known as data, new benchmark indices, and broader pro-active environmental, social and governance (ESG) scores. In engagement with issuers. addition to the traditional objective of delivering financial The widespread adoption of ESG investing has come hand returns, ESG investing enables investors to structure in hand with a subtle but critical change in emphasis. portfolios that are aligned with their values. The early charge was led by ethically motivated investors While not new, responsible investing has gathered clearly focused on environmental and social issues while momentum and taken on broader significance in the past most institutional investors looked on from the sidelines, ten years. The United Nations, for example, supported the concerned about the potential negative impact on portfolio launch of six Principles for Responsible Investing in 2006 returns. The key to gaining traction was in reversing the 1 to incorporate sustainability into investment practice . perceived effect on performance. Not only is it no longer Collectively known as UN PRI, it has since then attracted assumed that “doing the right thing” will place a drag on nearly 1,500 signatories, collectively controlling over $60 portfolio returns; rather, it is now seen as prudent to avoid trillion of assets under management. investing in companies that have a detrimental impact The rise in responsible investing has followed the growth on the world, because their business practices may not and increasing sophistication of large institutional be allowed to remain unchanged. ESG ratings providers investors such as pension plans, sovereign wealth funds, thus emphasise that their ratings measure the risks of insurance companies and mutual fund managers. As these negative events stemming from poor behaviour in the institutional asset owners are ultimately accountable to a Environmental, Social and Governance spheres; and the large base of individual policyholders, they have in many jargon used to describe the industry (see glossary on cases found it necessary to align their investment processes p. 8-10) has evolved towards terms that have positive with the priorities and values of their beneficiaries. connotations regarding performance. These large investors have often been at the forefront of ESG innovations, insisting on high standards of corporate “ Not only is it no longer assumed that governance as well as on controlling potential negative ‘doing the right thing’ will place a drag impacts of corporate activities on society and the on portfolio returns; rather, it is now environment. In addition, laws and regulations may not seen as prudent to avoid investing in 1 The six principles, which may be found at www.unpri.org/about/the-six- companies that have a detrimental principles, commit signatories to incorporate ESG issues into the investment impact on the world.” process and actively encourage others to do the same. 6

Figure 1 Number of UN PRI signatories and their total assets under management Assets under management (US $ trillion) Number of signatories 1500 80 70 1260 60 50 1070 40 719 30 20 362 10 100 0 2006 2008 2010 2012 2014 2016 Source: UN PRI 7

A brief glossary of ESG terms The idea that investors should look beyond traditional financial measures and incorporate ESG-related factors into the investment process has broad appeal. It has been espoused by many different groups, each driven by a slightly different set of motives. This has given rise to a profusion of terms to describe this type of investment, each emphasising a particular angle, but with significant overlap among them. In the brief (and certainly incomplete) glossary below, we attempt to summarise the industry jargon.

Terms for the industry as a whole Responsible investing (RI): Investing based on criteria that low productivity, or poor quality work; poor corporate are not purely financial, in order to support positive effects governance can give management wrong incentives on society and avoid negative ones. This is a blanket term or increase the likelihood of accounting irregularities. intended to encompass the items detailed below. By extension, a sustainable investment should not be Socially responsible investing (SRI): Investing based detrimental to the broad ecosystem in which it operates. amongst others on social criteria, for example by avoiding So sustainability can been seen at two levels: sustainability controversial industries such as tobacco, alcohol or of the investment and sustainability of the world. gambling. Ethical investing: Ensures that specific ethical or religious ESG: The environmental, social and governance metrics considerations are taken into account when choosing that investors apply to measure the sustainability of their investments. This is very similar to Socially Responsible investments. These factors are: Investing and generally involves exclusion of controversial industries. The “ethical investing” term has been used more Environmental: Issues connected to global warming, widely in the UK. energy usage, pollution and the like. Impact investing: Investments that consider social Social: factors such as how a company treats its workers, or environmental benefits alongside financial return.* health and safety considerations, and community Impact investors may be willing to earn below-market outreach. returns in order to help finance causes they deem worthy. Governance: a focus on topics including business This may be seen as an alternative to dividing assets ethics, board structure and independence, executive among investment funds seeking to maximize financial compensation policies and accounting. performance and philanthropic activities for social benefit and no financial return. By directing a larger fund base to ESG investing: Incorporates measurable criteria to address both issues simultaneously, a larger net impact compare investments across the three broad categories of might be achieved. An example of impact investing is Environment, Social and Governance. ESG metrics provide investing in green bonds, whose proceeds have clear net measurable attributes of a corporation that may be used in environmental benefit and comply with standards called many forms of responsible investing. Note that Governance Green Bond Principles (GBP)2. is distinct in nature from Environment and Social attributes, Sustainable and responsible investing (SRI): Used as an and that investors may have their own priority ranking 3 of the various categories. “ESG investing” has become umbrella term for all of the above by industry associations. synonymous with “sustainable investing”. This - the second definition of SRI - seems to be the preferred term accepted by industry organisations because Sustainable investing: Ensures that an investment will it is broader in scope and places greater emphasis on issues preserve its value over time. In the case of a corporation, that are financially material to investors. ensuring that it has the capacity to endure and can keep operating over a long period. In this view, ESG factors serve to highlight exposures to risks that could derail a company 2 See for example Bloomberg Barclays MSCI Green Bond Indices, over the long term. A poor environmental record may make September 2014. 3 See for example the web sites of the US Sustainable Investment Forum (www. a firm vulnerable to legal action or regulatory penalties; ussif.org) and its European counterpart (www.eurosif.org). mistreatment of workers may lead to high turnover, * The definition of impact investing was updated on 1 November 2016 following the initial publication of the report on 31 October 2016. 9

Ways to incorporate New roles for investors, asset ESG goals in a portfolio managers and corporates Negative screening: Excluding specific companies ESG investing has different implications for asset owners or industries that are considered to be particularly and asset managers: individual asset owners want to objectionable from the investment universe of a portfolio. make the world a better place by allocating resources For example, Bloomberg Barclays MSCI Socially Responsible to responsible companies while maintaining financial 4 apply a negative screen to existing Bloomberg (SRI) Indices performance. Asset managers acting on behalf of Barclays indices to exclude issuers involved in activities these investors want to be seen as ESG-compliant in that are in conflict with investment policies, values, or order to attract assets, but also need to deliver financial social norms, such as tobacco, alcohol, nuclear power and performance in order to retain those assets. weapon manufacturing. Responsible investors often hope to improve sustainability Positive screening: Selecting a portfolio of companies with by engaging with companies through proxy voting in desirable characteristics to form an investment universe or a shareholder meetings, allocating capital to more virtuous benchmark index. For example, the STOXX Global ESG Leaders companies and lobbying for changes in regulations and equity index offers a representation of the leading global reporting standards. As ESG factors are expected to companies in terms of environmental, social and governance play out over a long horizon, responsible investing can 5 criteria, based on ESG indicators provided by Sustainalytics . encourage the managers of public corporations to take ESG integration: The inclusion of ESG metrics in all aspects a longer-term approach to value creation. This can be a of the investment process, such as security valuation, the counterweight to the pressure for delivering short-term formation of expected returns, risk analysis and portfolio financial performance if it conflicts with a company’s long- construction. term sustainability. Corporate engagement: The process by which investors actively seek to influence corporations with a view to addressing ESG shortcomings and to encourage better practice. An active ownership culture – also called stewardship – among shareholders can help promote more sustainable and responsible business practices. Most 6, corporate engagement relates to governance issues as this is where the relationship between investors and corporate management can be anchored in existing accounting, financial and legal frameworks. 4 See Bloomberg Barclays MSCI ESG Fixed Income Index Series, June 2013. 5 See STOXX ESG Index Methodology Guide, June 2016, https://www.stoxx. com/document/Indices/Common/Indexguide/stoxx_esg_guide.pdf 6 According to a survey of UK equity investors, Environment and Social issues come seventh in rankings of both most frequently addressed and most important engagement issues, after governance and performance issues. See “Adherence to the Financial Reporting Council (FRC) Stewardship Code” published in June 2015 by the Investment Association (www. theinvestmentassociation.org) 10

Figure 2 ESG expands the relationship among asset owners, asset managers and corporations TRADITIONAL Maximize Invest based Maximize financial on financial shareholder performance attributes value ASSET OWNER ASSET MANAGER CORPORATION Align to values Consider ESG Adjust business model and attributes enhance governance Aim for sustainability of the world Aim for sustainability Enhance Corporate & of the investment Social Responsiblity (CSR) ESG Source: Barclays Research 11

Investors are motivated to invest E, S and G are responsibly for different reasons: fundamentally different Value alignment. Investors want to ensure that the Many responsible investors believe that ESG criteria are investment decisions of the asset managers they appoint material to future business success and, ultimately, to comply with their ethical and broad societal values. This financial performance. But if it exists, there may not yet be motivation is most prevalent in Northern Europe but it is enough evidence of such a relationship. Relying on ESG gaining traction in the US as well, as indicated by a recent therefore could be seen as an act of faith that desirable 7 survey on attitudes to wealth investing . corporate behaviour should be beneficial to investors over Risk management. Environmental, Social and Governance the long run. (ESG) considerations capture non-financial information The three individual elements of ESG differ in nature: that could affect financial performance. These can be as • Governance is an indication of how well-governed a diverse as scrutiny of corporate management and concern corporation is and the extent to which the primacy for strong governance to protect shareholders, work of shareholder interest is ensured. It can be seen as a practice considerations, or fear of global warming and measure of management quality. hence a preference for activities that have a low carbon footprint. • By contrast, the Environment and Social variables capture The different investment objectives – value alignment and the risk and opportunities that are often specific to financial performance – require changes to the relationship the industry and the activities of a company. The link between investor and investee. Financial data such as between E and S and future performance is therefore accounting statements are no longer sufficient to fully indirect. assess the nature and business prospects of a corporate While many investors agree that Governance has a link to investment in a changing environment. It becomes performance, there is less consensus on the importance necessary to identify and consider material, non-financial of Environment and Social attributes. A Barclays survey of drivers of business success as well. large asset managers in 2016 indeed found that they often So there is a need for additional information to describe have different views on the importance of E, S and G than the risks posed by negative factors, such as when the asset owners. The research showed that asset owners activities of corporations impose a cost on the broader find Environment more important, while managers see public through pollution, for example. It is necessary to Governance as more relevant to financial performance. relate these risks to corporate behaviour and organisational ESG indicators also play different roles depending on the processes which directly or indirectly affect the type of company and its geography. For example, the risk corporation’s sustainability. of pollution and environmental damage is important in Indeed, corporations that negatively impact society the chemical industry but not very relevant to the financial may ultimately face adverse changes in their operating sector, where governance and social factors may be much environment, due to regulatory action for example. ESG more relevant. addresses the need to supplement traditional financial Within industries, large variations can exist according to reporting with a broader, all-encompassing assessment of the business model and structure of individual companies. sustainability and can therefore reflect a holistic attitude to There is at this stage little standardisation of the selection risk management on a long horizon. of and weight attached to various ESG metrics in different industries. Disclosure of ESG-relevant information by issuers is mostly 7 In the 2016 U.S. Trust Insights on Wealth and Worth® by the US Trust Bank voluntary at this stage, but there is a strong appetite from of America, Millennials are more than twice as likely to consider investment investors for defining new, expanded, reporting standards decisions a way to express personal values than older generations. See http:// www.ustrust.com/ust/pages/insights-on-wealth-and-worth-2016.aspx that would be made mandatory and help investors form 12

Figure 3 Which one of E, S or G is most important to asset owners, and to asset managers? Environment 57% Environment 18% Society 23% Society 3% Governance 20% Governance 79% 75% Asset 25% 75% Asset 25% Owners Managers 50% 50% Source: Barclays Research. Barclays survey of large fixed income asset managers (2016) 8 a more holistic view of corporate performance . Several rating agencies. This business model can be seen as organisations are making efforts to define standards for the less prone to conflicts of interest and better aligned with reporting of non-financial information9. investor priorities. ESG ratings, or the corresponding In addition, there are specialised information providers numerical scores, aim to supplement traditional financial that analyse individual companies and publish ESG ratings and accounting measures of corporate strength to help and data. Providers of ESG data are generally funded by investors form views. investors, as opposed to issuers as is the case for credit ESG evaluation is relative in nature within relevant peer groups such as industry sectors, as opposed to absolute. 8 According to a recent survey of investors’ views on financial reporting A ranking of companies in a given industry based on ESG published by advisory service Ernst & Young. See http://www.ey.com/ criteria can help identify best-in-class peers and use them Publication/vwLUAssets/EY-tomorrows-investment-rules-2/$FILE/EY- as benchmarks. tomorrows-investment-rules-2.0.pdf 9 Influential standards organisations advocating the introduction of non- financial reporting include the International Integrated Reporting Council (IIRC), Figure 4 illustrates the relationships between the different the Sustainability Accounting Standards Board (SASB), and the Global Reporting participants in the ESG investment process. Initiative (GRI). 13

Figure 4 The ESG information flow Large investors Industry Lobby regulators Investors and asset for mandatory Regulators managers fund Associations non-financial industry bodies reporting related to ESG Require ESG Impose investing non-financial reporting to issuers and asset managers Invest and Change Publish Asset engage regulation to ESG Corporations limit negative indices Manager externalities Deliver financial returns and Obtain ESG report on ESG data from corporations, directly and indirectly Advise on engagement Provide ESG ESG Index analysis to managers, Analysis Publishers investors and Providers other service providers Source: Barclays Research 14

“We are at a turning point where ESG investing is maturing and formalised through ESG integration into decision- making processes, standardisation of ESG data, new benchmark indices, and broader pro-active engagement with issuers.” 15

The evolution of ESG: 10 recent trends Socially responsible investing (SRI), often implement its principles. Now, the PRI requires a detailed associated with excluding controversial report of how this has been translated into practice. sectors such as tobacco from a portfolio, Investors who do not complete an annual questionnaire 01 is increasingly being replaced by “ESG can be excluded from the list. investing”, which favours issuers with stronger ESG credentials. Two factors favour this trend. First, ESG The asset management industry introduces an element of objectivity in the investment initially focused on offering specialist process. ESG analysis typically results in a ranking of mandates where controversial sectors issuers within a particular sector based on measurable 04were excluded, often based on ethical criteria, without automatically excluding any one of them. considerations. Since then, broader generic and thematic For example, an issuer might operate in a controversial funds have been launched, for example low carbon. This sector, such as mining, but demonstrate pro-activeness includes exchange-traded funds (ETF) in equity and in in managing the risks inherent to that sector (e.g., clean- credit markets that follow specially designed benchmark up actions and social development for the community) indices. beyond the standard industry practice. Second, a blanket exclusion of a sector may change the structure and risk Large investors such as sovereign wealth funds and insurance profile of a portfolio. This can translate into large tracking companies have also started systematically divesting from errors relative to traditional market-weighted benchmarks. controversial issuers and sectors. For example, the Norway Without a suitable benchmark index, it is difficult for an Petroleum fund announced in June 2015 it would divest from asset manager to implement an ESG strategy. the coal industry out of concern for global warming, and the insurance company AXA announced in May 2016 that it Until recently, responsible investing was 10. would sell its tobacco investments a specialist activity limited to specific 02mandates. Now, several large asset Responsible and ESG investing have managers have created specialist ESG been mainly motivated by the concerns teams. Initially, they operated in isolation from the main of asset owners for value alignment. portfolio management teams, but integration is now under 05Regulation did not initially play much of way. ESG analysis is systematically incorporated in the a role and, in some cases, was not seen as supportive. For investment decisions of some large investors, especially example, a 2008 guideline from US pension fund regulation when the investment horizon is long and the asset less ERISA indicated that ESG investing could be seen as a liquid, as is the case for infrastructure and, increasingly, collateral goal that should not distract from maximising corporate bonds. financial performance. Only in October 2015 did the US Department of Labor publish a clarification saying The UN PRI has acted as a catalyst for that it “does not believe ERISA prohibits a fiduciary from making ESG investing an inherent part of 11. incorporating ESG factors” 03the institutional investment process. Its role has changed over time to encourage best practice. When it was created ten years ago, 10 See http://www.axa.co.uk/newsroom/media-releases/2016/AXA-Group- divests-tobacco-industry-assets/ signatories expressed their intent to invest responsibly and 11 See https://www.dol.gov/opa/media/press/ebsa/ebsa20152045.htm 16

16 But regulation around ESG is now taking shape. One striking widespread. As reported by a large accounting firm , most example is the introduction in August 2015 by the French large listed UK companies now publish comprehensive government of a law on energy transition and green growth corporate social responsibility (CSR) reports, while at which carries mandatory ESG and climate change reporting the turn of the century, only a small proportion of them 12 for listed companies, banks and institutional investors. had environmental policy statements. Also, many large corporations want to be seen as increasing their positive Index publishers have developed contribution to society by being active in CSR – regarded as benchmark indices incorporating ESG synonymous to ESG but from the perspective of the issuer. 06features. Initially, the focus was on ESG-related company data are much equity markets, but ESG bond indices have followed. Many indices can be customised, such as more readily available now, and of for thematic exchange-traded funds, but they may not be 09better quality. Information is still being fully comparable with more encompassing market indices. collected individually by asset managers For example, a focus on high ESG-rated companies may and service providers, but there are significant initiatives introduce differences in allocation in favour of a larger to standardise non-financial information. Bodies such as size and higher rating quality. Some market participants Sustainability Investor Forums (SIFs), the International therefore advocate the use of “smart beta” ESG strategies Integrated Reporting Council (IIRC), the Global Reporting that combine an ESG theme with the financial objective of Initiative (GRI) and the Sustainable Accounting Standard retaining exposure to rewarded risk factors while being well Board (SASB) are all pushing for mandatory reporting 13. standards of non-financial material information. diversified Collecting data and analysing an issuer’s The interaction between companies and ESG attributes can be hard work. Some investors has become two-way, with large 07asset managers have hired teams of ESG 10 investors and asset owners keen to engage specialists, but many rely on dedicated with issuers on all ESG-related topics. This ESG research providers. ESG analysis often evaluates engagement by investors has existed for a long time, in individual companies, but such scoring of mutual funds particular in the USA, but has been highly focused on has also been introduced by fund research companies such governance issues and proxy voting. Engagement is also a 14 15 17 as Morningstar and MSCI . Their approach currently relatively new phenomenon in Europe. In a recent study , consists of determining the ESG profile of a fund based Sustainalytics estimates that the European engagement on the ESG ratings of its underlying investments. This and voting market has grown to the point where over €6 industry is new, growing fast, and also showing signs of trillion of equity market capitalisation is concerned, up from consolidation as large investors require consistency of €118 billion in 2002. approach across a broad universe of issuers globally and also across the multiple dimensions of E, S and G. These developments, taken together, lead to a single inescapable conclusion: the trend towards sustainable The attitudes of bond issuers, too, have investing is not just a passing fad, but a movement that changed markedly. While ESG disclosure has brought, and will continue to bring, fundamental and 08used to be handled by corporations’ sweeping changes to the investment landscape. investor relations department upon request, ESG transparency and pro-activeness is now 12 See https://www.legifrance.gouv.fr/eli/loi/2015/8/17/DEVX1413992L/ jo#JORFARTI000031045547 13 See for example http://www.scientificbeta.com/#/documentation/latest- 16 See http://www.ey.com/Publication/vwLUAssets/EY-tomorrows- publications/scibeta-low-carbon-multibeta-multistrategy-indices investment-rules-2/$FILE/EY-tomorrows-investment-rules-2.0.pdf 14 See http://www.morningstar.com/company/sustainability/ 17 See http://www.sustainalytics.com/sites/default/files/engagement- 15 See https://www.msci.com/esg-fund-metrics blackboxofvaluecreation-2016.pdf 17

Figure 5 From fringe to mainstream: changes in the ESG investment landscape at a glance YESTERDAY TODAY Negative screening of “sin” industries Positive screening based on ESG Hiring of specialist ESG teams ESG is integrated in investment decisions Investors sign up to the UN PRI PRI Signatories report on ESG implementation Asset managers offer specialist Asset owners embrace responsible SRI mandates investing Regulation is at best indifferent to Regulation is supportive of ESG ESG investing Limited offering of ESG-related indices Broader offering of ESG indices; launch of thematic ETFs; ESG incorporated in “smart beta” strategies Emergence of specialist providers An industry of ESG providers is growing of ESG analysis fast and consolidating Limited ESG disclosure by corporations Corporations develop a Corporate Social Responsibility (CSR) agenda ESG data hard to collect ESG data broadly available. Push for mandatory reporting Active engagement limited to governance Active engagement covers all E, S and G and proxy voting dimensions Source: Barclays Research 18

But be aware of the cost… The evolution of the ESG landscape can potentially lead to incremental costs to investors, asset managers and corporations: ESG commitment, reporting and analysis take time and resources to implement. This raises a host of questions for asset owners and managers: • Many institutional asset managers have created specialist ESG teams. Is all this justified, or should such expertise just be embedded in traditional fundamental investment analysis with a long horizon perspective? • Can a focus on ESG distract the investment focus away from return maximisation? • In particular, could the increased emphasis on ESG ratings encourage mutual fund managers to make their funds attractive to investors by increasing the weight of high ESG-rated securities with insufficient consideration of financial risk and return? • Can the increasing scrutiny and reporting burden that comes with ESG deter private companies from going public, or even encourage public corporations to go private? ESG ratings are generally published for publicly listed companies although corporate bonds can be issued by both public and private firms. A trend towards private ownership could limit the ESG rated investment universe of asset managers. 19

The role of ESG ratings The emergence ESG ratings are of specialist providers used in various ways: Once investors have decided to incorporate ESG • They may be used to screen potential investments, and considerations into their investment process, how do they can be integrated into investment decision processes and proceed? The systematic consideration of a catalogue portfolio analysis. of environmental, social and governance issues for every • They form the basis for the design of benchmark indices company in the investment universe is complex. in both equity and debt markets (e.g., Bloomberg One approach is to leave the process to asset managers Barclays MSCI sustainability indices). that specialise in ESG investing. Another is to structure • They can be used in the design of ESG-targeted a mandate more formally, with quantitative metrics to investment products and strategies (e.g., thematic express the investment goals and constraints. An ESG- investing such as low carbon or ethical mandates). specific benchmark could be specified rather than a more traditional one. In any case, the asset manager will need to • Some ESG rating companies have also expanded report periodically to the asset owner on how the portfolio coverage to sovereign issuers and to investment is positioned relative to ESG issues. For all of the above, funds, in addition to individual corporations. In a asset managers and asset owners often rely on third-party recent development, Morningstar (in partnership with ESG ratings, in the same way that credit ratings from rating Sustainalytics) and MSCI have both started providing ESG agencies are pivotal to bond portfolios. rankings of mutual funds, based on aggregated scores of Several ESG service providers have emerged in the past two the companies comprising each fund’s holdings. decades dedicated to helping investors identify companies According to an annual industry survey by Independent that follow better and worse practices in different ESG Research in Responsible Investment, the top two providers areas. This relatively new industry is still fragmented of independent ESG research and rankings are MSCI ESG by product area and geography, but it is experiencing Research and Sustainalytics. Another important provider, consolidation. Only a handful of providers claim to offer Institutional Shareholder Services (ISS) has a 30-year comprehensive coverage across all three dimensions history of focusing on corporate governance issues, with of Environment, Social and Governance, and across expertise in law, accounting and compensation. ISS was geographies. In addition to specialist providers, large data part of MSCI until it was spun off in 2014, and only recently 18 and FTSE19 are also entering vendors such as Bloomberg expanded its services to cover a full range of ESG issues. this market. “While there are similarities, each 18 See http://www.bloomberg.com/professional/equities/ provider of independent ESG research 19 See http://www.ftse.com/products/indices/F4G-ESG-Ratings?_ga=1.14814 and ratings has its own methodology” 6999.1608349752.1470651995 20

How are ESG ratings formed? aggregated up to overall scores for each of the three pillars (E, S and G), and from there to an overall ESG score, as While there are similarities, each provider of independent a weighted average of the granular scores. Another key ESG research and ratings has its own methodology. ESG element in this aggregation process is the assignment of ratings are based on a multi-criteria scoring of individual weights. A given corporation may be involved in many corporations based on a large set of factors or metrics different businesses and geographies, each bringing across all three E, S and G dimensions (Figure 6). a different set of ESG exposures. Similarly, the relative The ranking process begins in a bottom-up manner. Within importance of each metric may vary substantially by each of the three main dimensions, dozens of specific industry or country. categories of risk are assessed, and each company is scored To meet this challenge, each ESG ranking firm has on its exposure to that category of risk and the steps it has developed a scheme for assigning different sets of weights taken to mitigate it. to underlying risk factors for each industry and company. In each category, the assignment of a numerical score to Thus, while an overall Environment ranking will be provided a company may require the synthesis of quantitative and for every firm, be it a bank, a pharmaceutical firm or an qualitative information from multiple sources. Among the oil company, the three scores will represent very different information sources and questions to be evaluated in a things, and the Environment score will form a different given area are: percentage of the overall ESG score. For example, the • Quantitative ESG data disclosed by a company regarding Environment score has a relatively small weight in the its own activities combined ESG score of banks, but a large weight in the ESG rating of energy companies. • Estimates of ESG data from third-party sources Both the selection of the underlying metrics that are • Level of self-disclosure evaluated and the weights assigned to these metrics • How exposed is the company to significant risks change over time, reflecting industry developments and in this area? evolving beliefs regarding corporate “best practice”. • How much has been done to manage such risks? The ESG rating firms’ research contains two kinds of rankings: relative and absolute. The most fine-grained • Has the company been involved in controversial incidents metrics are typically absolute scores, or raw scores, which on this topic? What happened? allow comparison between any two companies across the • Is there a formal program in place to manage this issue board. Conversely, the highest-level ESG ratings are based company-wide? on rankings relative to a peer group in the same industry. • Is the company well placed to capitalize on opportunities Rating comparisons are most useful for firms within the in this area? same peer group; a comparison of the overall ESG scores of companies in different industries is much less meaningful. ESG score providers combine information from all of In this sense, ESG ratings are very different than credit these sources and calculate fine-grained scores for each ratings, which rank the credit-worthiness of firms in all individual metric on an absolute basis. These are then industries on a common scale. 21

It’s not just about climate change Global warming may be the most widely recognised “poster child” of sustainable investing, but it is far from being the only issue. In fact, ESG ratings reflect a broad range of considerations within each of the three categories. Each ratings provider has a detailed hierarchy of sub-categories and specific issues that are used to arrive at numeric scores for each company. The following table offers a small sampling of the more detailed sets of issues examined by ESG ratings providers to form their E, S and G scores: Figure 6 ENVIRONMENT SOCIAL GOVERNANCE Carbon emissions Labour management Corporate governance Energy efficiency Diversity and discrimination Business ethics Natural resource use Working conditions Anti-competitive practices Hazardous waste management Employee safety Corruption and instability Recycled material use Product safety Anti-bribery policy Clean technology Fair trade products Anti-money laundering policy Green buildings Advertising ethics Compensation disclosure Biodiversity programmes Human rights policy Gender diversity of board Source: MSCI ESG Research, Sustainalytics

Each ratings provider has developed its own unique Do all these ratings tell approach to integrating all of these issues into a numerical the same story? scoring system for producing ESG ratings. While they often agree, there are differences in the different providers’ To what extent are individual E, S and G scores from the methodologies at every level: same provider correlated with each other? For example, • Selection of the detailed list of low-level factors is a company that scores highly in terms of Governance in each category also likely to have high Environment or Social scores? Our analysis of the ratings on corporate bond issuers from • Assignment of raw factor scores: how much emphasis both providers shows that all of these correlations are low is placed on the different types of information available? (near zero for MSCI and about 30% for Sustainalytics). How much of a penalty is assigned to companies that This means that individual E, S and G scores carry different do not disclose information or do not maintain formal information content so tend to complement each other to ESG programs? help form a holistic description of non-financial information • What parts of the ratings process are purely formula- and risk. driven, and where is there room for an analyst to apply Do different providers of ESG ratings tend to reach similar subjective judgement? conclusions? As a lot of the analysis done by each provider • Assignment of weights to different factors for each is based on publicly accessible data sources, and on the industry. Must these be constant across an industry, or information put forward by the rated companies, one could can a given firm be assigned different weights to respect expect the qualitative rankings of different companies to be its mix of businesses? comparable. However, as discussed, the differences in the way the data are processed, analysed and presented can • To what peer group should each firm be compared to lead to very different results. convert absolute scores to relative ones? In practice, we observe that MSCI and Sustainalytics Due to these differences in approach, it is not surprising ratings often disagree with each other. When measuring that different ratings providers can at times disagree in their the relationship between ESG ratings of the two providers, assessment of a company. we find positive but low correlations across all three For a more detailed analysis of the methodologies dimensions (Governance has 14%, Environment 31%), employed by MSCI and Sustainalytics, as well as a as well as for the composite rating. This is not surprising, comparative analysis of their ESG scores, given the differences in methodology described above. please contact the authors (details on page 38). Thus, ESG ratings should not be considered as a simple “Several ESG service providers have commodity; the ratings from different providers carry different information and can potentially suggest different emerged in the past two decades portfolio management decisions. This makes it all the dedicated to helping investors identify more surprising that our analysis seems to arrive at similar companies that follow better and conclusions using ESG ratings from either provider – as we shall soon see – in terms of both the relationship with credit worse practices in different ESG areas.” ratings and the performance implications. 23

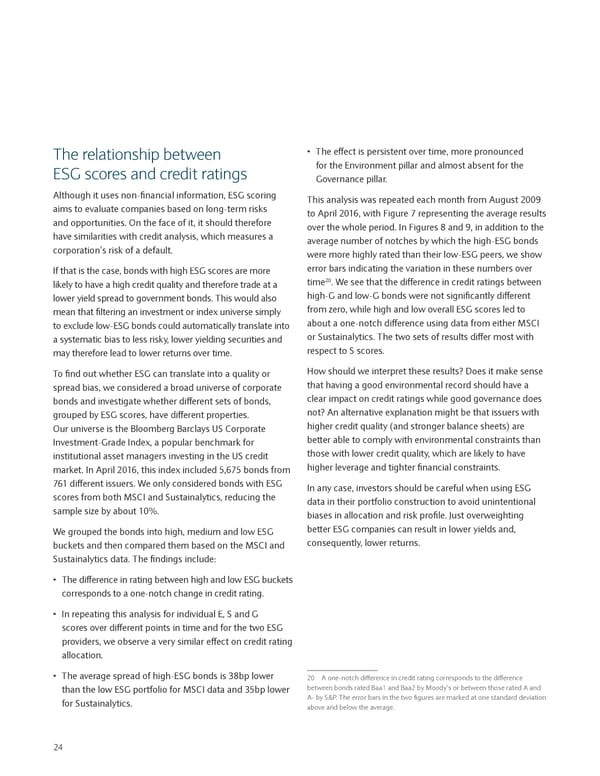

The relationship between • The effect is persistent over time, more pronounced ESG scores and credit ratings for the Environment pillar and almost absent for the Governance pillar. Although it uses non-financial information, ESG scoring This analysis was repeated each month from August 2009 aims to evaluate companies based on long-term risks to April 2016, with Figure 7 representing the average results and opportunities. On the face of it, it should therefore over the whole period. In Figures 8 and 9, in addition to the have similarities with credit analysis, which measures a average number of notches by which the high-ESG bonds corporation’s risk of a default. were more highly rated than their low-ESG peers, we show If that is the case, bonds with high ESG scores are more error bars indicating the variation in these numbers over 20. We see that the difference in credit ratings between likely to have a high credit quality and therefore trade at a time lower yield spread to government bonds. This would also high-G and low-G bonds were not significantly different mean that filtering an investment or index universe simply from zero, while high and low overall ESG scores led to to exclude low-ESG bonds could automatically translate into about a one-notch difference using data from either MSCI a systematic bias to less risky, lower yielding securities and or Sustainalytics. The two sets of results differ most with may therefore lead to lower returns over time. respect to S scores. To find out whether ESG can translate into a quality or How should we interpret these results? Does it make sense spread bias, we considered a broad universe of corporate that having a good environmental record should have a bonds and investigate whether different sets of bonds, clear impact on credit ratings while good governance does grouped by ESG scores, have different properties. not? An alternative explanation might be that issuers with Our universe is the Bloomberg Barclays US Corporate higher credit quality (and stronger balance sheets) are Investment-Grade Index, a popular benchmark for better able to comply with environmental constraints than institutional asset managers investing in the US credit those with lower credit quality, which are likely to have market. In April 2016, this index included 5,675 bonds from higher leverage and tighter financial constraints. 761 different issuers. We only considered bonds with ESG In any case, investors should be careful when using ESG scores from both MSCI and Sustainalytics, reducing the data in their portfolio construction to avoid unintentional sample size by about 10%. biases in allocation and risk profile. Just overweighting We grouped the bonds into high, medium and low ESG better ESG companies can result in lower yields and, buckets and then compared them based on the MSCI and consequently, lower returns. Sustainalytics data. The findings include: • The difference in rating between high and low ESG buckets corresponds to a one-notch change in credit rating. • In repeating this analysis for individual E, S and G scores over different points in time and for the two ESG providers, we observe a very similar effect on credit rating allocation. • The average spread of high-ESG bonds is 38bp lower 20 A one-notch difference in credit rating corresponds to the difference than the low ESG portfolio for MSCI data and 35bp lower between bonds rated Baa1 and Baa2 by Moody’s or between those rated A and for Sustainalytics. A- by S&P. The error bars in the two figures are marked at one standard deviation above and below the average. 24

Figure 7 How ESG scores relate to credit spread and credit rating Bonds with Bonds with low ESG scores high ESG scores Average ESG score (from 0 to 10) 2.6 7.7 Average spread (bp) 172 134 Average credit quality A3 A2 Source: MSCI ESG Research; Barclays Research Figure 8 Figure 9 Difference in credit rating between top and bottom Difference in credit rating between top and bottom tier of ESG rating – MSCI* tier of ESG rating – Sustainalytics* Rating notcheRating notchesRsRating notchesating notches 2.00 2.00 2.00 2.00 1.50 1.50 1.50 1.50 1.00 1.00 1.00 1.00 0.50 0.50 0.50 0.50 0.00 0.00 0.00 0.00 -0.50 -0.50 -0.50 -0.50 -1.00 -1.00 -1.00 -1.00 Env Env Soc Soc Gov Gov ESG ESG Env Env Soc Soc Gov Gov ESG ESG Source: MSCI ESG Research; Barclays Research Source: Sustainalytics; Barclays Research * error bars indicate variation over time * error bars indicate variation over time 25

Are ESG ratings stable? For investors considering full integration of ESG factors into strong predictor of a low ESG rating one year forward. the investment process, the stability of these ratings is an For example, Figure 10 shows that for both providers, a important consideration. Frequent changes in scores could top tier ESG company has more than an 80% probability potentially lead to excess turnover in investor portfolios, of remaining in the top tier a year later. Thus, there is little as well as less predictable risk exposures. This would be reason to fear that the adoption of ESG criteria would particularly difficult for credit portfolio managers, given the become a cause of excessive portfolio turnover. liquidity environment; secondary liquidity in the corporate bond market has deteriorated markedly since the financial crisis of 2008, forcing credit investors to adopt a long horizon by default. Our data analysis reveals that for both MSCI and Sustainalytics, ESG scores are stable. A company that has a high ESG rating is likely to retain a high ESG rating on a one-year horizon. Similarly, a low ESG rating today is a Figure 10 How likely is an ESG rating to change over a year?* MSCI SUSTAINALYTICS at end of period at end of period Low Medium High Low Medium High Low 73% 24% 3% Low 84% 15% 1% at start of period Medium 22% 60% 18% Medium 13% 73% 15% High 2% 17% 81% High 0% 13% 87% Source: MSCI ESG Research; Sustainalytics; Barclays Research * Averaged over the period August 2009 to April 2016 26

27

How do ESG ratings affect corporate bond performance? 23 Does the incorporation of environmental, social and The Bloomberg Barclays MSCI range of ESG bond indices governance criteria in the investment process improve include examples of both negative and positive screening. the financial performance of a bond portfolio or hurt it? The Socially Responsible (SRI) corporate bond index is Many studies have been published to try to establish based on negative screening and excludes companies an empirical link between ESG attributes and financial involved in industries such as tobacco, alcohol, gambling, 21 on this body of adult entertainment, nuclear power, genetically modified performance. A recent survey article organisms, stem cell research, firearms, and weapon research summarises the results from 60 distinct review systems. By contrast, the Sustainability index uses a best- studies, covering 2,200 primary studies. The authors in-class approach based on ESG ratings to choose the best- emphasise the difficulties in trying to generalise over many rated subset of index bonds within each industry. different studies, each of which may focus on a different aspect of ESG criteria in a different market, geography, or 24 conducted in 2015, Barclays Research In research industry. Nonetheless, they report that about half of the analysed the historical returns of both these indices relative published studies show a positive link between corporate to the Bloomberg Barclays US Corporate IG Index. While social responsibility and corporate financial performance, both had underperformed in terms of nominal returns, while less than 10% report a negative link. some of that underperformance was traced to systematic There is a key distinction between an ESG approach based biases unrelated to ESG criteria. Once they were corrected, on negative screening by industry and one based on relative we found that the return impact due specifically to the ESG comparisons of the firms in each industry. For example, an tilt in security selection was positive for the Sustainability investor using a negative screen may choose to exclude coal index but negative for the SRI one. We concluded that mining companies from its investment universe. Another the wholesale exclusion of entire industries from the may use ESG ratings to rank coal mining companies and investment universe, while it may be desirable based on choose to invest in the ones that have the best overall ethical considerations, is not justified based on purely ranking within the sector. In the first case, in a year in financial criteria. which coal mining companies outperform the market, the investment portfolio may lag a broad market index. In the second approach, the portfolio is neutral with regard to the systematic sector exposure, but favours companies with better ESG policies, as these are considered to be less likely 22 to suffer from the risks inherent in the industry. 21 Gunnar Friede, Timo Busch & Alexander Bassen (2015),”ESG and financial performance: aggregated evidence from more than 2000 empirical studies”, Journal of Sustainable Finance & Investment (2015) 5:4, 210-233. 22 It may seem at first glance that negative screens provide a much more powerful impetus for social change. However, in the context of our example, which investor is more likely to influence the behavior of a coal mining company 23 See Bloomberg Barclays MSCI ESG Fixed Income Indices, A New Market executive? The first will not buy stock in any case, while the second will be Standard for Environmental, Social, and Governance Investing, June 2013. reviewing ESG policies as the basis for the investment decision. Thus, the “best- 24 Albert Desclée, Lev Dynkin, Anando Maitra and Simon Polbennikov, ESG in-class” approach can be supported even from an idealistic viewpoint as well as Ratings and Performance of Corporate Bonds, Barclays Research, from a purely capitalistic one. 18 November 2015. 28

Our methodology: rebalancing, to ensure that they kept pace with any objectively measuring ESG impact changes in the structure of the corporate bond market. Both would be expected to track the index quite well, on performance experiencing the same broad rallies and declines as the For the purpose of this research paper into the impact of benchmark, so that monthly tracking error volatility should ESG on corporate bond portfolios, we applied an ESG tilt be low. The key question is whether substantial differences in security selection within each industry. Can such an would arise over time between the average returns of the approach improve portfolio performance over the long term? two portfolios. To measure the effect of ESG investing on credit portfolio The difference between the high and low ESG tracking performance in an objective manner, it is important to portfolios can be interpreted as an ESG factor: the return isolate the ESG effect from all other possible sources of risk. contribution associated with systematically favouring To do this, we constructed pairs of portfolios that differed high ESG corporate bonds over low ESG ones while drastically in their ESG scores, but whose risk profiles were keeping everything else equal. This approach does not nearly identical across all important dimensions of risk for automatically exclude any issuer or any industry sector, corporate bonds. We then measured and compared the no matter how controversial they might be. performance of these portfolios over time. In addition to pairs of portfolios with the minimum and The core of our portfolio construction technique is a maximum overall ESG rating, we also created portfolio mechanism for building well-diversified portfolios of pairs that accentuate the differences in individual E, S and bonds designed to track a benchmark – in this case, the G scores, to try to observe which one of these three pillars Bloomberg Barclays US Corporate Investment-Grade Index. is most related to performance. All of these studies were We applied a simple model that constrains the portfolio carried out twice, using ESG ratings from either MSCI or to remain neutral to the benchmark along multiple risk Sustainalytics. dimensions that could arise from differences in yield, maturity, credit quality, or sector allocation. In addition, limits on concentration ensured that the tracking portfolios 25 were highly diversified. Many such portfolios could be created; in our procedure, the model was run once to find the portfolio with the highest possible average ESG score that meets these constraints and once to find the one with the lowest ESG “Wholesale exclusion of entire industries score. The two tracking portfolios were reconstructed from the investment universe, while on a monthly basis, coordinated with the monthly index it may be desirable based on ethical 25 To ensure consistency, the set of bonds considered for portfolio considerations, is not justified based construction was limited to those for which ESG ratings were available from both on purely financial criteria.” MSCI and Sustainalytics. 29

Our findings Figure 11 • Most portfolio pairs (high-ESG minus low-ESG portfolios) Cumulative return (%) of a portfolio with high ESG delivered a positive return, indicating a generally positive rating over a portfolio with low ESG rating using return premium for the “ESG factor” in corporate bond Sustainalytics ESG scores markets. • Figure 11 shows the cumulative excess returns of the 3.0 high-ESG over the low-ESG portfolio from August 2009 2.5 to April 2016. The time window of the analysis is limited by the availability of historical ESG data from the two 2.0 providers considered. For this pair of portfolios, the cumulative outperformance has been almost 2% over the 1.5 past seven years. 1.0 • Figures 12 and 13 summarise the returns of various simulated portfolio pairs, based on both MSCI and 0.5 Sustainalytics data. For each one of these two providers, 0.0 we construct four portfolio pairs to measure the performance associated with the combined ESG factor, -0.5 as well as the Environmental, Social and Governance Jul-09 Jul-10 Jul-11 Jul-12 Jul-13 Jul-14 Jul-15 pillars taken in isolation. The average return differences reported in Figures 12 and 13 represent the difference in Source: Sustainalytics; Barclays Research performance between high and low ESG score portfolios. For both providers, the combined ESG rating has been associated with incremental returns over the past seven years. The return differences between the high and the low ESG portfolios are small (0.42%/y in one case and 0.29%/y in the other) but positive. • It is striking that despite different approaches to evaluating bond issuers, a similar pattern is observed for both providers: Governance had the strongest link with performance and Social the weakest, being even associated with slightly negative returns. Environment is in between. So the intuition of portfolio managers that governance is more important to portfolio risk and return than the other two dimensions of ESG (as seen in Figure 3) is validated in this analysis. • The message conveyed by this analysis is that incorporating an ESG tilt in an investment-grade credit portfolio is not detrimental to returns, but can be beneficial. This is “The intuition of portfolio managers particularly the case for Governance, which may indeed that governance is more important be a reflection of management quality that, over a long horizon, can be beneficial to bondholders of a corporation. to portfolio risk and return than In the example shown in Figure 14, the return associated to the other two dimensions of ESG is the Governance score has been high (5.5% of cumulative validated in this analysis.” outperformance) and persistent over the past seven years. 30

Figure 12 Figure 13 Return difference (%/y) between portfolios with Return difference (%/y) between portfolios with high and low scores for ESG provider Sustainalytics high and low scores for ESG provider MSCI Source: Sustainalytics; Barclays Research Source: MSCI ESG research, Barclays Research * Sustainalytics’ Governance pillar measures governance of sustainability issues. The firm has a separate Corporate Governance rating that is not represented in this study Figure 14 Cumulative return of a portfolio with high governance score over a portfolio with a low governance score (using MSCI ESG scores) 6.0 5.0 4.0 3.0 2.0 1.0 0.0 Jul-09 Jul-10 Jul-11 Jul-12 Jul-13 Jul-14 Jul-15 Source: MSCI; Barclays Research 31

No evidence of “systematic roughly 1 bp/year – this should translate into an estimated richening” of high ESG bonds underperformance of about -0.10%/year. For Sustainalytics ratings, the performance difference was estimated at There is a possibility that, as a result of the increased -0.02%/year. Thus, if there was a systematic effect of ESG popularity of ESG investing, portfolio flows from issuers ratings on pricing, the small changes to this number should with poor ESG attributes to those with high ESG scores have caused a small underperformance for high-ESG bonds have resulted in the systematic richening of high ESG bonds over the study period. We can thus rule out the possibility (and cheapening of low ESG bonds). If that is the case, the that the outperformance of high-ESG portfolios described returns observed in our analysis should be considered as above was due to a systematic richening of ESG bonds; and transient and typical of a specific time period that may not there is therefore no reason to expect this outperformance be representative of future market conditions. to be reversed. If such a systematic ESG-based repricing of bonds happened in the past few years, it should be visible in bond What is the reason for high valuations, in particular spreads over Treasuries. However, ESG outperformance? issuers with high ESG scores could also have tighter spreads for unrelated reasons – they could be tilted towards If there was no systematic richening of bonds with good higher credit ratings or specific industries, for example. We ESG rankings, what has made them outperform? One use statistical analysis to measure the extent to which there interpretation could be that poor ESG rankings relate is a systematic ESG-specific spread premium that would to risks of various types of adverse events that could cause the spreads of high-ESG corporate bonds to be negatively impact companies’ fortunes and that even over higher or lower than those of their peers after controlling the relatively short time period we have investigated, our for sector, quality and duration. We repeated this analysis high-ESG portfolios experienced fewer such events than each month and observed both the average results over our the low-ESG portfolios. Unfortunately, we do not have study period and the changes that were observed in the sufficient data to document such an effect with regard interim. We then calculated a crude estimate of the impact to ESG-specific events. However, we know that in bond that these observed spread differences could have been markets, negative changes to a company’s outlook are expected to have on portfolio returns. often associated with a downgrade in credit ratings, as well We found no evidence of a systematic tightening of high- as negative returns. Do we find that high ESG scores are ESG bonds relative to the broader market; in fact, if anything, associated with a lower rate of subsequent downgrades? we found the opposite. Results of the statistical analysis had To test this, we partitioned our bond universe into two low significance in many months, indicating that the market groups – above and below the median ESG scores – and was largely pricing corporate bonds based on sector, quality observed the number and magnitude of downgrades in and duration, with little or no systematic preference for ESG each set. This allowed us to report an annual “downgrade bonds. As shown in Figure 15, using overall ESG scores from notch rate” capturing both the frequency and intensity of both MSCI and Sustainalytics as the ranking variable, a small downgrades. (For example, if 10% of the issuers in a given negative spread premium was detected at the start of the group experience one-notch downgrades and another 3% period, indicating that high-ESG bonds were more expensive have two-notch downgrades, the downgrade notch rate for than their low-ESG peers. However, by the end of the study, the year would be 16%.) We compared these downgrade this reverted to a small positive number. rates for bonds scoring high and low in different ESG The effect of this premium on returns would be two-fold. categories according to the two providers; the most First, over the long term, high-ESG bonds should earn a striking difference in the two groups was observed using carry advantage equal to the spread, which for the MSCI Governance scores. As shown in Figure 16, bonds with low rankings came to an estimated -0.04%/year. Second, governance scores experienced a consistently higher rate if the spread widened by 6 basis points over the course of subsequent downgrades than those with high scores of the seven years of the study period – representing throughout our study period. 32

Figure 15 Bonds with high ESG scores have not become richer Implied returns from changes to ESG spread premium MSCI SUSTAINALYTICS Beginning of period (Aug 2009) -5.3 -1.0 ESG Spread Premium (bp) End of period (April 2016) 0.8 2.9 Average Aug 09 - Apr 16 -3.7 1.5 Cumulative Change (Beg to End) 6.1 3.8 Carry -0.04% 0.01% Implied Return Advantage Price return from ESG spread premium trend -0.06% -0.04% of High - ESG Bonds (%/yr) Total Return -0.10% -0.02% Source: MSCI ESG Research, Sustainalytics, Barclays Research Figure 16 Bonds with high MSCI Governance scores have experienced fewer credit rating downgrades 12-month rolling downgrade notch rates for bonds with high and low Governance scores 40% 35% 30% 25% 20% 15% 10% 5% 0% 10 10 1 11 11 11 2 12 12 12 3 13 13 13 4 14 14 14 5 15 15 15 6 16 Jul- t- -1 Jul- t- -1 Jul- t- -1 Jul- t- -1 Jul- t- -1 Jul- t- -1 Oc Jan Apr- Oc Jan Apr- Oc Jan Apr- Oc Jan Apr- Oc Jan Apr- Oc Jan Apr- High Gov Low Gov Source: MSCI ESG Research; Barclays Research 33

Conclusion: sustainable investing has been beneficial to bond returns All the indications are that the trend towards sustainable In many publicly quoted companies, corporate decision- investing is not only becoming more sophisticated but makers have been forced to balance the long-term also gaining widespread acceptance. ESG has become best interests of their firms against relentless investor an increasingly popular framework for measuring and pressure for short-term earnings growth. The growth managing assets in a way that resonates with the values of the sustainable investing movement can help redress and beliefs held by many asset owners. ESG investing is the balance. As ESG considerations play out over a long now becoming embedded in the investment process of horizon, and as they increasingly become a priority for many institutional investors. company managers, they may help alleviate the pressure While evaluating an investment on Environment, Social for short-termism and rather encourage a focus on long- and Governance dimensions used to be a demanding task, term value creation – to the mutual benefit of the firm, its a number of service providers have emerged that offer ESG investors and the world at large. scores derived using non-financial metrics of corporate performance. Our research into the impact of ESG on the performance “As ESG considerations play out of US investment-grade corporate bonds in the past over a long horizon, and as they seven years has shown that portfolios that maximise increasingly become a priority for ESG scores while controlling for other risk factors have outperformed the index, and that ESG-minimized portfolios company managers, they may help underperformed. The effect was most pronounced for alleviate the pressure for short- the Governance tilt and least pronounced for the Social termism and rather encourage a tilt. Favouring issuers with strong Environmental or Social rating has not been detrimental to bond returns. These focus on long-term value creation – conclusions hold using ESG ratings data from two different to the mutual benefit of the firm, its ratings providers, despite significant differences between investors and the world at large.” the two ratings methodologies. 34

35

Important Content Disclosures Personal Use Only in this publication has been obtained from sources that All information contained herein shall only be used by the Barclays Research believes to be reliable, but Barclays recipient for his/her own personal reference. Any other makes no representations that the information contained use, including any disclosure or distribution to of any herein is accurate, reliable, complete, or appropriate for use information to any third party, requires the express written by all investors in all locations. Further, Barclays does not permission of Barclays. guarantee the accuracy or completeness of information which is obtained from, or is based upon, trade and For Information Purposes Only statistical services or other third party sources. Because of the possibility of human and mechanical errors as well as This information has been prepared by the Research other factors, Barclays is not responsible for any errors or Department within the Investment Bank of Barclays Bank omissions in the information contained herein. Barclays is PLC and is distributed by Barclays Bank PLC and/or one not responsible for, and makes no warranties whatsoever or more of its affiliates (collectively and each individually, as to, the content of any third-party web site accessed via “Barclays”). The views expressed in this publication are a hyperlink contained herein and such information is not those of the author(s) alone and are subject to change incorporated by reference. without notice. Barclays has no obligation to update this publication. This information is intended for informational Information Provided Is Not Indicative purposes only and should not be regarded as an offer to sell of Future Results or a solicitation of an offer to buy the products or securities to which it applies. No representation is made that any Any data on past performance, modelling or back-testing returns will be achieved through its use. contained herein is not necessarily indicative of future results. All levels, prices and spreads are historical and Information Provided May Not Be Accurate or do not represent current market levels, prices or spreads, Complete and May Be Sourced from Third Parties some or all of which may have changed. The information referenced herein or any of the results derived from any All information, whether proprietary to Barclays or a third analytic tools or reports referenced herein are not intended party, is provided “as is” and Barclays makes no express or to predict actual results and no assurances are given implied warranties, and expressly disclaims all warranties with respect thereto. The value of and income from any of merchantability or fitness for a particular purpose or investment may fluctuate from day to day as a result of use with respect to any data included herein. Other than changes in relevant economic markets (including changes disclosures relating to Barclays, the information contained in market liquidity). 36

No Liability Not Available In All Jurisdictions To the extent permitted by law, in no event shall Barclays, Not all products or services mentioned are available in nor any affiliate, nor any of their respective officers, all jurisdictions. No offers, sales, resales, or delivery of directors, partners, employees or third party licensors have any products or services described herein or any offering any liability, direct or indirect, including but not limited materials relating to any such products or services may be to (a) any special, punitive, indirect, or consequential made in or from any jurisdiction except in circumstances damages; or (b) any lost profits, lost revenue, loss of which will result with compliance with any applicable laws anticipated savings or loss of opportunity or other financial and regulations and which will not impose any obligations loss, even if notified or advised of the possibility of such on Barclays. damages or potential loss, arising from any use of the information provided herein. Tax Disclaimer No Advice Barclays does not provide tax advice and nothing contained herein should be construed to be tax advice. Accordingly, The information provided does not constitute investment you should seek advice based on your particular advice or take into account the individual financial circumstances from an independent tax advisor. circumstances or objectives of the clients who receive it. You should consult with your own accounting, legal or Intellectual Property other advisors as to the adequacy of this information for © Copyright Barclays Bank PLC (2016). All rights your purposes. reserved. No part of this document may be reproduced No Use For Valuation Purposes or redistributed in any manner without the prior written permission of Barclays. No data or price information should be used for any Barclays Bank PLC is registered in England No. 1026167. valuation, trading, settlement, accounting purposes or other Registered office 1 Churchill Place, London, E14 5HP. related functions. 37